Deep Dive: How Machines Are Becoming Better Investors Than Humans

Today, public and private information are instantly priced in. As such, strategies that depend on reacting to news, reading filings, or “having an opinion” compete in a game where the half-life...

Humans are not wired to win in today’s modern markets.

For most of history, investing was about relationships, judgment, and timing. It was about who you knew, what you believed, and whether you had the conviction to act. That edge worked when information was scarce, and markets were slower.

Today, public and private information are instantly priced in. As such, strategies that depend on reacting to news, reading filings, or “having an opinion” compete in a game where the half-life of new information is measured in milliseconds.

No human, no matter how smart, experienced, or well-networked, can manually process that firehose of data in real time and execute on trades accordingly, with perfect discipline.

Unsurprisingly, the best long-term returns in modern investing come from a fund mainly managed by code, not by humans.

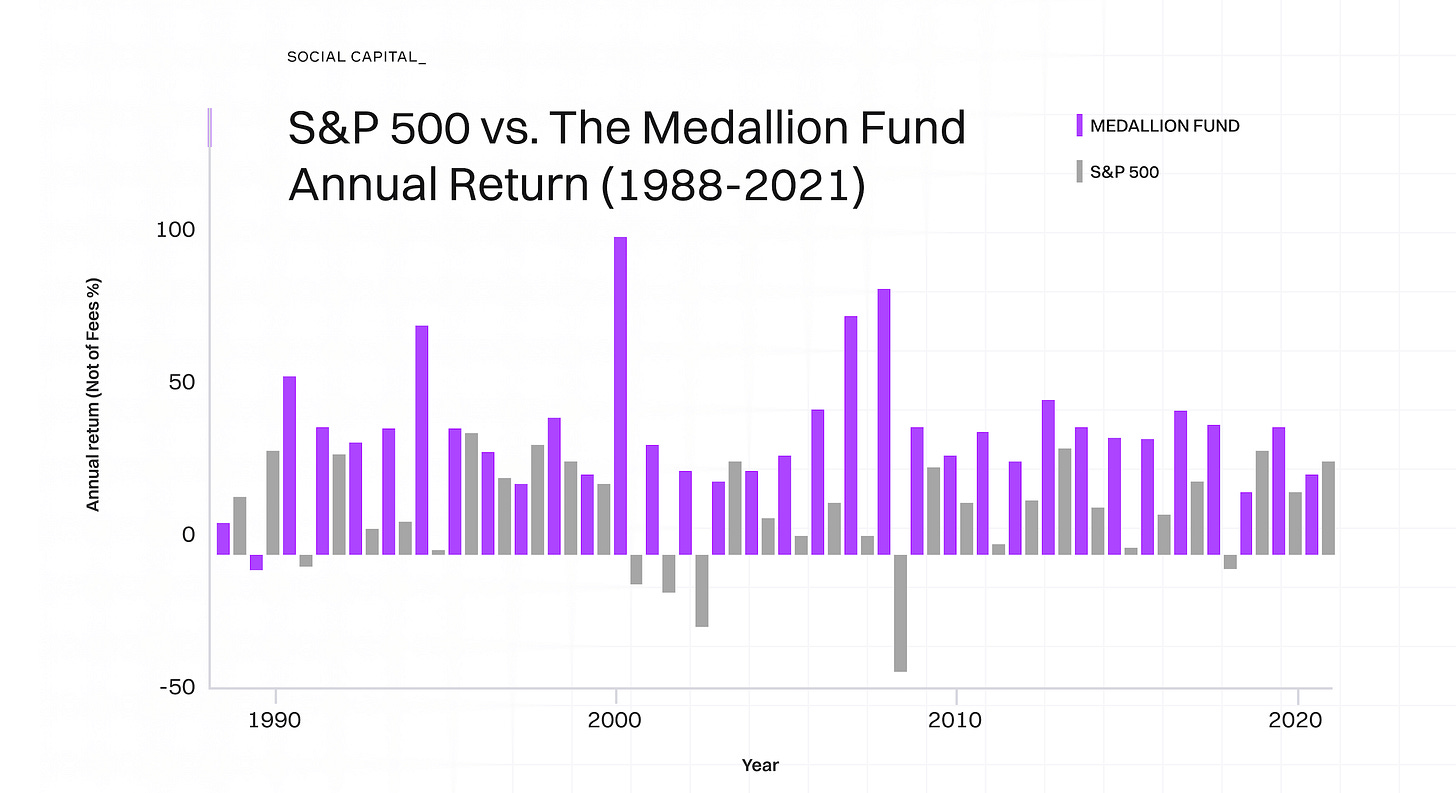

The chart shows a top-performing autonomous system, outpacing the S&P 500 over many years.

