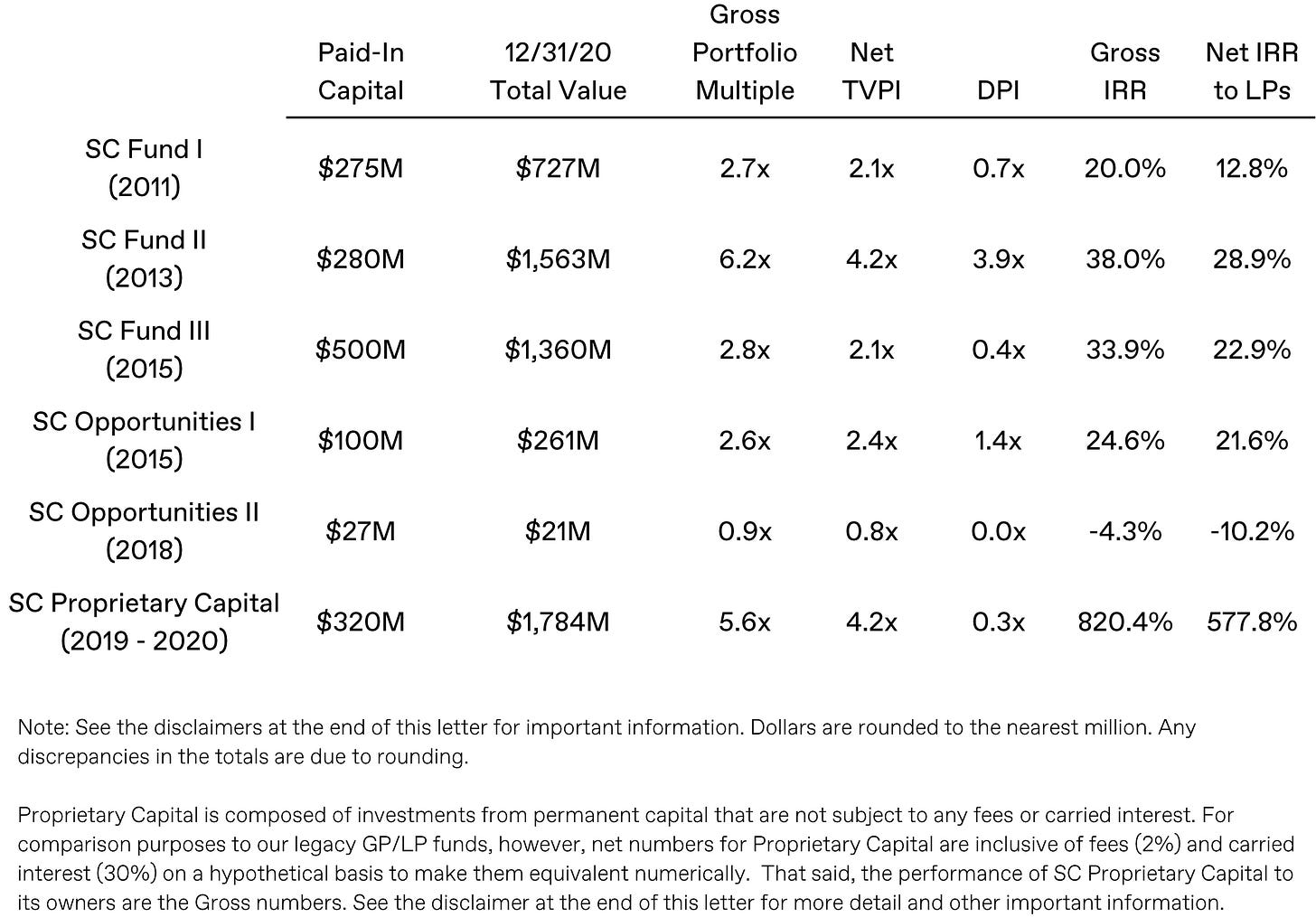

Social Capital Performance Summary

To the supporters and friends of Social Capital:

This is the sixth of our annual letters where we share our reflections, key observations, and learnings over the past year, including how the economic and technological trends of the year have shaped our thinking and our investment portfolio.

Since I started Social Capital in 2011, our work has spanned the spectrum of technology. From investments in Bitcoin and SaaS in the early 2010s, to our more recent bets in deep tech, the global energy transition and the creator economy, we have tried to find big trends and get behind them early.

Our work has also spanned the life cycle of companies. From incubating new teams and ideas at the very earliest stages, to capitalizing fast-growing companies in both the public and private markets. Great opportunities are stage and sector agnostic, so we try to stay nimble and skate to where the puck is going to be.

Even though our investing has spanned many areas of technology and has leveraged a range of capital-raising tools, we believe there has been a common theme that has defined our work over the past 13 years: partnering with ambitious founders working to solve hard and non-obvious problems, and constantly challenging our own cognitive biases by learning from first principles.

For me, 2023 was a continuation of the hard landing of 2022. A decade-plus of cheap capital has firmly come to an end, and advances in AI are going to change the way companies are built.

To founders, my advice is to remain laser-focused on building products and services that customers love, and be thoughtful and rational when making capital allocation decisions. Finding product-market fit is about testing and learning from small bets before doubling down, and it is often better to grow slower and more methodically as that path tends to lead to a more durable and profitable business. An axiom that doesn’t seem to be well understood is that the time it takes to build a company is also often its half-life.

