How Solar Beat Coal, Gas, and Nuclear Combined

In 2025, the energy landscape hit a historic inflection point. Solar now attracts ~$500B in investments each year, more capital than all other electricity sources combined. What happened?

In 2025, the energy landscape hit a historic inflection point. Solar now attracts ~$500B in investments each year, more capital than all other electricity sources combined. Last year, the world installed more new solar generation than coal, gas, nuclear, wind, and hydro put together.

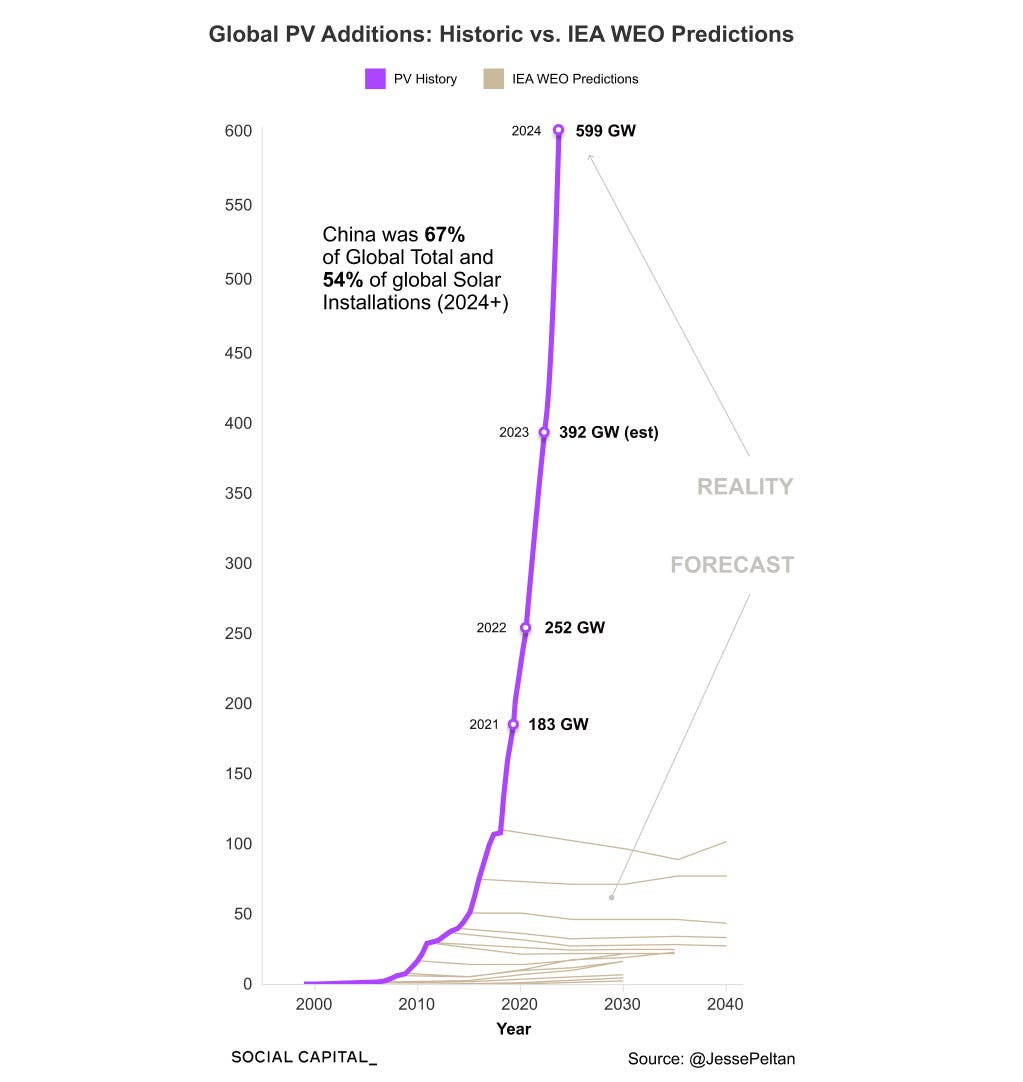

While the International Energy Agency spent the last two decades underestimating solar growth, costs have fallen by 90%, and annual installations have grown exponentially.