That is the Renaissance Medallion Fund, which has earned 39% annual returns since the late 1980s.

How did a fund run by code double the returns of the market?

Medallion’s edge came from consistently repeating small statistical advantages across thousands of instruments simultaneously. Tiny edges, captured over and over through rapid trades in highly liquid assets.

Human investors can closely track only a limited number of instruments. They can’t monitor thousands of markets in parallel, spot micro-opportunities in milliseconds, and execute that process across thousands of trades consistently.

The shift to code-driven systems started when researchers began building mathematical frameworks to work around them.

Brief history of autonomous investing

Between 1952 and 1973, three breakthroughs made automation inevitable.

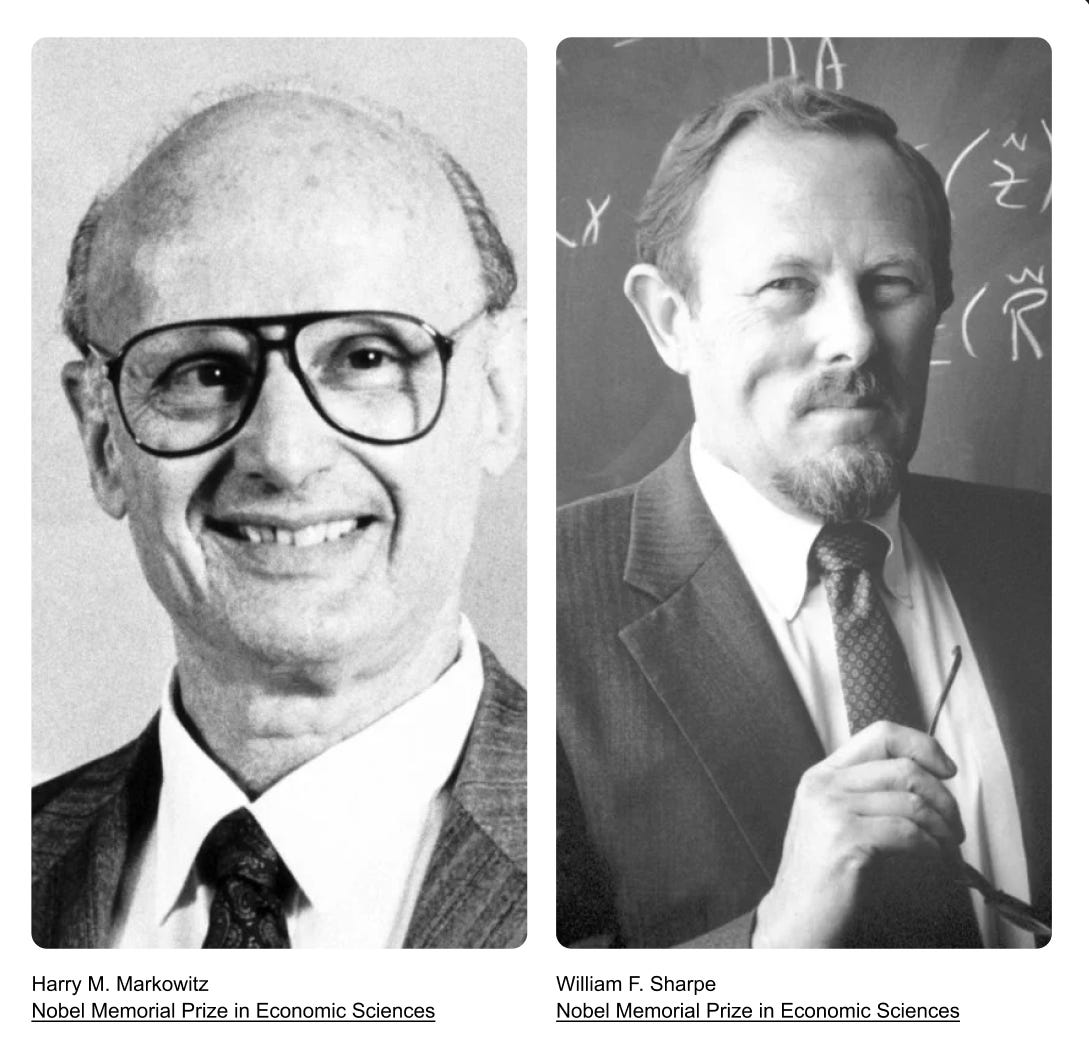

1. In 1952, Harry Markowitz proved portfolio construction could be mathematical.

2. In 1964, William Sharpe introduced the Capital Asset Pricing Model (CAPM), giving investors a way to measure risk, compare returns to a benchmark, and quantify performance with what became known as the Sharpe ratio.