What the hell is going on – 2023 edition

Rate Tightening to Powell’s Capitulation

In 2022, the Federal Reserve embarked on one of the most aggressive rate hiking cycles in the history of monetary policy, increasing the Federal Funds Rate from 0.25% to 4.5%. In 2023, this hiking cycle continued as the Federal Reserve continued to increase interest rates to 5.5% by the end of the year.1

This resulted in several downstream consequences for markets. While many of these became apparent in 2022, more cracks began to emerge in 2023.

First, the decline in valuations of assets that promised profits far into the future created a new discipline in technology companies, shifting their focus from unsustainable “growth at any cost” (and speculative bets) to more prudent forms of capital allocation. This often involved laying off employees and slashing projects not central to the core profit-centers of a company.

Companies that shifted their focus well, like Meta, which laid off 21,000 employees and quickly streamlined its Reality Labs metaverse bet, were rewarded with a swift recovery in their market cap.2 Other companies that were more obstinate or failed to act sufficiently did not fare as well.

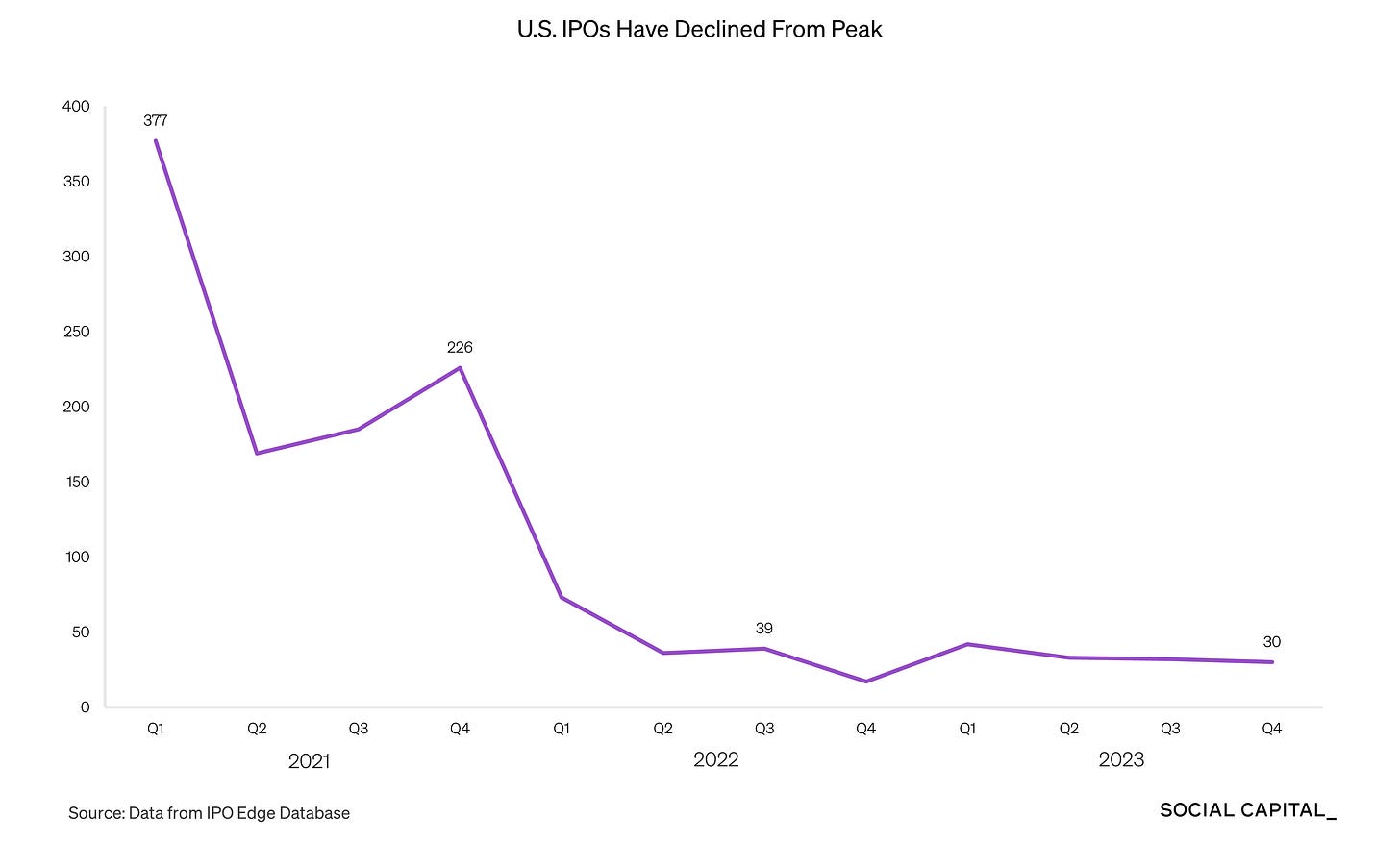

As valuation multiples declined in many private companies, including pre-IPO companies, we saw bankers, investors, and founders choose to wait on the sidelines, hoping for better conditions or a magical market-clearing event (e.g., a Stripe IPO), rather than accept lower valuations. This created a slowdown in IPOs, which then created a reflexivity in the private markets. VCs became hesitant to finance subsequent rounds due to unclear exit pathways, and VC funding ground to a halt, leading portfolio companies to burn through cash without the promise of more capital.

