WIRTW: Deepseek Breakthrough

Deepseek's latest paper paper focuses on improving how information moves inside large...

What I Read This Week: a summary of the content that I consumed this week…

Caught My Eye…

1) DeepSeek’s New Breakthrough

DeepSeek recently published a new AI architecture paper called Manifold-Constrained Hyper-Connections, presented by CEO Wenfeng Liang. The paper focuses on improving how information moves inside large AI models.

For the last decade, all AI models have used a single, narrow “express lane” to pass information between their internal layers. DeepSeek’s new paper, mHC, is a blueprint for turning that single lane into a multi-lane “superhighway”, allowing much more information to flow through the AI at once. In the past, whenever researchers tried to build these wider highways, the AI would become “unstable” and crash because the data would get too chaotic.

DeepSeek solved this by adding mathematical guardrails (the “Manifold” part), limiting how streams are mixed so each layer can only rearrange information, not amplify it.This keeps the model stable across many layers. The result is small but consistent accuracy gains with little added cost, showing that preserving and combining information more cleanly through better internal structure can deliver real advantages without making models bigger or more expensive.

The result is an AI that is significantly more powerful and capable of handling complex details, but costs almost nothing extra to build or run.

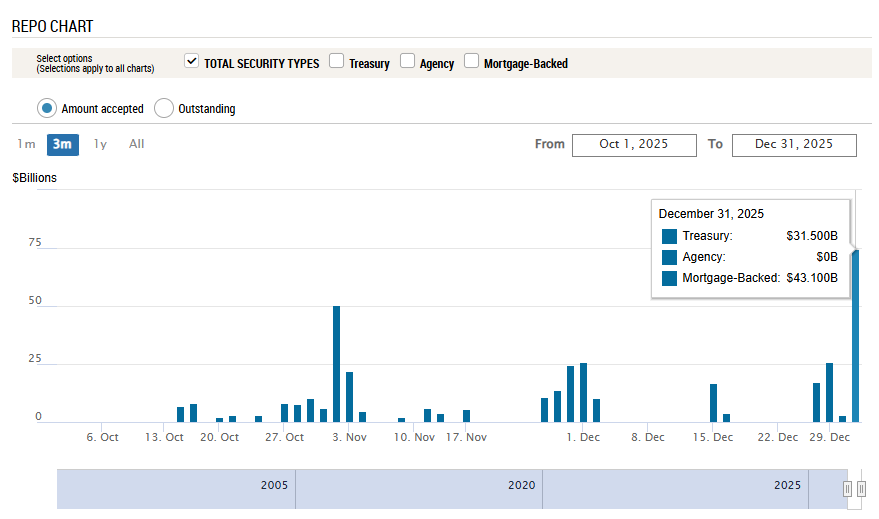

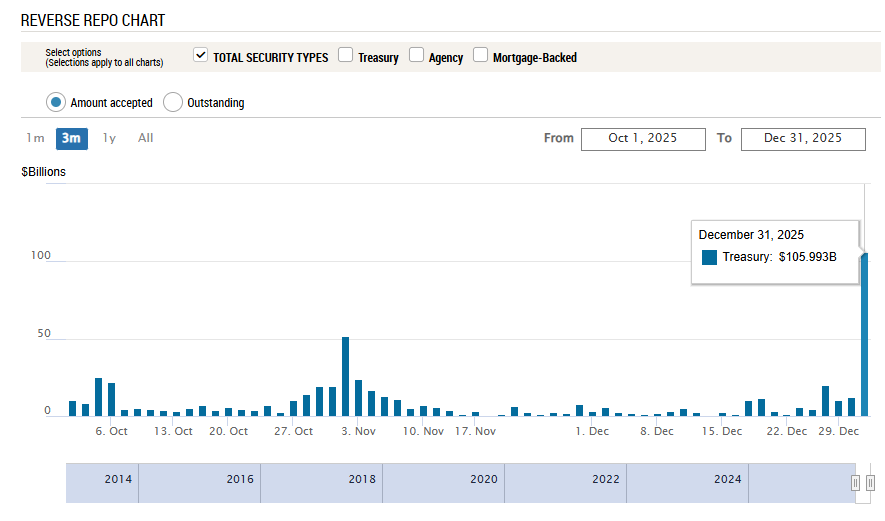

2) The Fed Steps In On New Year’s Eve

On December 31, 2025, two Fed facilities spiked to new ATHs this year causing a stir online as people saw it as massive money printing and stress in the financial piping of our economy.

Standing Repo Facility (SRF): $74.6B Borrowed

The SRF acts as the “Emergency Credit Line” where banks or dealers give the Fed their bonds (Treasuries or MBS) and the Fed gives them cash. The next day, the firm “repurchases” its bonds by paying the cash back plus interest. This puts a ceiling on interest rates. If the market suddenly runs out of cash and interest rates spike, the SRF acts as a backstop and pressure release valve so banks can get the liquidity they need.

Reverse Repo Facility (RRP): ~$106B Parked

The RRP acts like a “Savings Account” where money funds give the Fed cash and the Fed gives them Treasury bonds as collateral for the night. The next day, the Fed “repurchases” the bonds and gives the cash back with a little bit of interest. The goal is to put a floor under interest rates by offering a safe place to park money. The Fed ensures that interest rates don’t fall below a certain level because no one would lend to a private company for less than what the Fed pays.

It can seem odd that some firms borrow cash while others park excess cash at the same time, especially since these trades reverse the next day. The reason is that December 31 is a reporting snapshot, not a normal market day.

At year-end, banks shrink balance sheets to look stronger for regulators. Holding cash increases balance-sheet size, so some firms move cash off their books overnight via the RRP. At the same time, other firms still need cash to settle trades, but banks are unwilling to lend because they do not want balance-sheet exposure on the reporting date.

This creates a temporary mismatch. Some institutions have cash but will not lend, while others need cash but have collateral. The Fed fills the gap for one night through the RRP and SRF. On January 1, the trades unwind and markets normalize.

Learn With Me and My Friends…

Other Reading…

Capital in the 22nd Century (Philip Trammell & Dwarkesh Patel)

AI’s Trillion-Dollar Opportunity: Context Graphs (Jaya Gupta)

The Battle to Stop Clever People Betting (Economist)

♥

I wonder on the deepseek stuff. They keep using the same approach, it’s like using DCT for jpeg compression, whether for KV compression or now manifold compression. Yes, they use less memory, yes they take less compute to train and infer but the resolution is limited for complex problems. JPEG vs RAW. The hard stuff needs RAW…