What happened?

Extraction vs Manufacturing

Traditionally, energy relied on extracting finite fuel from the Earth. In extraction, ongoing opex costs for coal and gas plants stay high because you must continuously pay to extract and consume fuel to generate every unit of power.

Solar power represents a paradigm shift from extraction to manufacturing. With solar, we do not burn a scarce resource; we use silica sand, the second most common substance on Earth, to manufacture panels. Because solar is a manufactured technology, it follows a deflationary learning curve. As factories scale, automation improves, and material use declines, the unit cost declines.

This shift created a historic cost collapse. Since 1975, solar panel costs have fallen by more than 99.9%. Module prices dropped from ~$2.00 per watt in 2010 to ~$0.10 per watt in 2026.

Solar is now the cheapest major source of new electricity. The total cost to build and operate a solar plant, known as the Levelized Cost of Electricity (LCOE), is now $30–$40 per megawatt-hour (MWh). By comparison, coal and gas generation cost $50–$150+ per MWh.

China Built the Solar Cost Curve

The global solar cost collapse was brought on by China.

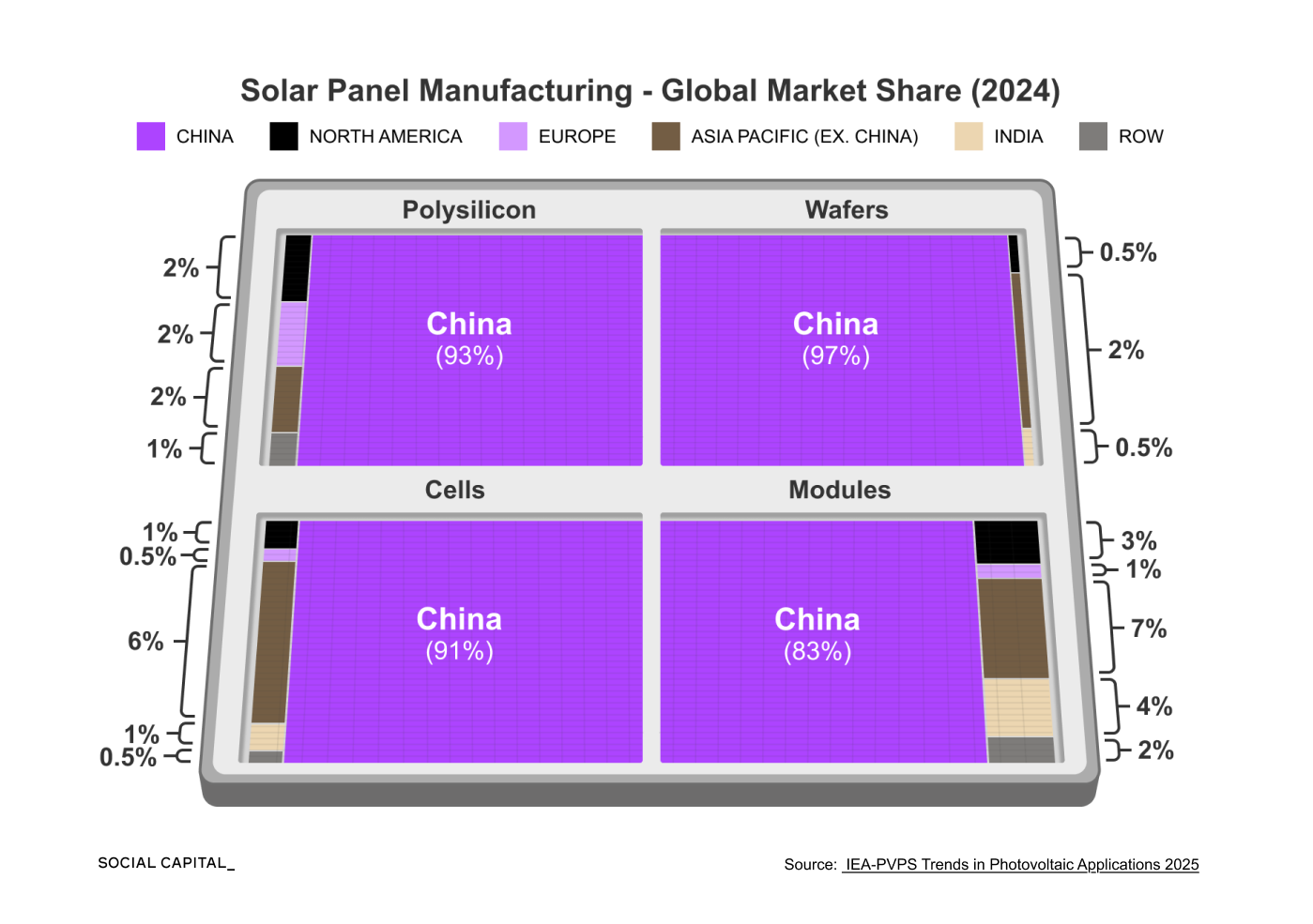

China dominates the solar manufacturing supply chain. Across polysilicon, wafers, cells, and finished modules, Chinese firms control the majority of global capacity. China accounts for roughly 80-95% of production. No other major energy technology has ever been this geographically concentrated.

China treated solar as an industrial manufacturing strategy. State-backed capital funded factories years ahead of actual demand. Cheap, coal-dominant electricity powered energy-intensive production. Oversupply pushed prices down globally. Western manufacturers exited. Chinese firms scaled further, vertically integrated, and concentrated regionally. Meanwhile, through gig projects, China generated nearly unlimited domestic demand.

This created a flywheel. Lower prices increased global demand. Higher demand justified larger factories. Larger factories reduced costs again.

