WIRTW: China's minerals, AI financing, Nobel winners, robotics...

China tightens control over minerals and money, AI financing carries us GDP growth, the 2025 Nobel prizes, and more.

Caught My Eye…

1) China Tightens Control over Minerals and Money

On October 9th, China added five heavy rare earths to its export-control list and requires licensing for processing equipment that will go into effect on December 1st. This is an extension of the initial restrictions that were placed in April of 2025 in response to Trump’s tariffs. The move is framed as a safeguard to national security with some space carved out for applications in humanitarian aid. Anything else that is dual use with even 0.1% value in their rare earths will need to submit relevant documents for approval.

China is consolidating control upstream of every semiconductor fab, AI data center, robotics company, defense contractor, and EV manufacturer around the world. Some analysts see this as a way to gain leverage in the upcoming meeting of Donald Trump and Xi during the Asia-Pacific Economic Cooperation (APEC) summit in late October 2025.

These controls will raise global frictional costs (permits, delays, compliance risk) that cascade into capex timelines for fabs, EVs, and weapons. It will also accelerate domestic efforts to mine and refine rare earths as we’ve seen in the EO signed this year to increase American Mineral Production. In addition, the Senate just passed a new bill requiring Nvidia and AMD to prioritize U.S. customers over China. Trump has also responded by calculating a raise of tariffs on Chinese products.

In parallel, as the trade war continues, some sellers of Russian crude asked India’s state refiners to pay in yuan again. This routing had appeared before, but lapsed. It is back as sanctions pressure and counterparty risk rise across the world.

The relationship between India and China is improving but can be unstable at times, so the yuan settlements for Indian oil are not a sudden “petroyuan” flip, but they are a pragmatic path to clear sanctioned barrels. Currently China’s tender is used in only 4% of international payments by value (compared with 50% for the dollar), but the trend is making progress.

2) AI Financing Carries US GDP Growth

xAI is assembling a ~$20B financing (equity + debt) where NVIDIA plans to invest around ~$2B into a special-purpose vehicle (SPV) that buys NVIDIA GPUs and rents them to xAI. The primary function of the SPV is risk mitigation through asset-backed securitization. At the end of the five-year lease period, the SPV retains ownership of the GPUs, providing crucial security for the debt holders. This massive capital raise is aimed at expanding the infrastructure for xAI’s Grok model inside the Colossus 2 data center in Memphis.

Around the same time, AMD and OpenAI announced a large strategic partnership to deploy 6 GW of AMD GPU capacity over a multi-year agreement. This adds an explicit second sourcing beyond NVIDIA, paired with a unique commercial term using 160 million shares of AMD common stock as part of payment.

BEA’s latest tables show that a large portion of real GDP growth came from these types of investments tied to data centers and information-processing tech. In the first half of 2025, “information processing equipment” totaled about 1.11 percentage points to real GDP growth, while “software” added about 0.99 points. Together they explain a large share of the 3.8 percent annualized growth print, even as other components were mixed.

These deals show the financialization of compute, where capex turns into structured financing vehicles (SPVs, vendor equity, asset-backed leasing). This optimizes buildouts for AI labs while locking in roadmap milestones based on the chip vendor’s supply cadence, which becomes a large foundation for U.S. GDP growth.

3) The 2025 Nobel Prizes

The 2025 Nobel Prize in Medicine went to Mary E. Brunkow, Fred Ramsdell, and Shimon Sakaguchi for revealing how the immune system “applies the brakes” through regulatory T cells and the FOXP3 gene. That work reframed immune tolerance, which is central to autoimmunity, transplant acceptance, and cancer immunology. It turned a long-running debate about where tolerance is set into a roadmap for therapies that modulate Tregs, an area now in clinical trials.

Physics honored John Clarke, Michel H. Devoret, and John M. Martinis for showing quantum behavior in electrical circuits at macroscopic scales, including tunneling and quantized energy levels. This underpins superconducting devices from ultrasensitive magnetometers to today’s leading qubit architectures, which lay the foundation for many quantum computing efforts. The prize effectively recognizes the bridge between fundamental quantum effects and engineered platforms.

Chemistry recognized Susumu Kitagawa, Richard Robson, and Omar M. Yaghi for metal-organic frameworks (MOF), that can be used to harvest water from desert air, capture carbon dioxide, store toxic gases or catalyse chemical reactions. Following the breakthrough discovery, MOFs moved from a clever lattice idea to a toolkit for chemists that designed thousands of applications.

