Who Controls the American Food Supply?

It was fascinating to research about a $5T economy that functions largely out of sight while affecting everyone in America. Food continues to reach consumers, but several constraints are...

Feeding the United States is an economic operation that serves over 340 million people every day. The $5 trillion economy of food production and distribution must function regardless of weather, labor availability, or price swings.

Several constraints are adding pressure to the American agriculture system at the same time:

Farm input costs remain elevated relative to the pre-2020 period.

Water sources in key producing regions are being depleted roughly 10x faster than they are replenished.

Labor shortages persist in crops that cannot be easily mechanized.

The average farmer is now 58 years old, and rising.

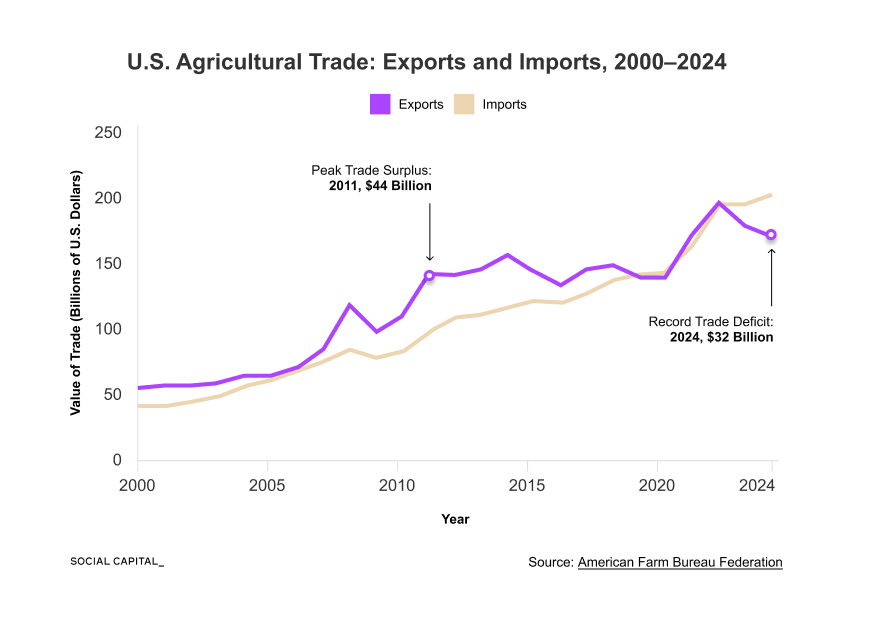

In 2024, the US agricultural trade surplus flipped into a $32 billion deficit.

Food continues to reach consumers, but the system has absorbed more cost to deliver the same outcome.

Most people encounter agriculture through prices at the grocery store or restaurant. Those prices are the final output of a much larger system. The forces that shape them operate upstream, where food production behaves more like infrastructure.

Physical limits shape what gets grown. Economic incentives shape who survives. Policy shapes how stress moves through the system. These forces define how the food system operates.

The current system formed through four waves of change. Each wave solved a constraint, but also introduced new ones.

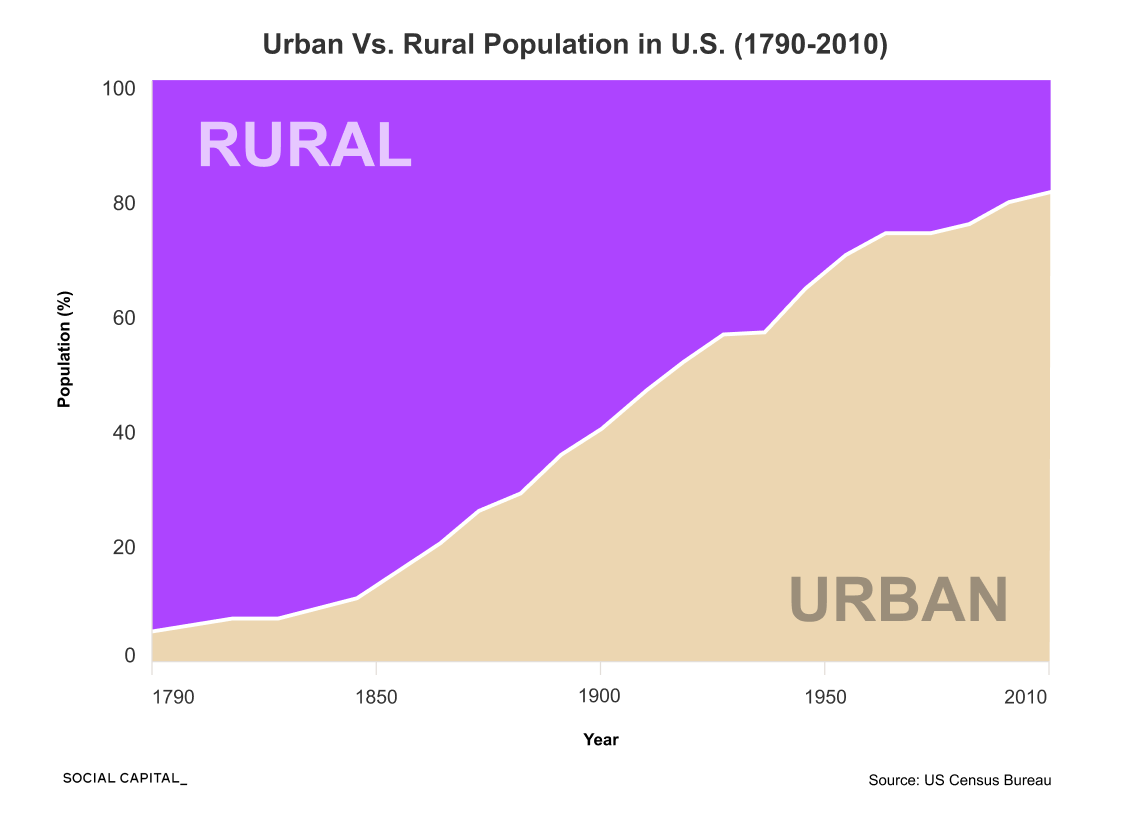

Wave 1: Mechanization Era

Tractors replaced animal labor and made scale economically decisive, sharply increasing output per worker.