We also began to see more systemic cracks arising from this higher interest rate environment as the U.S experienced its first significant banking crisis since 2008. This began with Silvergate Bank and then quickly extended to Silicon Valley Bank, Signature Bank, and First Republic Bank.

What happened?

During a decade of zero-interest rates, and more recently following the pandemic, many of these banks sought higher rates of return by purchasing longer duration assets (i.e. a 5yr or 10yr bond vs a 2 yr bond). The valuations of these long duration assets, however, are negatively correlated to interest rates, so when the Federal Reserve embarked on its hiking cycle, the value of their longer-duration assets plummeted and the banks were caught off guard. This resulted in significant unrealized losses. As these losses became public knowledge, a liquidity crisis ensued. Customers rushed to withdraw their deposits, and banks were forced to liquidate assets and realize losses in their long-duration portfolio.

Given the backdrop of all these downstream consequences, if you had asked me at the time, in Q1 2023, what the most likely outcome would have been, I would have told you that two scenarios were equally likely:

The Fed’s aggressive rate hikes were necessary to reduce inflation, but the speed and magnitude of the hikes will create a recession.

Despite the Fed’s hikes, inflation will persist or even run out of control, resulting in a difficult period of stagflation.

Neither scenario happened. Neither scenario happened.

The CPI decreased responsively to rate hikes, but GDP continued to grow throughout 2023, driven by resilient consumer spending.3 Thus, at the end of 2023, Powell came off the sidelines and signaled three rate cuts for the second half of 2024, just one month after he indicated that the Fed may not be done with its tightening cycle. 4

So is the problem solved? Not quite.

Inflation is still above the Fed’s 2% target, and the last three inflation prints were higher than expected.5 While the worst may be behind us, there is still more work to be done before inflation returns to the norm.

The Federal Reserve continues to walk a very precarious tightrope. On one side, they must hold the line by keeping interest rates high to kill inflation once and for all. On the other side, with high rates, interest payments on government debt have become the fastest growing component of the Federal budget, and elevated short-term rates relative to long-term rates makes profitable lending much more difficult for banks, setting the stage for economic contraction.

AI Has its Watershed Moment

The year began with ChatGPT hitting 100 million monthly active users in two months, becoming the fastest-growing consumer app in history.6

More broadly, generative AI is the fastest growing technology that I have ever experienced in my career. Developments are occurring in weeks, not months or years. Just last year alone, there were over 21,000 ML and AI papers published on arXiv, versus 18,000 papers the year before.7

For language models specifically, we have seen the formation of an incredibly vibrant ecosystem of businesses ranging from open and closed-source models that serve as the foundation for new types of applications, to a new infrastructure designed to support how these models are built, supported and run. As models became increasingly performant, we saw the emergence of a chatbot race, where companies like OpenAI, X and Google are now all competing to release the most capable, user-friendly and intelligent chatbot.

In light of these rapid advancements, several key themes have emerged.

First, generative AI has significantly lowered the barriers to entry for starting a software company. Tools like code-generating AI are lowering the cost of software development, enabling entrepreneurs and even non technical founders to bootstrap new ventures with minimal upfront investment.

The same is true for “hard tech” businesses. AI-driven simulations and experiments are reducing the capital requirements to compete in traditionally capital intensive industries like biotech and material sciences. Generative AI can now create novel protein and crystal structures to form the basis for new drugs, materials and semiconductors - historically the exclusive domain of scientists toiling for years in a lab.

The implication is that the process of building companies is fundamentally changing, characterized by leaner teams, faster iterations, and a shift from physical to digital experimentation.

Moreover, as Generative AI levels the playing field, the traditional moats that protected incumbent businesses will erode. The same tools that enable rapid startup growth are also empowering new entrants to challenge established players by being orders of magnitude more efficient and cost-effective. Incumbents risk becoming obsolete unless they adapt quickly to this new paradigm.

With such a fast-paced and dynamic ecosystem, how do we determine where value creation and capture will take place, and ultimately, when and where capital should be allocated and companies should be started?

Historically, following the emergence of new trends like Cloud, SaaS and VR in the 2010s, Silicon Valley cycles through phases of rapid speculation and investment followed by a clearing function where the market’s premature expectations are corrected. We saw this in social media, where early platforms like Friendster emerged, but quickly gave way to successors like Myspace, only to eventually lose to Facebook which became the ultimate winner.

While I believe it is premature to declare the winners, as of today, I see two clear areas of value creation over the long term.

The first is proprietary data. While we always talked about data as being the “new oil” over the past decade, we are finally starting to see how it can be monetized to help enhance the capabilities of AI models. This trend is exemplified by the recent partnership between Reddit and Google, where access to Reddit’s vast, diverse dataset will be leveraged to train Google’s Gemini model to be more sophisticated and context-aware.8

The second is the underlying infrastructure used to run AI applications. While GPUs, a type of parallelized compute hardware, are very effective at training AI models, they are not particularly well-suited to run inference that require high-speed sequential computations like language models, resulting in significant latency. For applications built on top of language models, responsiveness is a critical lynchpin – without it, even the most innovative applications are facing an uphill battle to find product-market fit.

