What I Read This Week...

JPMorgan Chase announced a sweeping plan to deploy $1.5T toward what it calls “security and resiliency”, Google's AI Biology Breakthrough, and more.

Caught My Eye…

1) JPMorgan’s $1.5 Trillion Bet on America

On October 13, 2025, JPMorgan Chase announced a sweeping plan to deploy $1.5 trillion in financing over the next decade toward what it calls “security and resiliency”. The categories are a blend of industrial strategy, national defense, and infrastructure modernization.

“It has become painfully clear that the United States has allowed itself to become too reliant on unreliable sources of critical minerals, products and manufacturing – all of which are essential for our national security… It also needs to remove obstacles that stand in the way: excessive regulations, bureaucratic delay, partisan gridlock, and an education system not aligned to the skills we need.” - Jamie Dimon, CEO of JPMorganChase

The initiative will channel financing into sectors that underpin U.S. economic and technological independence. JPMorganChase is also directly investing $10 billion into equity and venture investments in select U.S.-based firms.

JPMorganChase plans to focus on the following four key areas:

Supply Chain and Advanced Manufacturing: Critical minerals, pharmaceutical precursors and robotics

Defense and Aerospace: Defense technology, autonomous systems, drones, next-gen connectivity and secure communications

Energy Independence and Resilience: Battery storage, grid resilience and distributed energy

Frontier and Strategic Technologies: AI, cybersecurity and quantum computing

In practice, this means JPMorgan is aligning its lending, project-finance, and investment arms with public priorities, effectively acting as a private-sector proxy for the kind of long-term capital seen in federal programs. The firm also plans to advocate for policies that can accelerate advancement through R&D, permitting, procurement and regulations conducive to growth

At a functional level, the bank’s move leverages its balance-sheet power to shape the industrial cycle. The next generation of energy and semiconductor projects require debt, insurance, and syndication at increasingly larger scales to keep up with the exponential demand.

Dimon concluded, “Hopefully, once again, as America has in the past, we will all come together to address these immense challenges. We need to act now.”

2) The Netherlands Seizes Nexperia, a Chinese Owned Chipmaker

The Dutch government’s decision to seize control of Nexperia, a semiconductor firm owned by China’s Wingtech, marks a watershed moment in Europe’s industrial policy. The official reason was “recent and acute signals of serious governance shortcomings and actions within Nexperia” under former CEO Zhang Xuezheng. This move hopes to safeguard crucial technological knowledge and capabilities that could pose a risk to Dutch and European economic security.

The Minister of Economic Affairs invoked the rarely used Goods Availability Act, suspending the company’s Chinese leadership, placing its shares under custodial management, and any company decision may be blocked by the Minister if deemed harmful to the company or the Dutch and European value chain. The Act was created in 1952 and initially enacted during the Cold War to allow the Dutch government a legal basis to manage national resources and ensure economic stability in the event of a future conflict.

The Dutch action came after meetings with the U.S. Bureau of International Security and Nonproliferation (ISN) officials, in June this year. They showed rising pressure to remove Nexperia’s Chinese CEO to help keep the company off the US Entity List that dictates export control restrictions. Although Nexperia is not explicitly mentioned, the company is affected due to its status as a subsidiary under Wingtech Technology Co., Ltd. (a Chinese partially state-owned publicly-traded semiconductor company under the same CEO) that was put on the BIS entity list last December.

“The fact that the company’s CEO is still the same Chinese owner is problematic… It is almost certain the CEO will have to be replaced to qualify for the exemption from the entity list.” - translated quoted minutes from the meeting on June 12th.

This intervention is rippling through the European corporate supply chain as China continues to tighten rare earth exports while the U.S. responds with further tariffs. Multiple German automakers rely on Nexperia’s components for power management and battery control units, the kinds of chips that are essential for the EV transition. The European Automobile Manufacturers’ Association (ACEA), said it was “deeply concerned by potential significant disruption to European vehicle manufacturing if the interruption of Nexperia chips supplies cannot be immediately resolved.”

3) Google’s Breakthrough in AI through Biology and Fusion

Google DeepMind’s latest research marks a profound turning point for AI. On October 15th, Sundar Pichai announced that their model generated a novel hypothesis about cancer cellular behavior that was validated by scientists in living cells. The model was built in collaboration with Yale, and is called C2S-Scale 27B.

The task they gave was for the model to find a drug that acts as a conditional amplifier. Something that would boost the immune signal only in a specific “immune-context-positive” environment where low levels of interferon (a key immune-signaling protein) were already present, but inadequate to induce antigen presentation on their own.

The model generated an unexpected insight into how tumors evade immune detection by suggesting a way to transform “cold” (invisible to the body’s immune system) tumors, which resisted treatment, into “hot” ones that respond to immunotherapy. The hypothesis was then tested in the lab and remarkably resulted in a roughly 50% increase in antigen presentation, which would make the tumor more visible to the immune system.

“We can finally begin to simulate how real human cells behave—in context, in silico. This is where AI stops being just an analysis tool and starts becoming a model system for biology itself.” - David van Dijk, PhD, Associate Professor of Medicine, Yale

If results continue to hold, this represents one of the first instances where an AI system not only mapped biological correlations but helped discover new biology.