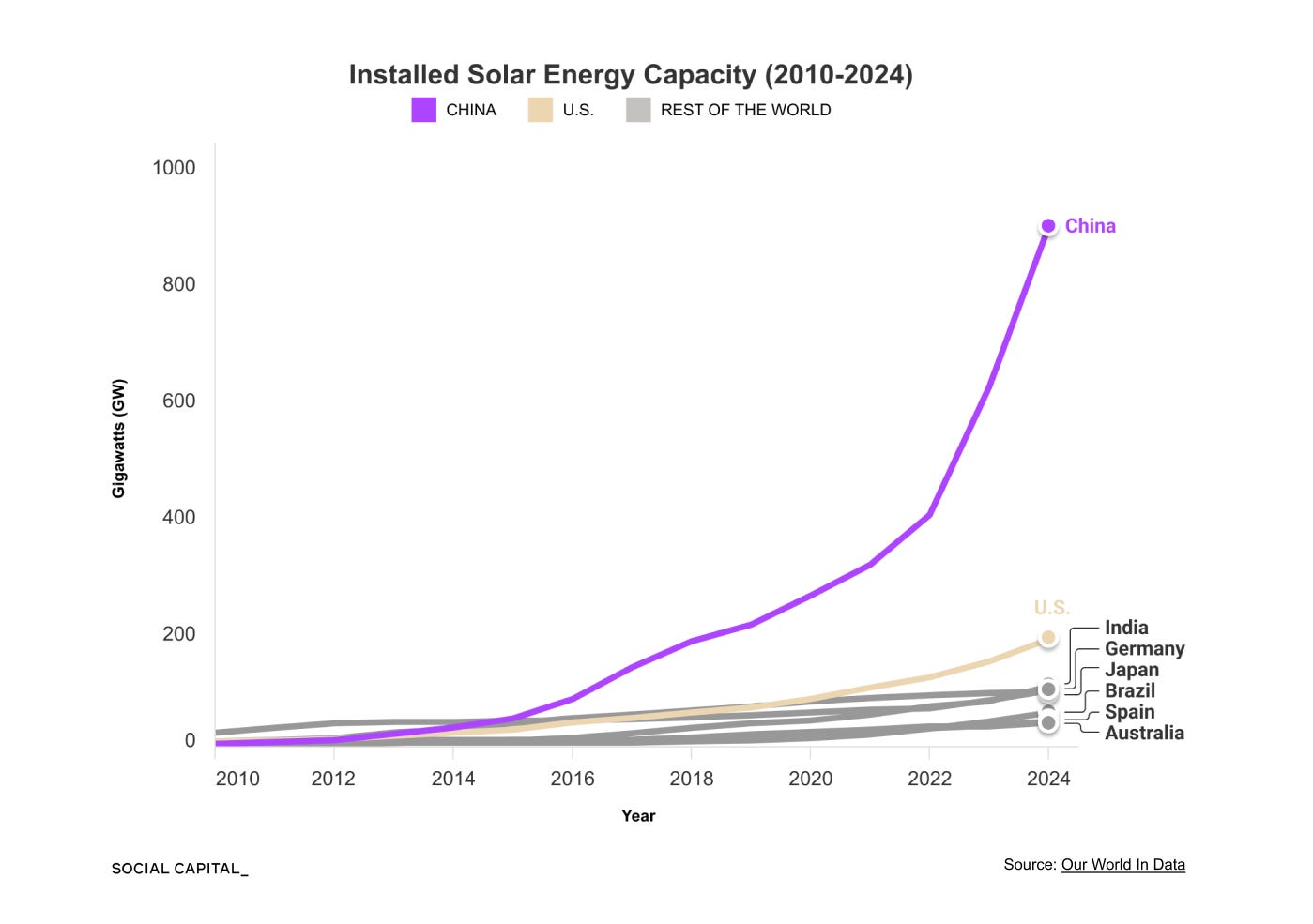

China also deployed solar at scale. Last year, China installed more new solar capacity than any other country by a wide margin, and more than the U.S. has in its entire history

China’s scale explains why solar became cheap. However, cheap solar panels alone do not explain why solar now anchors future power systems.

That role is split between utility-scale solar and distributed solar, each solving a different constraint.

Utility-scale solar supplies bulk power. Individual projects now reach multi-gigawatt scale, with total national build rates measured in the tens or hundreds of gigawatts per year. Data centers, manufacturers, and hyperscalers increasingly contract directly with solar providers through long-term power purchase agreements (PPAs). In 2024, data center operators signed over 40% of all clean energy PPAs.

Distributed solar solves a different problem.