Beyond these few select areas in the AI ecosystem, if the past informs the present, our emphasis should shift from prematurely declaring winners in the space to, instead, deeply understanding the underlying mechanisms that will be responsible for value creation over these next few years.

Deglobalization Continues to Fuel an Industrial Renaissance

In 2023, the world faced heightened geopolitical tensions, with the ongoing Russia-Ukraine conflict, a new war between Israel and Hamas, and escalating tensions between China and Taiwan. These flashpoints mark one of the most charged times in recent history, presenting the increased possibility of a tail risk of global war.

In this world marked by escalating geopolitical tensions, deglobalization is now not just a trend but a critical strategic shift. Every country feels the pressure to fuel a domestic industrial renaissance, prompting nations to rethink their dependencies, friends and enemies. In the U.S., this rethinking has resulted in the passage of key legislative initiatives aimed at bolstering domestic production and reducing foreign inputs. From the CHIPS Act incentivizing the semiconductor industry to build domestic operations, to the Infrastructure Investment and Jobs Act fueling U.S. physical and digital infrastructure (via roads, bridges, broadband internet, and so on), to the Inflation Reduction Act encouraging investment in domestic EVs, manufacturing, and renewable energy, these acts represent a concerted effort by the U.S. federal government to navigate the challenges of deglobalization by incentivizing reshoring and fostering a more secure and resilient supply chain.

For capital allocators and founders, there may be a unique wave of opportunities that are coming from the shift towards reshoring. Against a backdrop of trillions of dollars of non-dilutive government funding and the resulting tailwinds to reshore critical industry, companies that can creatively and strategically tap into different pools of capital – debt, equity, and government funding – may represent some of the biggest winners over the next decade.

A look at some of our recent bets

As the investing landscape has developed over the past decade, our focus has continued to shift between sectors and markets that are well-positioned to benefit from new and developing tailwinds. While some of our early bets (Slack, Yammer, Netskope, Intercom) were concentrated in enterprise SaaS, in more recent years, our focus has shifted to addressing challenges in energy transition, AI, life science and deep-tech.

Relativity Space

Reaching for the Stars

The world is becoming increasingly autonomous and interconnected, creating a pressing need for uninterrupted global connectivity.

Terrestrial methods of scaling connectivity include fiber optic cables and cellular towers, but these are too expensive and capital intensive to scale effectively to more remote locations. Low Earth Orbit (LEO) satellites are the most economically viable method to achieve uninterrupted global connectivity, but this requires a constellation of thousands of satellites and an almost 24x7 launch method of sending these satellites into orbit cost effectively.

Relativity Space is building a reusable launch system for this market, powered by 3D metal printing and a new methalox-fueled engine - promising a large factor decrease in cost and flexibility. In March 2023, Relativity launched Terran 1, the first 3D metal printed rocket with a methalox engine to reach space. Now, the company is focused on developing Terran R, a much larger 3D printed rocket with sufficient payload capacity to launch LEO satellites into orbit.9

