Higher Rates Will Lead to the Next Generation of Great Tech Startups

Lessons learned from the past 60 years of technology investing may show what’s ahead as we enter a turbulent macroeconomic backdrop

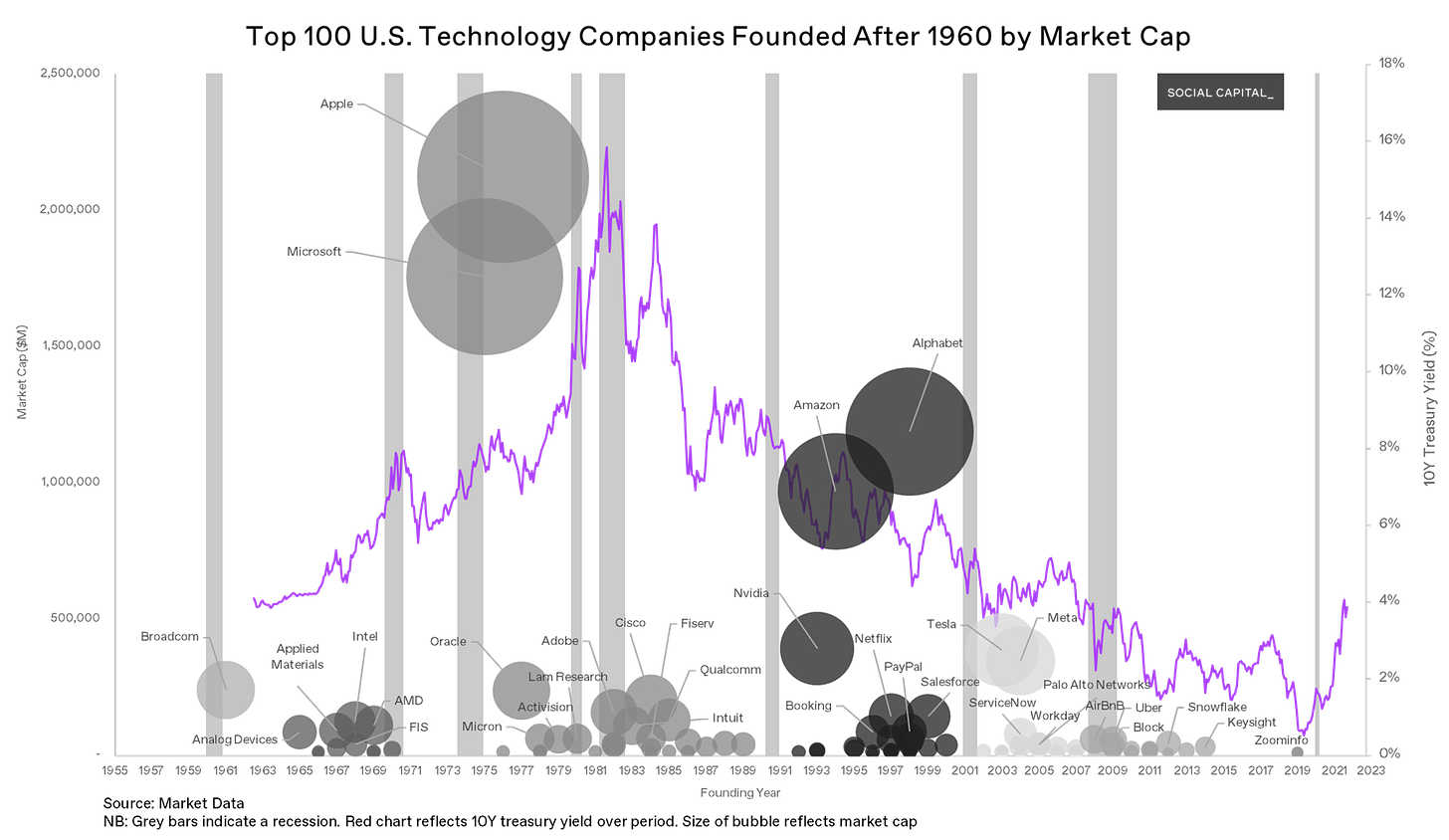

More than 13 years of zero-interest-rate policy in the U.S. has now come to an end. With sticky inflation, climbing interest rates, a focus on near-term cash flow, and potentially a looming recession on the horizon, the outlook for many technology companies appears bleak. In response, the risk appetites of U.S. VC funds have shrunk dramatically, with capital invested down more than 60% between Q4 2021 and Q4 2022.

And yet, when you look at the past 60 years of technology successes, the counterintuitive fact is that successful startups were created during every part of the cycle, and even more so during periods of economic turmoil. So, what can we learn from the past, as investors and founders, to guide the next generation of tech startups to achieve similar greatness?