Small farms could not justify the capital cost, pushing consolidation and driving millions of workers off the land.

Wave 2: Chemical Revolution Era

Synthetic fertilizer, pesticides, tractors, and irrigation raised output per acre and per worker.

Production became dependent on energy, water, and chemical inputs.

Wave 3: Consolidation Era

Processing, cold storage, logistics, and national retail chains scaled distribution.

Market concentration increased across the supply chain.

Wave 4: Data and Genetics Era

Precision inputs, sensors, automation, and gene editing improved efficiency at the margin.

Scaling remains limited by regulatory clarity, adoption costs, and integration with existing systems.

Our Deep Dive examines each wave in detail, what it solved, what it constrained, and how those effects compound today.

Those waves now collide with a set of converging constraints. Some are familiar, like labor and water. Others are less visible. Here are just a few from our report:

Subsidies stabilize output but concentrate risk and create dependencies.

Trade flows now matter as much as domestic production.

Demand is shifting in ways the supply side was not built to absorb.

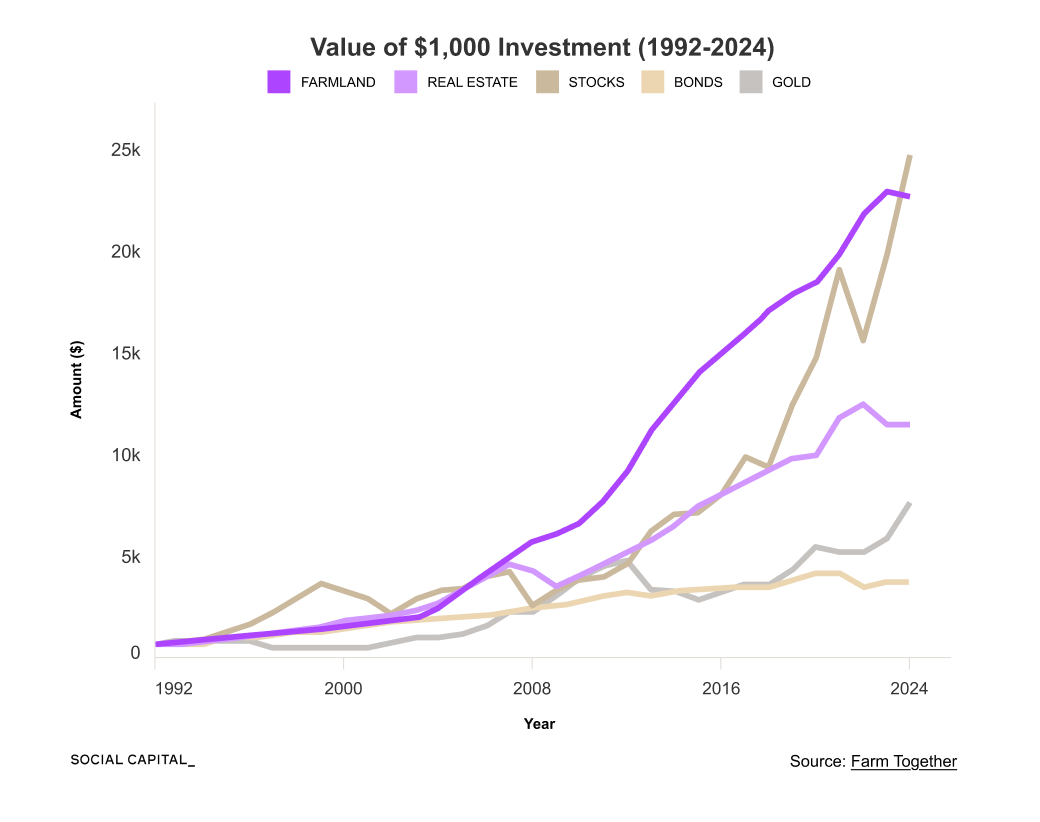

Land consolidation changes incentives faster than technology changes yields.

None of these pressures operate in isolation. Together, they influence where food gets produced, how production is organized, and how the system responds to stress.

This is the backdrop for our Deep Dive.

Our analysis traces how value, risk, and control move from inputs to farms to processors to retailers. It connects the historical waves of change to today’s pressure points and shows how decisions made upstream shape outcomes that appear much later.

The report is organized around a set of questions:

How does current agriculture actually work?

Where does each food dollar go across the supply chain?

What challenges does U.S. Agriculture face?

What explains the recent shift toward agricultural imports?

Where are the innovation and competitive edge?

It was fascinating to research and learn about a system that functions largely out of sight while affecting everyone in America. Hope you enjoy learning with me.

Chamath

PS: Ask me any questions about this Agriculture deep dive or past releases in the Substack group chat!

Disclaimer: The views and opinions expressed above are current as of the date of this document and are subject to change without notice. Materials referenced above will be provided for educational purposes only. None of the above will include investment advice, a recommendation or an offer to sell, or a solicitation of an offer to buy, any securities or investment products.

Deep Dive below ↓