Deep Dive: China's History, Culture, and Politics

Many people talk about a “race” between the U.S. and China. In investigating China from that paradigm, we have to understand its strengths in relation to the United States...

In 2020, I tweeted: "I've invested $0 in China. I aim to double that in 2021."

Here's what many people misunderstand about my position:

The reason why I didn't invest in China wasn't because I was bearish on it, but because I didn't understand it. I couldn't speak the language, I didn't grasp the political landscape, and I felt like an outsider looking in, and I don't invest in things I don't understand.

Many people talk about a “race” between the U.S. and China. In investigating China from that paradigm, we have to understand its strengths in relation to the United States.

The U.S.'s unrivaled global hard power comes from two main factors - its military and its economy. Those, in turn, build on technological edge.

China now contests that technological edge, showing strong progress on leading indicators like electricity infrastructure, R&D spending, and STEM talent.

Consider AI. I've said many times that winning the AI race comes down to who can make cheap energy abundant at scale. That is because without cheap energy, you can't power the compute needed to train and deploy the next generation of AI models, and you'll be left behind in a world where energy is the currency of innovation.

We need cheap abundant energy, and we need it fast.

And in the short term, that energy cannot come from traditional sources only. We have a 3-7 year backlog on the machines we need for more traditional fuel sources (like natural gas) for an AI race where months make a difference. That's why Elon and I, amongst others, believe it has to come from renewables and solar, which are faster to deploy.

In regards to renewables, at this moment in time, it's hard not to conclude that China is ahead of the U.S.:

China installed more solar capacity from 2023 to 2024 (278GW) than the U.S. has installed all-time (177GW)

Of all the new solar and wind facilities being built around the world, roughly two-thirds are in China

China also has over 50,000 km of ultra-high voltage lines to move energy cross country (U.S. has almost none)

In 2021, China produced over 85% of all solar cells

Adding to this, in 2025, China had 33 nuclear reactors under construction. The U.S., for context, had zero (although our wattage from nuclear reactors still outperform China’s.)

China is deploying infrastructure significantly faster, benefiting from different regulatory frameworks and decision-making processes.

The U.S. still leads in chip technology and data centers, but in regards to renewable energy, we aren’t increasing capabilities as fast as China is (just look at the numbers).

To be clear - China's investment into electrification, at least partially, comes out of necessity. Coal, China's biggest source of energy, requires a lot of water. Water is scarce in China, and cities like Beijing face extreme scarcity. China is also the world's biggest oil importer, and 80% of its oil imports pass through a two-mile wide chokepoint in the Malacca Strait.

In other words, China needs renewables for its energy security.

It's important to understand that China doesn't compete the way America does. Their greatest strength is their ability to execute at scale through centralized control, which allows them to move fast. While Western systems prioritize market-driven competition and distributed decision-making, each approach has distinct advantages depending on the context. You can see their playbook with industries like steel, solar, commercial drones, and EVs:

1) The CCP (China's ruling party) decides to make an industry a strategic priority

2) China picks one or two "National Champions" in that industry, then subsidizes them infinitely

3) They use aggressive pricing strategies, provide substantial financial support, and compete intensively until market dynamics shift

This playbook makes conventional competition difficult for private U.S. firms because Chinese counterparts sometimes can sell at prices below their costs.

This isn't to say China doesn't face problems.

China is seeing its slowest growth in decades. Foreign Domestic Investment (FDI) into China, a large enabler of its growth, plummeted after covid and even turned negative in Q3 2023. China also faces a demographic problem of too many old people and its fertility rate is one of the lowest in the world.

Most analyses of China look at GDP growth rates, military budgets, and technology investments in isolation. Depending on which outputs they track, you'll find that they either conclude that China is inevitably going to surpass the U.S. or that China has peaked.

Yet, all these analyses fall short by looking at outputs while ignoring what creates them.

This Deep Dive series explains China from first principles. There will be 3 parts and are designed to be read in order, assuming no prior knowledge.

Our analysis aims to understand different approaches to development and competition, recognizing that both systems have evolved to address their respective contexts and challenges.

Through the slides, our aim is to give you an overview of China from a curious Western perspective (since that's where most of our audience sits).

PART 1: History, Culture & Politics

Why did the Chinese Communist Party endure while nearly every other communist regime collapsed?

What matters more for Chinese politics: ideology, performance, or the ancient pursuit of “face”?

Does control come at the cost of truth - and if so, how long can a system survive on selective reality?