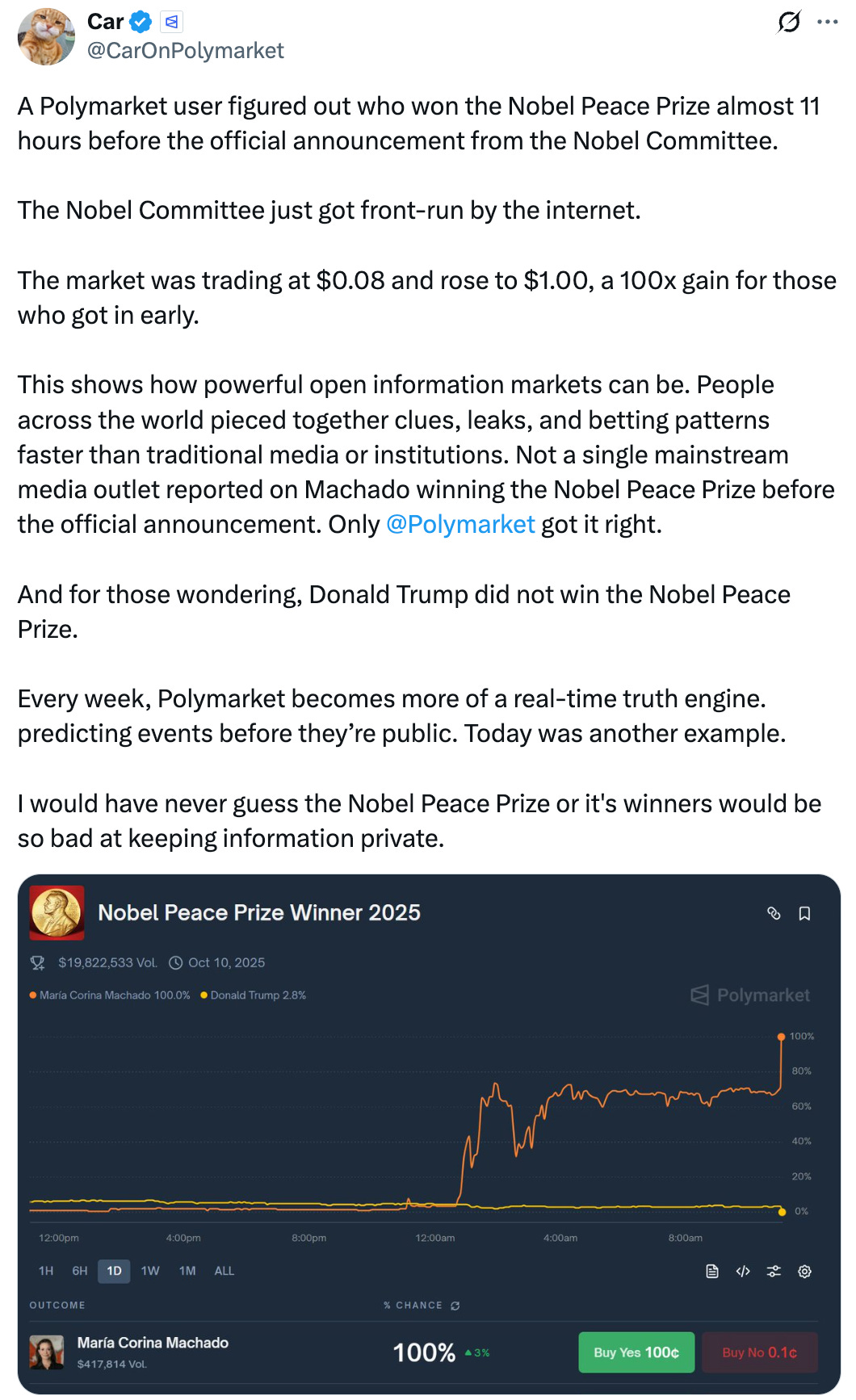

The Nobel Peace Prize was awarded to Maria Corina Machado, the key unifying leader of the democracy movement in Venezuela. She has brought her country’s opposition together, resisted the militarisation of Venezuelan society and supported the peaceful transition to democracy. After receiving the prize, Maria announced that she would dedicate the Nobel to the people of Venezuela and President Trump for his decisive support for their cause.

Learn With Me and My Friends…

Read our Deep Dive: Magnificent 7 (Amazon to be released next week)

Other Reading…

The Future of White-Collar Work May Be Unionized (The Washington Post)

Only 48% Of US Adults Under The Age Of 30 Have A Full-Time Job (Zerohedge)

Revolut’s Billionaire CEO Moves Residence From UK to Mideast (Bloomberg)

Stablecoin Leader Tether Seeks Capital for Tokenized Gold Hoard (Bloomberg)

Inside The $40,000 A Year School Where AI Shapes Every Lesson, Without Teachers (CBS News)

With that being said, in regulatory compliance, I see request for Rare Earth disclosure all the time.

The smart companies have been scrubbing boms looking for risk.

It has been at least two years, maybe 5 or more.

This is why corps need to have been doing FMEA or something to identify constraints and risk. Simple Goldblatt.

We are about to see who has been skinny dipping when the tide goes out.

J

Excellent weekly curation. The AMD-OpenAI partnership structure you highlighted - using 160 million shares of AMD common stock as part of payment - is a masterstroke of creative deal-making that deserves more attention. This equity-for-compute swap transforms a standard hardware procurement into a strategic joint venture where incentives compound. What I find most intriguing is your observation about 'the financialization of compute' through SPVs, vendor equity, and asset-backed leasing. We're basically seeing the build-out of AI infrastructure turned into structured securitized products. The fact that information processing equipment and software alone contributed 2.1 percentage points to GDP growth really underscors how dependent the macro picture has become on these AI buildouts. The parallel to oil capex cycles is striking - but this time the 'oil' is compute and the refineries are data centers.