DeepMind also just announced a new partnership with fusion startup Commonwealth Fusion Systems, using AI models to accelerate plasma simulation and reactor optimization. They have developed a specialized model called Torax with the goal to reach “breakeven,” a critical milestone on the path to generating net fusion energy (more power from fusion than it takes to sustain it). If they succeed this will make SPARC the first magnetic fusion machine in history to generate net fusion energy.

Learn With Me and My Friends…

Watch All-In: Trump: Send National Guard to SF, China Rare Earths Trade War, AI’s PR Crisis

Watch All-In: 1929 vs 2025: Andrew Ross Sorkin on Crashes, Bubbles & Lessons Learned

Read our Deep Dive: How China Built Its Industrial Power (discussed on this week’s All-In)

Other Reading…

Aging as a Loss of Goal-Directedness (Advanced Science)

Gita Gopinath on the Crash that Could Torch $35trn of Wealth (The Economist)

Agent Learning via Early Experience (ARXIV - Meta Superintelligence Labs)

Protein Powders and Shakes Contain High Levels of Lead (Consumer Reports)

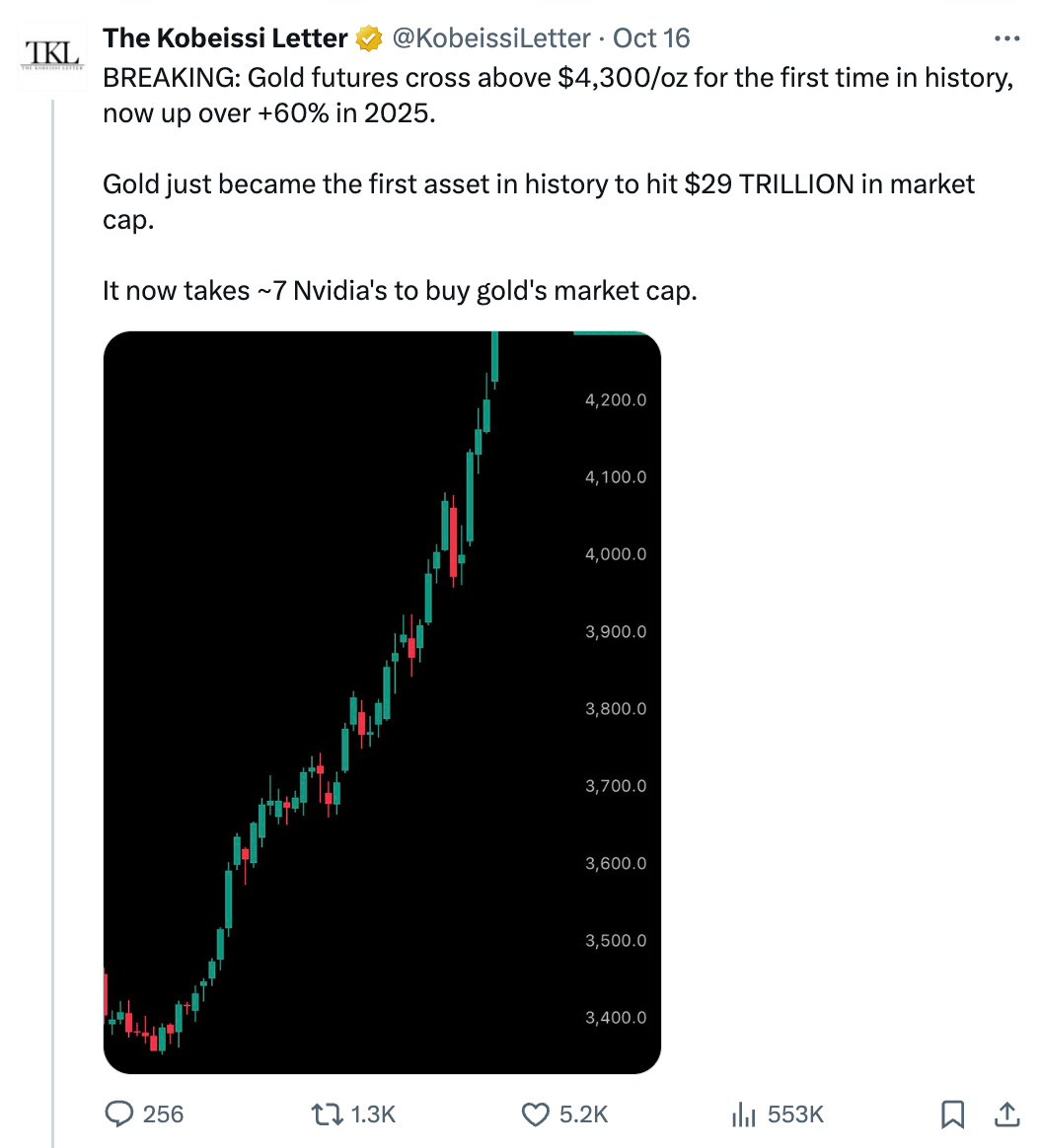

My Answers to Your Questions About Gold (Ray Dalio)

AI’s impact on science ❤️

Jamie diamond is right on with his comments. Not only do we have a wealth gap. We have a massive education gap, which obviously causes a wealth gap Andrew Sorkin mentioned one of the markers of 1929 collapse was when one of the banks started buying equities. hopefully 10 billion by Chase is impactful.