Palmetto

Arming the Rebels

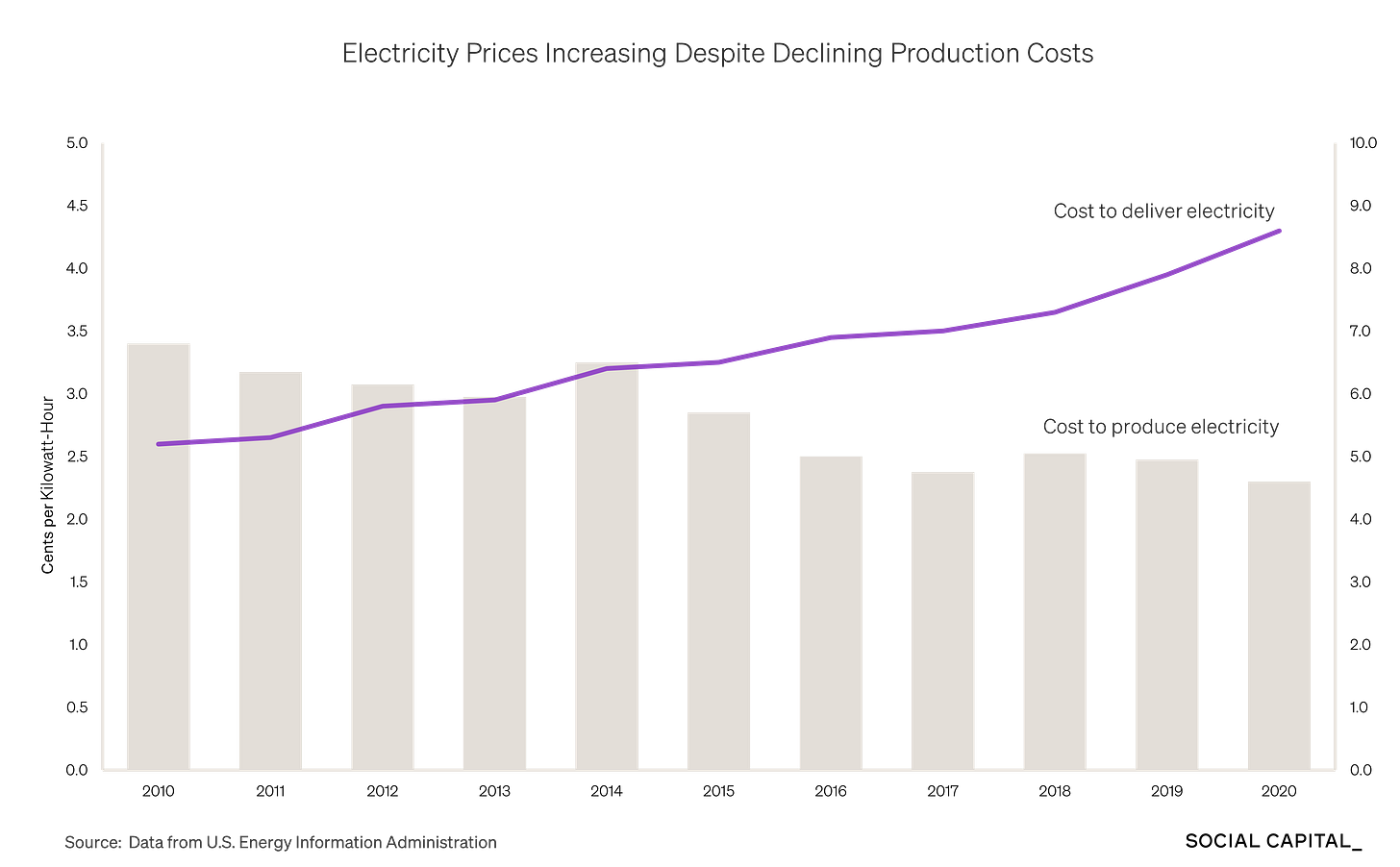

Over the past decade, the cost to produce electricity has fallen by roughly ~⅓ from 6.8c/kWh to 4.6c. Despite this, electricity prices, as paid by consumers, keep going up. 10

The reason lies with the utility companies, which own an aging U.S. grid infrastructure. Over the past decade, the cost to deliver electricity over this grid has risen by ~65%, and it will require nearly a trillion dollars of upgrades over the next decade to bear the additional load of electrification. Meanwhile, an evolving climate with more extreme weather events is threatening the resiliency of existing grid infrastructure, with rampant outages and service interruptions that result in an increasing human toll.

The solution? Turn homeowners into their own mini utilities.

Palmetto is the fastest growing and largest private company in the US helping consumers become their own utility, starting with rooftop solar, storage and an app to manage it. Over time, Palmetto’s goal is to operate a clean energy marketplace, acting as a one-stop-shop for power generation, storage, utilization and financing for millions of Americans.

Mitra Chem

AI Meets Material Science

Achieving net-zero emissions will require rapid electrification across all sectors. Batteries are a critical platform technology enabling this transition, but today, the overwhelming majority of iron-based cathode production (currently the prevailing choice for lithium-ion batteries) takes place in China.11

Mitra Chem is building the first North American lithium-ion battery materials product company that aims to accelerate lab-to-production timelines by 10x using machine learning to dramatically shorten the R&D timeline. In 2023, Mitra Chem announced a $60 million Series B financing led by General Motors to scale cathode materials production.12

Closing remarks

While 2023 was full of challenges, we are near the end of the hard reset from zero interest rates. After a decade of low rates and rising valuations, many of the tailwinds that benefited us as technologists are now gone. Instead, disruptive change via advancements in AI and reshoring of critical industries are reshaping how companies are built.

Alongside my work at Social Capital, in 2023, I took over as the CEO of a company I own called Hustle. While it is a small software company, becoming an operator again has put me back in the middle of many of the disruptions that are reshaping how companies are built. I am hoping these learnings will help me identify my old biases and inform new frameworks with which to make better decisions.

Separately, I started a new subscription research product called Learn With Me, where I share the longform deep dives my team and I create on a monthly basis to teach me about the things that matter. These decks have formed the basis of how I think about the world and have helped me be aware of where the world may be going and, thus, make better decisions. I am happy to be able to share them, now, with a like-minded audience of people who share this same ambition.

Learn With Me is my second foray as a creator in the creator economy - my first being as co-host of the All In Podcast. In a world where consumer consumption is still more than 60% of global GDP, but traditional media is the least valuable it's ever been, content creators are the new tastemakers - of opinions, ideas, truths and products. They are creating a seismic shift in how the demand generation for trillions of dollars of goods and services works. And it is very poorly understood - which is where the opportunity is. I will focus more and more of my time in the creator economy over the coming years as I see it as one of the most disruptive new trends that will be impactful in the future.

In short, despite all the ups and downs over the past few years, I feel very lucky that I get to learn every day and work with brilliant founders on ambitious ideas. There are some visible greenshoots on the horizon but we will need to work very hard and focus for them to materialize.

Innovation presses on.