First, some history…

Platform I: Creating the ‘Silicon Valley’

While transistors had been invented back in the late 1940s, they were initially based on germanium, not silicon, and thus were unable to function at high temperatures. So, when American chemist Morris Tanenbaum designed the first silicon junction transistor in 1954 – which resolved the temperature constraint – it kicked off a wave of process innovation, notably leading to the birth of the first semiconductor company, Shockley Semiconductor, in Mountain View, California.

However, Shockley was by most accounts a resounding failure. But in 1957, eight of the company’s employees (now known as the “traitorous eight”) left Shockley to start a new company called Fairchild Semiconductor. One of those employees was Gordon Moore, co-founder of Intel and the original proponent of Moore’s Law, an exponential trend whereby the number of transistors that can fit on an integrated circuit doubles every two years.

Fairchild became an incubator for major engineering talent, and dozens of leading companies, including Intel and AMD, were founded over the course of the decade to manipulate atoms and create the original platform on which all computing sits.

Notably, this first major cohort in the 1960s found success while interest rates wavered from 4% to 10% over the course of the decade. But despite above-average rates, the semiconductor greats – Intel, AMD, Applied Materials, and Analog Devices – were formed, creating a ‘valley of silicon’ in the mid-peninsula of the Bay Area, or what we know today as Silicon Valley.

Platform II: Inventing the PC

Buoyed by advances in semiconductors and electrical components, the second cohort of great technology companies was marked by the personal computing (PC) era. With the PC, we were able to tame atoms in various forms of transistors, CPUs, and memory to operate as a cohesive machine usable by non-engineers.

The first personal computer was introduced to the public in 1975 in the form of a ‘kit computer’ called the MITS Altair 8800. Just a year later, Apple launched the Apple I, but this too was a kit computer requiring a separate keyboard, power supply, and enclosure.

The modern PC industry really took off in 1977 with the launch of the PC “trinity” – the Apple II, Commodore’s PET, and RadioShack’s TRS-80. Unlike their predecessors, these were sold to be plug-and-play out of the box, meaning they included all necessary peripherals and components, marking the pivotal expansion of the PC market from avid hobbyists to everyday consumers.

This version of the PC also served as a new platform to sell a new type of product – software. This kicked off the formation of numerous software companies, including the likes of Microsoft in 1975, Oracle in 1977, and Adobe in 1982.

Much like the 60s semiconductor boom, the 70s and 80s cohort was built on top of a new technological breakthrough at that time, which created an opportunity for dozens of new companies to thrive. Also similar to the 60s, the 70s and early 80s saw multiple recessions, hyperinflation, and the most aggressive interest rate hikes in modern history in an attempt to rebalance the economy.

Platform III: Creating the Internet Economy

Sandwiched between two recessions at the beginning and end of the 1990s, we saw the advent of the world wide web, fueled in part by declining interest rates in 1998 and 1999 which ultimately led to what we now know as the “dotcom bubble.”

In search of new business models to monetize the web, the next cohort of companies was formed. This era was driven by massive growth in internet adoption and the highly speculative funding of any company with a “.com” suffix after its name. Nonetheless, the 90s birthed several of today’s internet giants, including Amazon, Google, and PayPal.

However, these successes were far from obvious winners at the time. During a period of declining rates and seemingly infinite valuations, companies were incentivized to prioritize growth over profits, and at all costs. Competition was fierce, with hundreds of companies funded across search, e-commerce, payments, and more.

But, when the Fed began to hike rates towards the end of the decade, the bubble inevitably popped. By 2004, a sobering 48% of dotcom companies were still doing business, with the survivors having successfully pivoted to profitability and capitalized on the shake-out in competition.

Platform IV: Mobile computing

The next, and most recent, meaningful breakthrough came in 2007, with the launch of the iPhone. This revolutionary product provided yet another new platform on which companies could be built: mobile apps. Thus emerged an entirely new business model that would spur a new generation of consumer-facing technology companies – including Airbnb in 2008, Uber in 2009, and Snapchat in 2011 – all readily accessible in the palm of your hand.

The Platformization Conjecture

Despite there being many winners and losers over the course of more than six decades, we can identify a clear pattern that led to the formation of each cohort of technology companies: major technology breakthroughs can act as platforms for new companies and business models.

First, the development of the silicon microchip set the stage to produce computers. Next, the creation of computers provided a device to improve productivity via software. Then, enabling computers around the world to connect with one another spurred the creation of the internet. And finally, by making the internet easily accessible anywhere, anytime, and affordable, the mobile internet economy was born.

The obvious takeaway is that we cracked the age-old question of which came first: the chicken or the egg? The answer is that a new technology platform dramatically increases the odds of startup success. Said differently, starting a PC company in 1994 was a much worse idea than starting it in 1984 (Dell).

But there are two non-obvious takeaways as well.

First, it’s notable that all of these big leaps in technology involved the manipulation of atoms – it wasn’t just bits! In other words, leaps in software coinciding with leaps in hardware have always led to much bigger markets than an advance in software could create on its own.