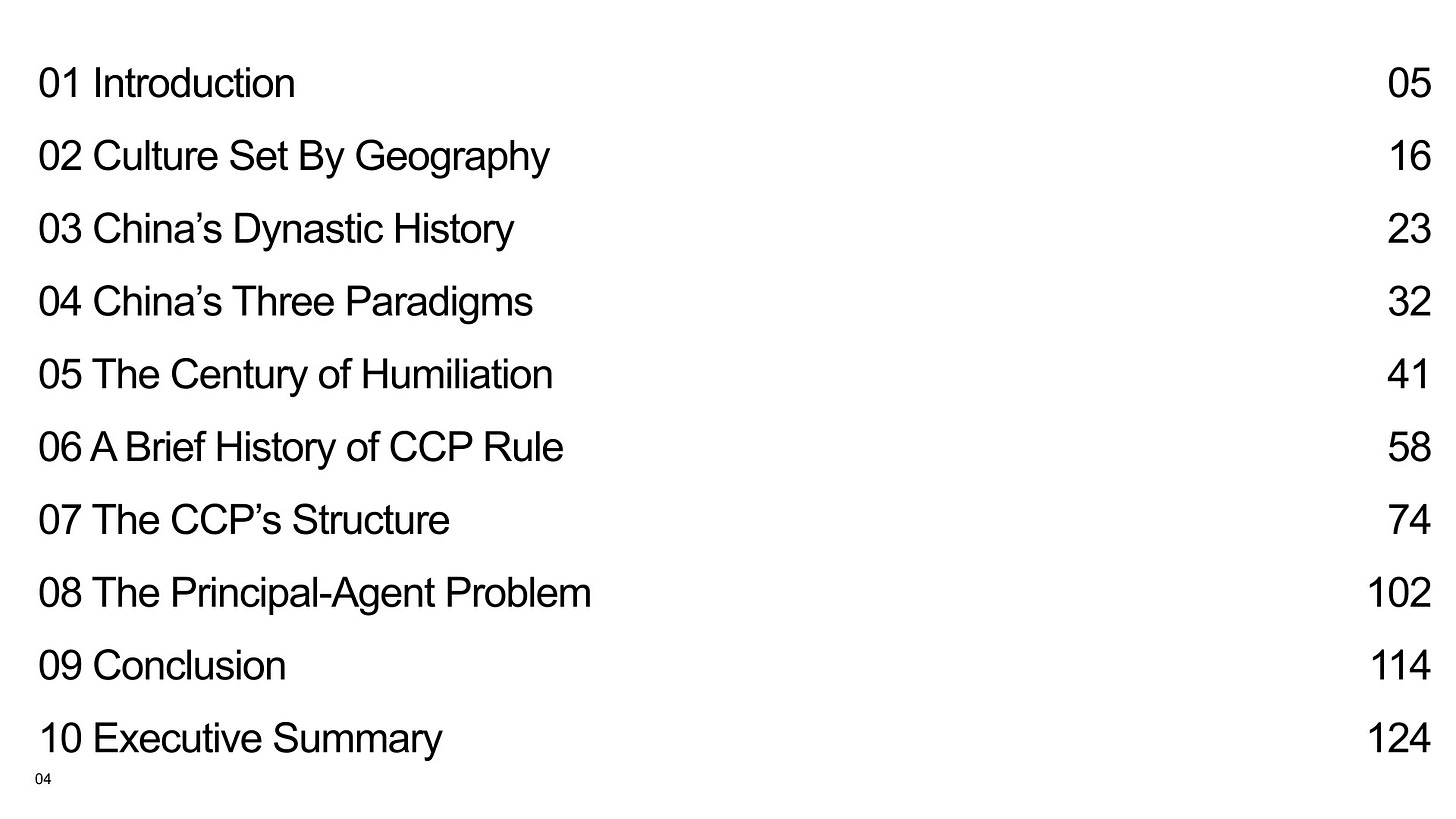

Chapter Overview:

Afterwards we will be releasing the next 2 parts in the subsequent weeks to follow:

PART 2: Domestic Policy & Infrastructure (Coming Soon)

How did a country once known for cheap toys and textiles leapfrog into EVs, solar, and AI?

Can China sustain growth under mounting debt, demographics, and political centralization?

How does China's coordinated approach to tech development compare to the West's market-driven competition?

PART 3: International Relations (Coming Soon)

What role does China play in the global economy - and what role does it want to play in the decades to come?

Does Beijing see the U.S.-led world order as something to join, bend, or break?

What does the world look like if China succeeds - and if it fails?

I hope you enjoy reading and learning about China with me. Let me know what you think in the group chat and comment section below.

Chamath