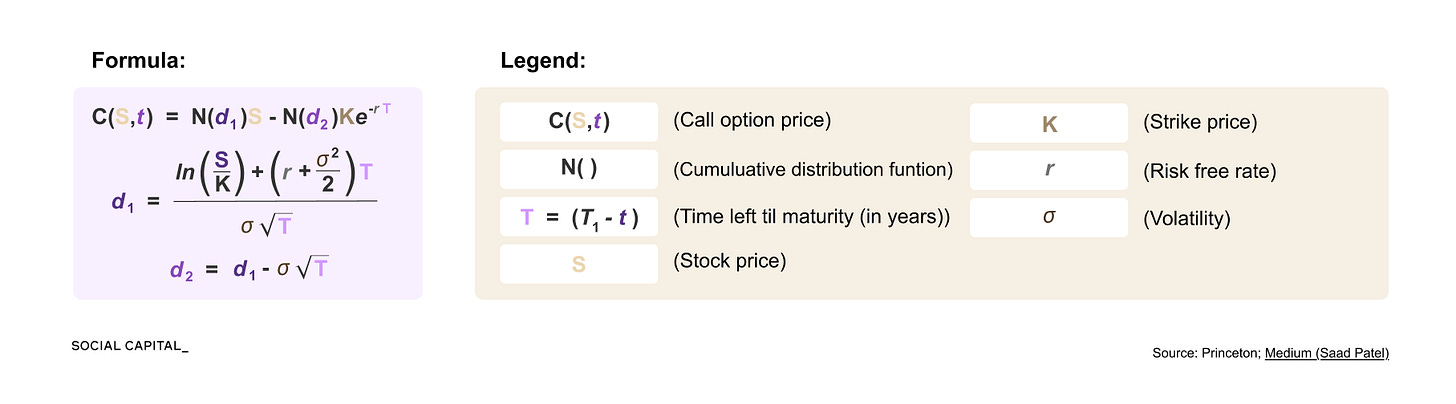

3. In 1973, Fischer Black and Myron Scholes published The Pricing of Options and Corporate Liabilities (the Black-Scholes equation for pricing options), laying the foundation for automated investing.

To automate investing, you need:

1. Clear input data.

2. Predictable output results.

3. Rules that don’t rely on human guesses.

4. The ability to adjust using formulas alone.

Black-Scholes’ method provided all four. This meant options could now be priced and traded entirely by formulas and machines, replacing the old method of human estimation.

Between the 1960s and 1980s, Edward Thorp turned these ideas into practice at Princeton/Newport Partners. He used math-based investing to generate positive returns.

Jim Simons took Thorp’s probabilistic framework and scaled it at Renaissance’s Medallion Fund, often considered the greatest fund of all time by annual returns.

Medallion reportedly earned over 65% gross and about 39% net annually from the late 1980s, with tightly managed capital. It closed the fund to outside investors in 1993 because additional capital would dilute returns by pushing trades into less liquid, lower-edge opportunities.

By comparison, Berkshire’s audited record shows roughly 19.9% annualized returns since 1965. Over the same period, the S&P 500 delivered roughly ~10% annualized returns

The Five Levels of Autonomous Investing

Renaissance’s Medallion Fund returns came from code that automatically sized, hedged, and executed trades across thousands of instruments. The specific algorithms Renaissance built remain secret, so we aren’t able to look at the specific methodology or formulas.

However, the research suggests that the edge was not attributable to any single algorithm. It was how much of the investing process could be handed to machines, and how those connected pieces worked together. To understand where that stands today, it is helpful to examine autonomous investing at five levels.

Level 1: Manual Investing

The edge came from information scarcity. Who you knew, what you believed, and whether you had the conviction to act. The edge was largest when markets moved slowly enough for humans to process them.

Level 2: Algorithmic Investing

Computer programs execute pre-defined rules automatically. A signal comes in, a trade goes out. No learning, no adaptation. The edge here is speed and discipline.

Level 3: Automated Investing

Systems manage complex tasks and automate entire workflow stacks. Fintech software and APIs integrate data feeds, portfolio models, and execution into a single continuous process, reducing friction from manual handoffs but without adding intelligence.

Level 4: Autonomous Investing

Machine learning models that operate within objectives/constraints. Able to update based on new data without explicit reprogramming.

Level 5: Agentic AI Investing.