Respectfully,

Chamath Palihapitiya

Appendix

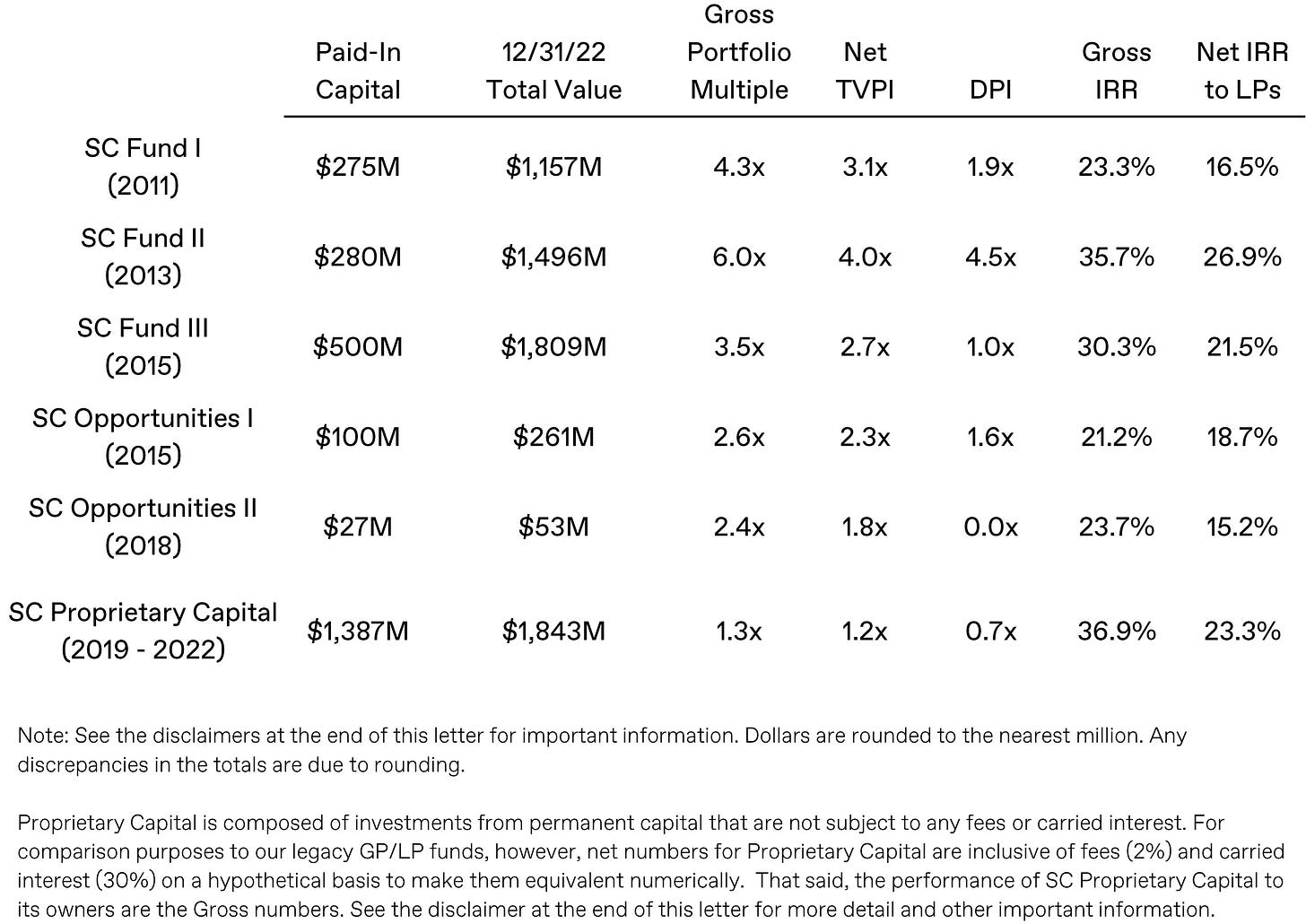

2022 Social Capital Performance Summary

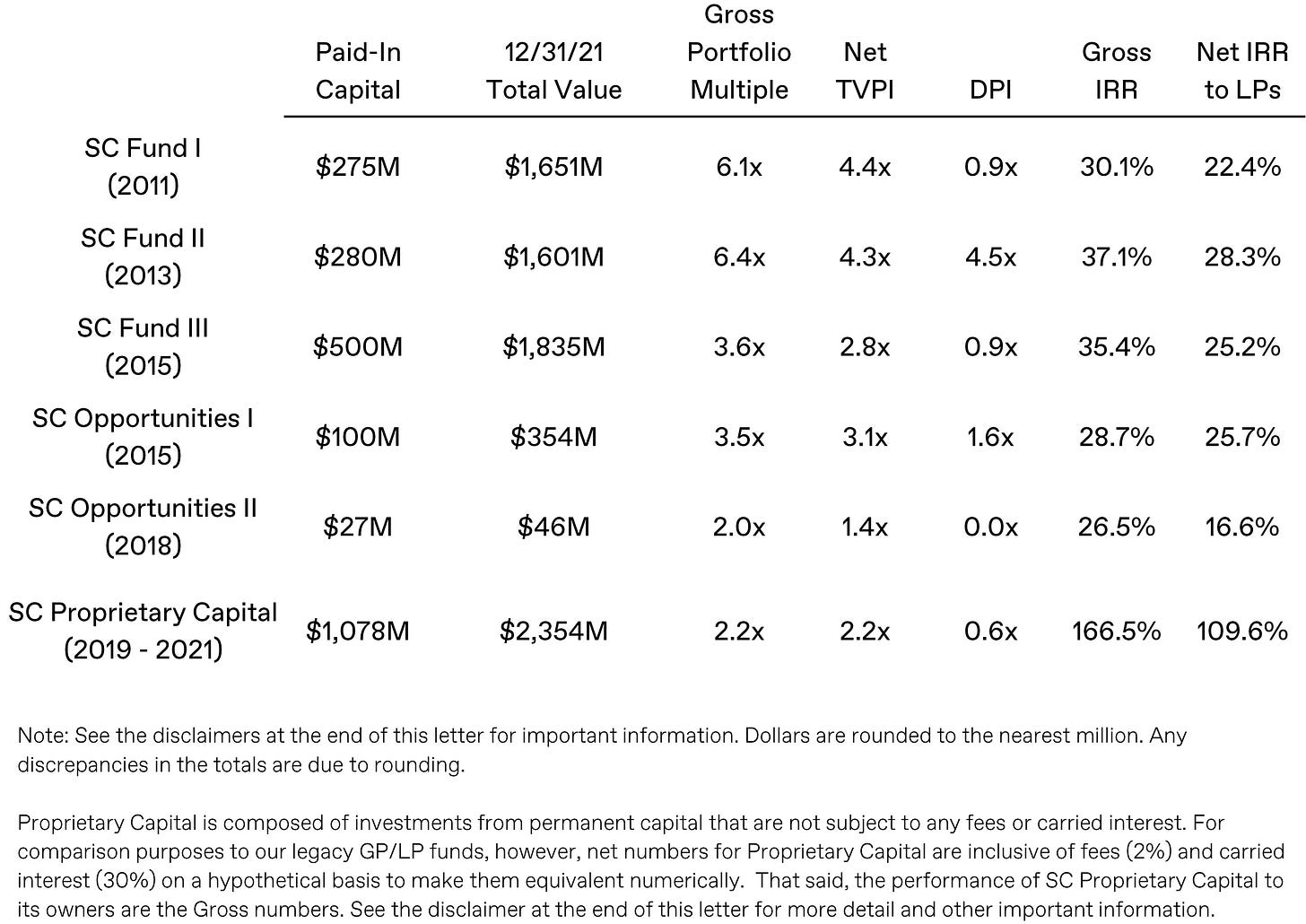

2021 Social Capital Performance Summary

2020 Social Capital Performance Summary

