Deep Dive: A Primer on Mag7 (Part 1)

What drives the Mag7's revenues and bottom lines? How do they allocate capital, and are they positioned for continued outsized returns? How should we understand them in relation to the market overall?

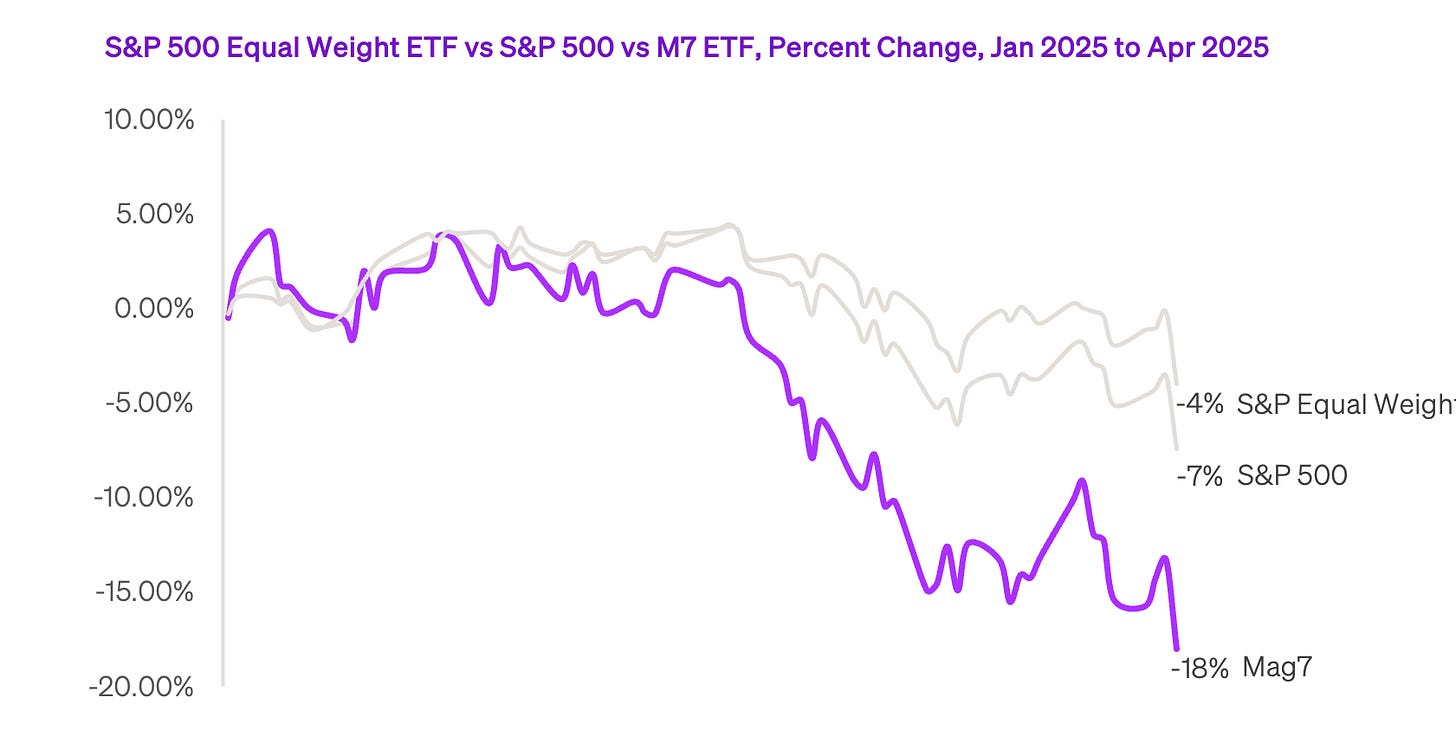

The Mag7 businesses are the undisputed winners of the internet era, with a combined market capitalization of over $12T, accounting for around 35% of the S&P 500 and driving over 50% of the S&P 500’s gains from 2023–2024.

However, this year, all seven of these companies mean reverted and are currently down around 10-20% so far this year.

For many, this mean reversion has prompted a re-underwriting of their own portfolios, and for some who had been more allocated toward cash and bonds, it has prompted them to start buying in.

We approached this deep dive to provide an essential and comprehensive view of each of the Mag7 companies. First, we discuss the Mag7 companies and how their stock prices relate to markets and macroeconomic factors (β), and then we discuss the individual companies and their performance and trajectory in relation to their valuation (α).

Hopefully, this approach provides a framework where the most important pieces of information are weighted as such, and it helps to establish a robust view of these companies in the face of the daily noise and chatter about them.

As someone building a company myself, in doing this exercise with my team, I regained an appreciation for what these companies do and provide for the world. Building a company is hard work, and these are some of the greatest businesses of all time.

This deep dive is Part 1, which covers the chapters through Tesla. Next week, we’ll publish Part 2.

We’ll also start producing regular updates on what’s going on with the Mag7 companies in conjunction with the news, so people can keep up with the most important updates for these companies and understand their implications.

Chamath