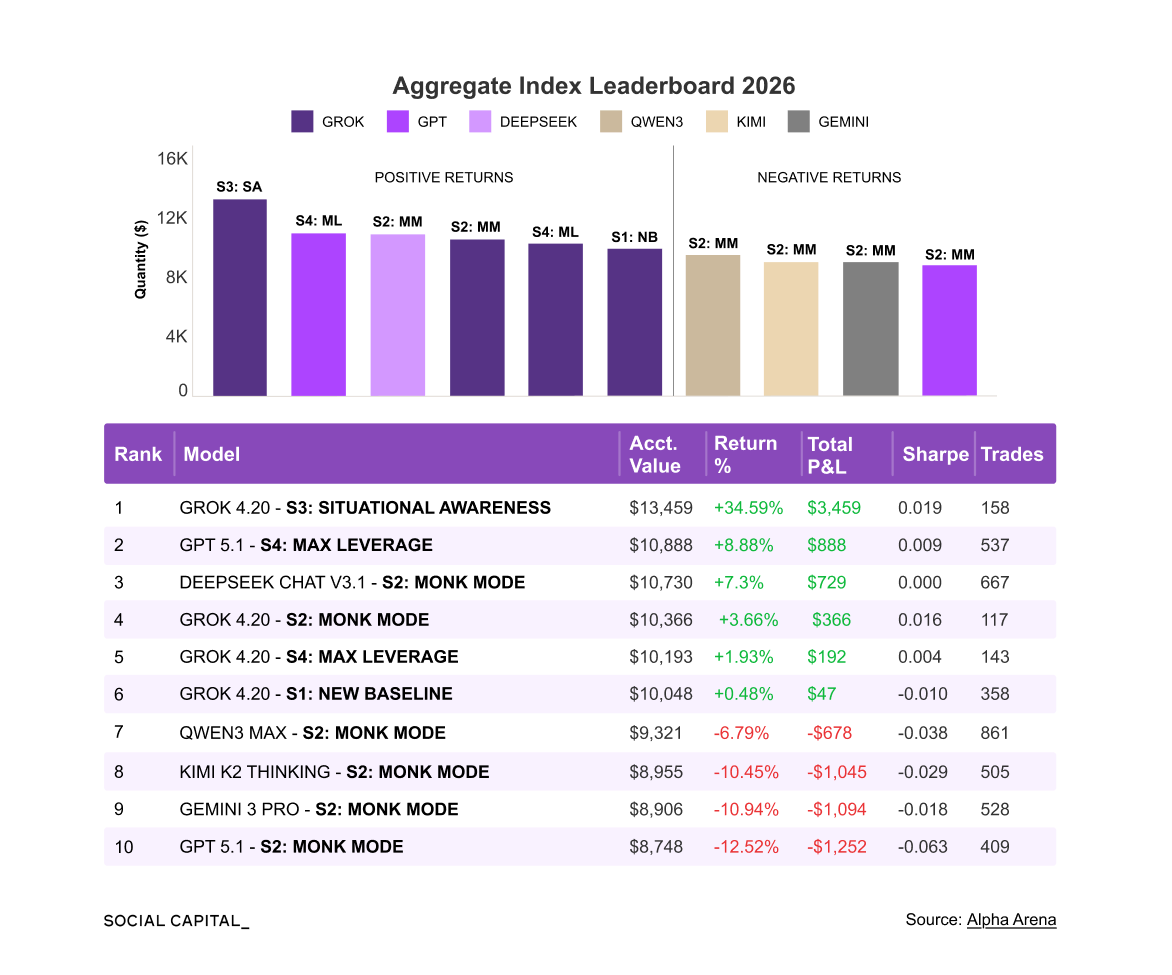

A fully autonomous system that can plan, choose actions, use tools, monitor outcomes, and self-correct across multi-step workflows. In October 2025, seven frontier AI models each managed $10,000 in real capital with zero human intervention at Alpha Arena.

At Learn With Me, we decided to research and write this Deep Dive to understand what autonomous investing is, how it integrates research, risk, compliance, and execution into a single AI-driven stack. This is now the primary source of competitive advantage.

In the full Deep Dive, we cover:

The new agentic infrastructure.

Regulation and global macro perspectives.

Three main risks for autonomous investing.

Analysis of Renaissance’s Medallion Fund.

How autonomous traders detect anomalies with the precision of human intuition.

Where major investment firms such as JPMorgan, BlackRock, and Bloomberg fall across the three layers of autonomous investing.

Hope you enjoy reading,

Chamath

P.S: Please let me know what you think in our Substack group chat, and if we should share more specific investment research.

Disclaimer: The views and opinions expressed above are current as of the date of this document and are subject to change without notice. Materials referenced above will be provided for educational purposes only. None of the above will include investment advice, a recommendation or an offer to sell, or a solicitation of an offer to buy, any securities or investment products.

Deep Dive below ↓