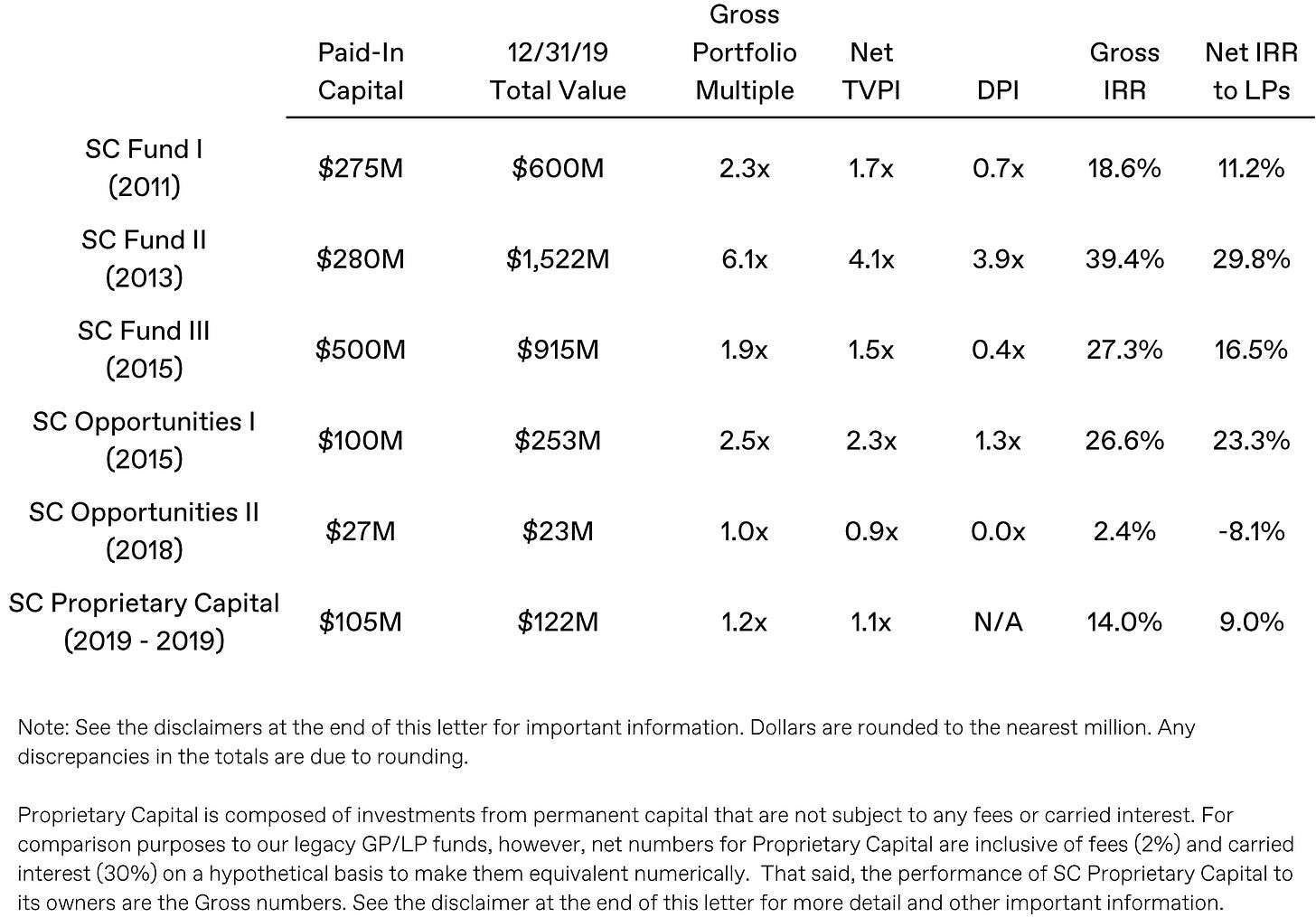

2019 Social Capital Performance Summary

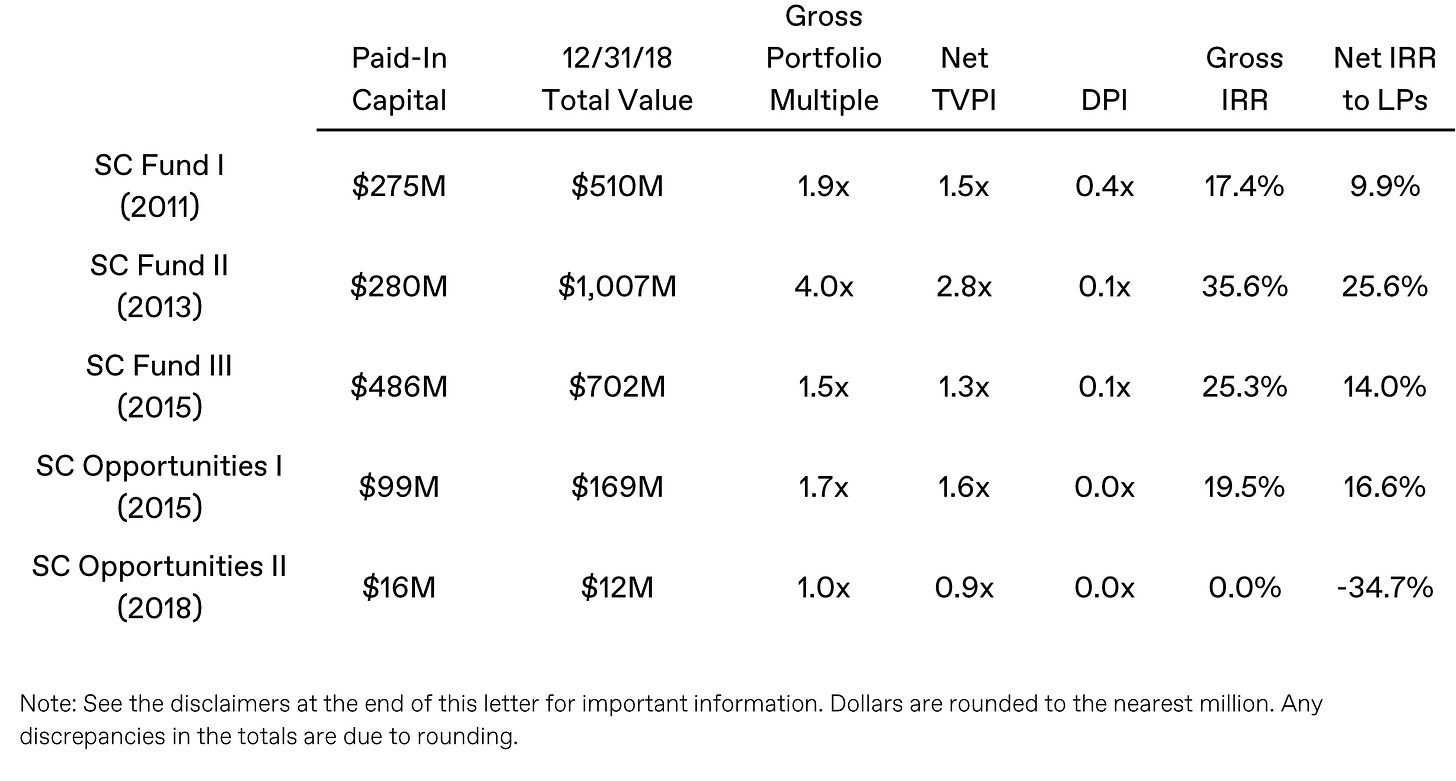

2018 Social Capital Performance Summary

Thank you for writing. We know that government always has an incentive to spend money on new technology. In the case of AI, do we think US spending will make any difference in success versus failure? We know if they regulate AI, it will hurt.

Bizarre question I know, but are the "8" numerals in the initial graphic upside down!?