WIRTW: Gemini 3 Pro Tops Benchmarks, JPN Bond Spikes, and Ramp's $32B Valuation

Google's most intelligent model release to date, Japan long-dated bond yield surges, Ramp raises $300M, and more.

What I Read This Week: a summary of the content that I consumed in the previous week…

Caught My Eye…

1) Google announced Gemini 3 on November 18, 2025, calling it its “most intelligent” model to date and rolling it out day-one across Search (AI Mode), the Gemini app, AI Studio, Vertex AI, and a new agentic dev environment called Google Antigravity.

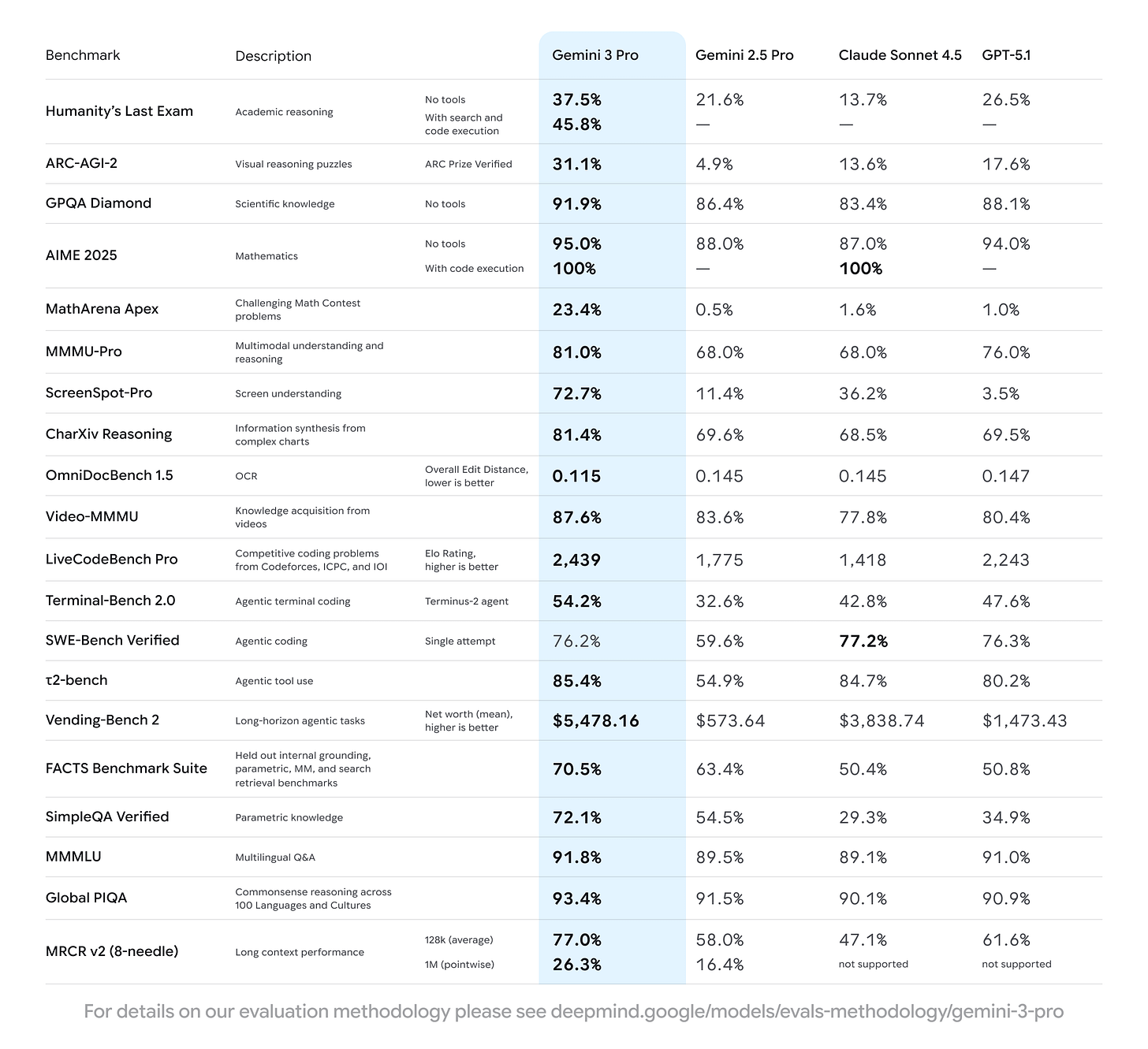

It has topped the charts on:

LMArena Leaderboard with a breakthrough score right above Grok’s 4.1 release

Humanity’s Last Exam with PhD-level reasoning

GPQA Diamond (for scientific knowledge)

And leading many more benchmarks, showing that scaling laws are still intact.