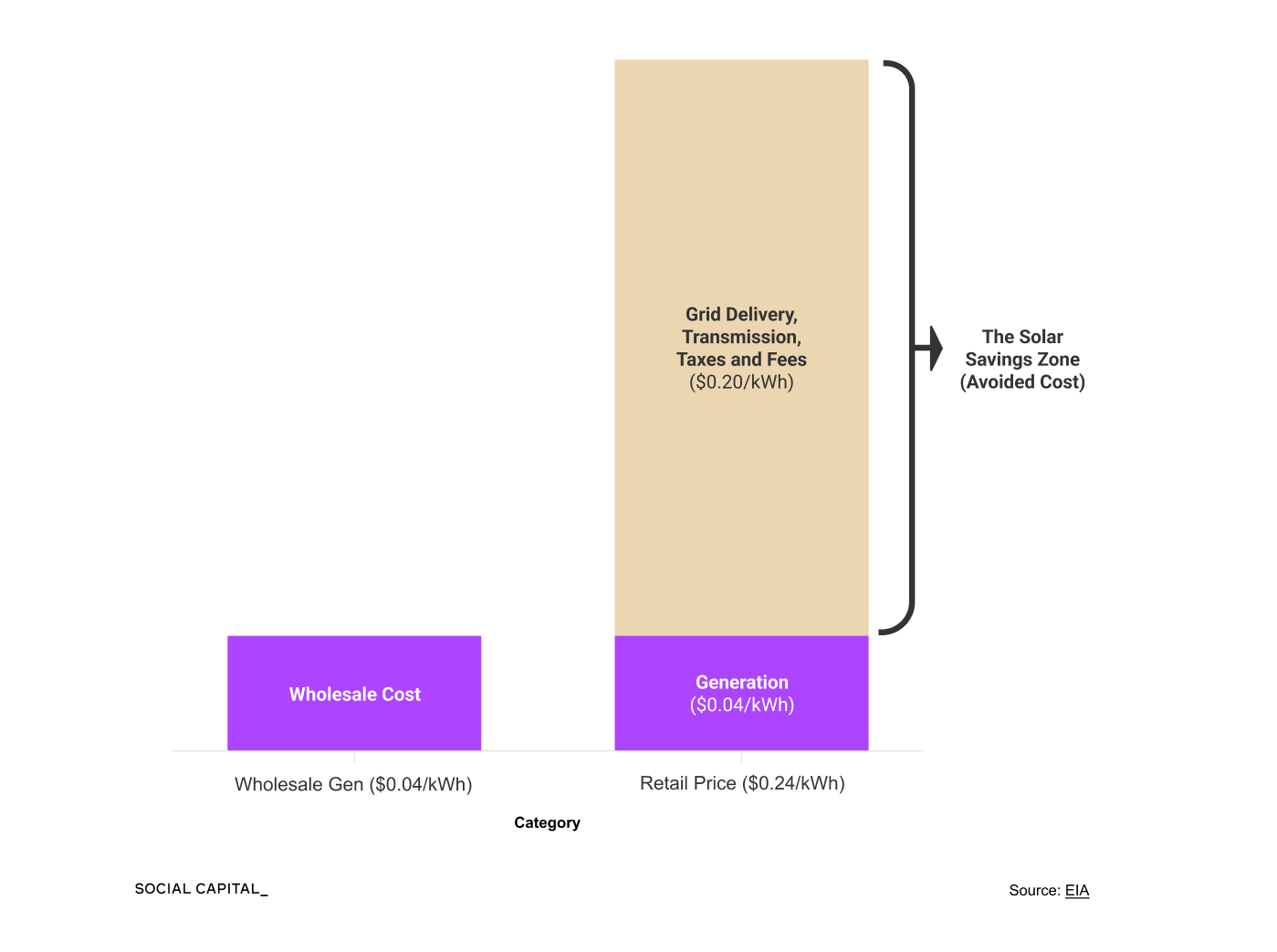

I have said before that the marginal cost of energy is collapsing toward zero. People pushed back, noting that their electricity bills keep rising.

The confusion comes from where electricity costs actually sit.

Generation is only a minority of the retail electricity bill. Transmission, distribution, and grid delivery fees and taxes make up most of what households pay. Centralized power must travel long distances, pass through substations, and move across congested wires. Those infrastructure costs rise even as generation gets cheaper.

Distributed solar bypasses that system entirely. Electricity is generated where it is consumed. The homeowner captures the avoided grid costs directly.

When aggregated, distributed systems also behave like power plants. Virtual power plants coordinate thousands of rooftops and batteries to deliver capacity comparable to traditional gas plants during peak hours.

Put simply, utility-scale solar feeds the grid. Distributed solar relieves it.

Solar dominates new investment. The remaining constraints are fewer but more complex. Intermittency, grid balancing, and supply concentration are among the most important. Together with other unresolved issues, they now determine solar’s deployment limits. The answers require an understanding of manufacturing economics, load-balancing mechanics, and next-generation technologies.