Second, the data shows that many of the most successful startups are born (Apple, Microsoft, Amazon, Alphabet, etc.) during times of above-average interest rates, particularly compared to when similar advances occurred during times of lower rates.

We can see that the largest and most successful cohort of startups was founded during the 70s and 80s, which benefited from the trifecta of: (1) advances in hardware, (2) advances in software, and (3) soaring interest rates. In the face of multiple recessions and interest rates peaking in the mid teens per cent, this era produced the largest and most successful cohort of technology startups ever, with 27 companies now worth more than $5.4 trillion in cumulative market cap.

Alternatively, the years between the dotcom crash and the global financial crisis were somewhat of a no-man’s land. Unlike previous cohorts, there was no breakthrough innovation that would provide a platform for new startups.

That said, there was still a slow grind upwards in interest rates, and VCs – which were scarred by the glut and excesses of the prior decade – were reluctant to put capital to work. Yet this period of austerity still supported the births of Tesla and Palantir in 2003, Facebook (now Meta) in 2004, and Palo Alto Networks in 2005.

This flies in the face of conventional wisdom which would suggest that low interest rates benefit startup creation through an increase in risk capital.

As a heuristic, our Platformization Conjecture could be written that the environment for a successful technology startup, over decades, can be simplified as follows:

Company success is more likely when founded to exploit a new leap of technology.

Company success is more likely when founded during a period of higher-than-average interest rates.

Company success is even more likely when companies are founded to exploit a technology innovation that involves both software and hardware during periods of higher-than-average interest rates.

Why are high interest rates good for startups?

Interest rates cut both ways. While startup creation is directly proportional to the availability of risk capital, free money can actually be a headwind for sustained success. Instead of concentrating financial resources in a few promising ventures, it can have the tendency to spread capital and talent too thinly over a broader set of companies.

As a result, during low-rate environments we find that competition thrives, talent gets diluted, and input costs like labor and advertising go up while the individual probability of any company succeeding goes down.

At the same time, the market becomes too quick to reward a dollar of revenue growth with several more dollars of incremental enterprise value. In turn, companies are mistakenly given a clear incentive: grow at any cost.

The unfortunate outcome is that this promotes unsustainable growth models, which as we are experiencing now, are extremely difficult to snap out of, particularly when regimes (like interest rates) change.

For example, even with the massive tailwind of internet growth in the 90s, many people underestimate how close Amazon was to bankruptcy. The company’s stock price was down more than 90% following the dotcom crash, and had it not been for a last-minute infusion of capital prior to the bubble bursting, the company could have followed the same fate as most of its dotcom peers that went bankrupt.

From where we sit today, we can now see clearly that 13 years of zero-interest-rate policy has taken its toll on company profitability and executive proficiency. Just compare the early margins of leading companies in previous cohorts (founded during high rates) with those of today (founded during zero rates). They don’t build them like they used to…

Uber and Snapchat have never generated a full year of positive EBITDA, and Block (formerly Square) is barely a breakeven business. Contrast their margins with those of Microsoft, Google, and Meta, which all went public sooner during a regime of rising rates and were all resoundingly profitable immediately prior to and following IPO.

Rising rates give us an opportunity to see the forest through the trees. They concentrate capital and talent more intentionally in ventures that create value, shake out competition, and force sustainable growth models.

If inflation turns out to be stickier than expected and the 2020s really are an analog for the 70s and 80s – marked by higher rates and economic downturn – it could ironically prove beneficial for startups that are able to embrace regime change, build sustainable business models, and capitalize on an era that should see competition diminish and talent become available.

Platform V: Energy and compute become free and abundant

Looking ahead, the natural next question is: as the Fed continues to raise, and likely sustains, higher rates over the coming years, will there be platform-level leaps of bits and atoms that coincide with the new interest rate regime?

For us, we are intently focused on what we anticipate will be the two biggest drivers of the next decade:

The first is the marginal cost of energy going to zero. This happens through a proliferation of zero-carbon solutions like solar and wind, along with moderately intensive solutions like natural gas, all working to create energy that quickly approaches $0/kwh.

Second, complementing this new energy model is a shift away from Moore’s Law and CPUs to the proliferation of GPUs. This would support scaling Moore’s Law through parallelism, which favors applications of machine learning and AI. As a result, the marginal cost of compute will go to zero.

With these two trends put together, there is seemingly no challenge too expensive or too complex to solve. We are already beginning to see the green shoots (CRISPR and AlphaFold), but the universe will grow exponentially as scale, cost, and access continue to improve.

Finally, it’s important to remember that boundary conditions should always exist when making risky startup investments. But, if the trifecta of boundary conditions are met – a new bit platform, a new atom platform and sustained above-average rates – history has shown it to be a very lucrative period for both investors and founders.