The key insight is that multiple sources, including model cards and press coverage, confirm that Gemini 3 Pro was trained on Google’s own Tensor Processing Units (TPUs), not Nvidia GPUs. This gives Google a strong advantage over other firms that are in extreme competition for processing units.

Google Antigravity is the new ‘agent-first’ IDE (Integrated Development Environment), with a focus on giving developers the tools to manage AI agents. They showcase how enterprise developers can delegate to multiple ‘background agents’ within Antigravity and move onto a new window while tasks are being completed.

Nano Banana has also been upgraded to a Pro version and is Google’s advanced image generation and editing tool. It introduces 4K output, real-time iterative refinement, and hybrid JSON prompting for complex scenes, at roughly a 4x speedup over prior Nano Banana generations. The additional speed and quality is attributed explicitly to optimized tensor processing on TPUs.

2) This week, Japan’s long-dated government bond yields have surged to their highest levels since (and in some cases beyond) the 2008 financial crisis.

The new PM, Sanae Takaichi, is pushing for Japan’s biggest stimulus since COVID, with the cabinet approving a 21.3 trillion yen ($135.40 billion) economic stimulus package.

JGB yields have long set a baseline for global debt markets because of the country’s ultra-loose monetary policy and negligible inflation. However, growing concerns about the nation’s worsening fiscal position brought about by Takaichi’s stimulus package have sent the Japanese currency to 10-month lows and government bond yields to record highs. When people sell bonds (increasing supply), and there is not enough demand from buyers, the bond’s price must fall to attract new investors. This decrease in price is what causes the yield to rise.

This ties into the fear we saw last year with the Yen carry trade unwinding when the Bank of Japan’s (BoJ) unexpectedly hiked interest rates on July 31, 2024. The market is potentially moving in preparation for a 2.0 crisis if the BoJ needs to raise interest rates as inflation stays above their 2% target and the yen continues to slip against the dollar due to further stimulus.

The carry trade strategy had been popular for decades due to Japan’s near-zero or negative interest rates, which allowed investors to borrow yen very cheaply and invest in higher-yielding currencies and assets abroad. This created a multi-trillion dollar market, but any appreciation of the yen forces investors to quickly unwind their positions to repay their yen loans. This means selling foreign assets, particularly US equities and bonds, and buying yen, which further strengthens the yen’s value, creating a cascading effect.

3) On Nov. 17, Ramp announced their raise of $300M at a $32B valuation led by Lightspeed Venture Partners. Their revenue doubled to over $1B in one year with a 153% YoY growth rate, 10x faster than the median public SaaS business.

Their massive move has been on the back of their new AI initiative. Ramp’s AI has made over 26 million decisions across $10 billion in spend to create “thinking money”, auditing itself with intelligence, memory and reason. By automating the obvious key decisions, this leaves room for the finance team to make higher-leverage decisions.

Ramp is now positioning itself as a full-stack finance operations platform. Modules now cover cards, expense management, bill payments, procurement, travel, and analytics, all powered by automation. Their core pitch: The median customer that Ramp serves is able to save 5% while growing revenue 12% YoY, running on leaner teams with faster closing times on the books.

Learn With Me and My Friends…

Other Reading…

Some Thoughts on AI (Gavin Baker)

The Big Dangers of Big Bubbles with Big Wealth Gaps (Ray Dalio)

Musk’s xAI and Nvidia to Develop Data Center in Saudi Arabia (WSJ)

The New AI Consciousness Paper (Astral Codex Ten)

I think Gemini 3.0 being trained on TPUs is a big deal and not too many people are talking about it. That gives Google a big advantage over other firms!