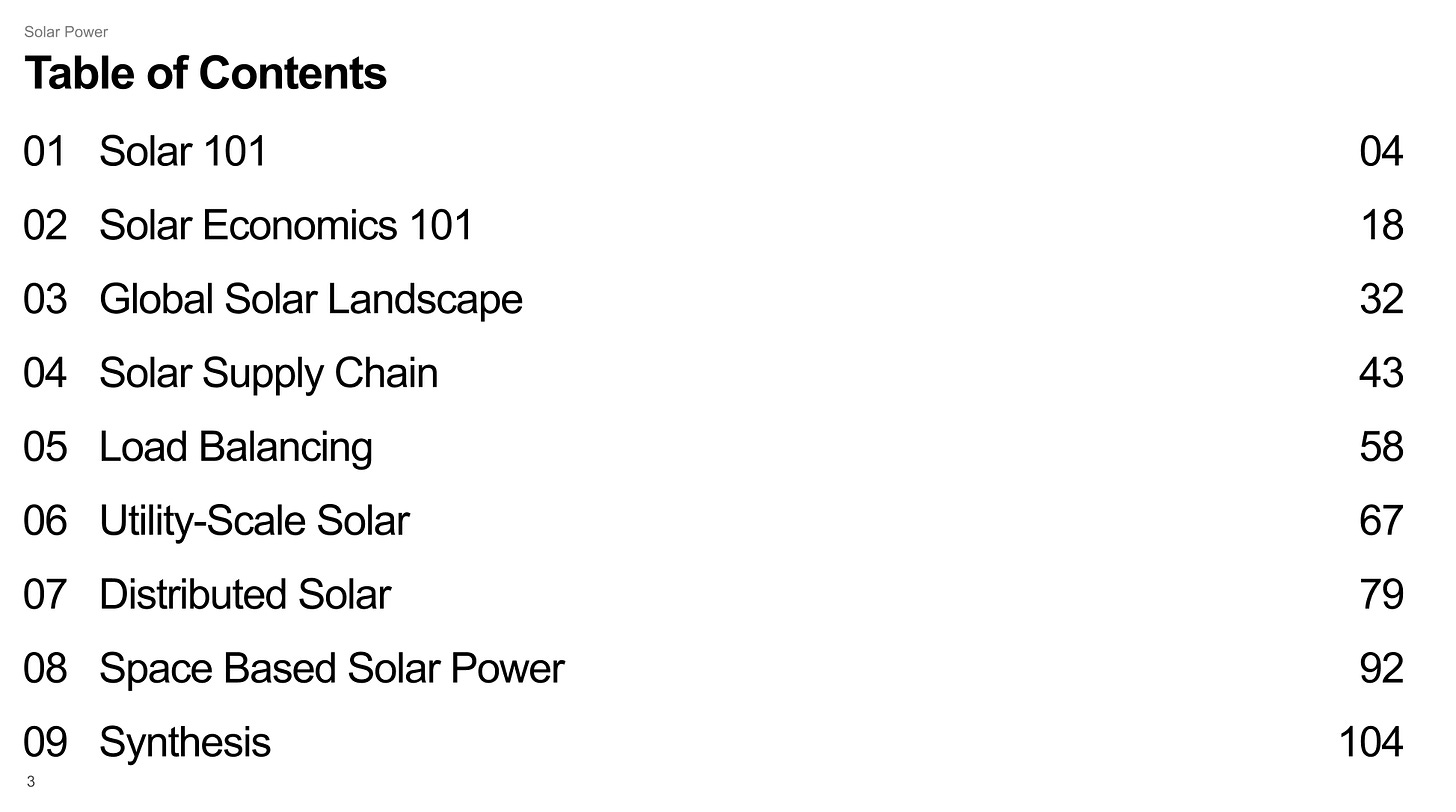

This is why my research team at Social Capital spent months putting together this 115-page Deep Dive on solar. We cover:

How sunlight, traveling 93 million miles, becomes usable electricity.

Why solar deployment is driven more by specific policy and deliberate market design than by sunlight.

How batteries convert intermittent solar into dispatchable power and where the economics still fail.

Why China’s solar overcapacity created total Western supply chain dependency with no fast rebuild path.

Where does the opportunity for U.S. energy dominance exist while China controls 80% of global hardware manufacturing?

If you follow me on X and on All-In, you know I have strong opinions on solar. We have a Substack subscriber-only group chat. Let me know what you think and if you have any questions over there. Will do my best to answer them throughout the week.

Hope you enjoy learning with me,

Chamath

Disclaimer: The views and opinions expressed above are current as of the date of this document and are subject to change without notice. Materials referenced above will be provided for educational purposes only. None of the above will include investment advice, a recommendation or an offer to sell, or a solicitation of an offer to buy, any securities or investment products.

Deep Dive below ↓