2022 Annual Letter

Disclosure

The below letter (this “Letter”) is provided for educational purposes only. This Letter was originally published on April 4, 2023 and was subsequently revised to conform to how performance metrics of Social Capital are presented to present comparable information throughout our annual letters and to update this disclaimer and the “Other Disclosures” section. The other data, views, and information have not been changed, as we believe they show how our views have evolved over time.

Nothing in this Letter is investment advice, a recommendation or an offer to sell, or a solicitation of an offer to buy any securities or investment products. Offerings are made only pursuant to a private offering memorandum containing important information. Statements in this Letter are made as of April 4, 2023, unless stated otherwise, and there is no implication that the information contained herein is correct as of any other time. Certain information contained in this Letter has been obtained from sources believed to be reliable and current, but accuracy cannot be guaranteed. References herein to specific sectors are not to be considered a recommendation or solicitation for any such sector. Projections or forward-looking statements contained in this Letter are only estimates of future results or events that are based upon assumptions made at the time such projections or statements were developed or made. There can be no assurance that the results set forth in the projections or the events predicted will be attained or occur, and actual results may be significantly different from the projections or statements. Also, general economic factors, which are not predictable, can have a material impact on the reliability of projections or forward-looking statements.

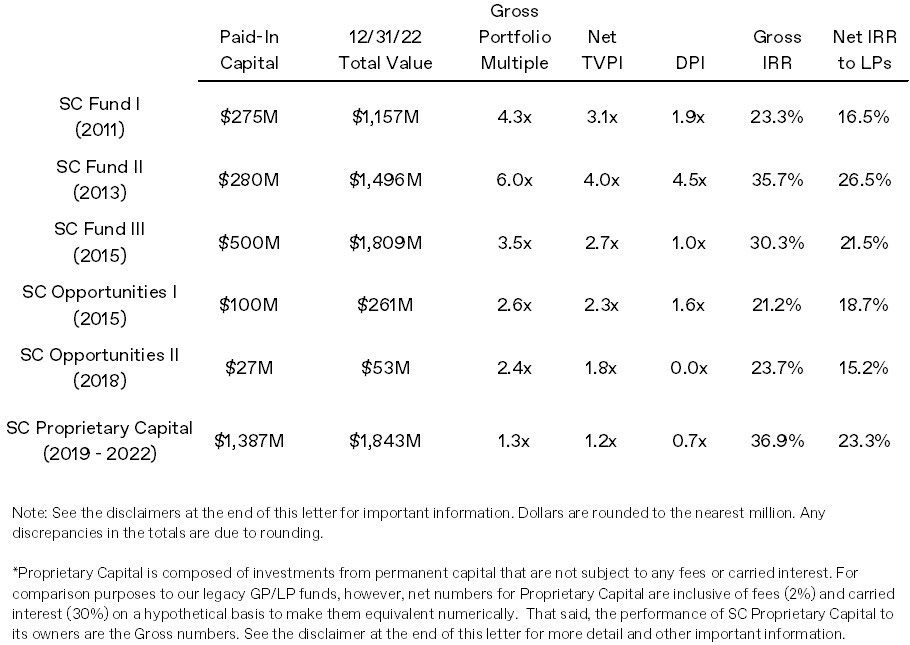

Social Capital Performance Summary

To the supporters and friends of Social Capital:

This is the fifth of our annual letters in which we discuss our observations and reflections of the year passed, how they’ve shaped our investment views, and other ideas on technology, markets, and our mission to build the future.

Since we started Social Capital in 2011, our work has touched many different parts of the technology ecosystem, from investing in Bitcoin and SaaS in the early 2010s to our more recent bets in deep tech, life sciences, and energy transition.

As an organization, we have tried to be flexible in how we allocate and deploy capital, whether it’s investing across stages from seed to growth, funding strategic acquisitions and seeking M&A opportunities for our portfolio, anchoring IPOs and making public market investments, or enabling access to the public markets via SPACs.

With each opportunity we weigh the risks with the information at the time, and if we believe an opportunity is priced correctly, we take the risk. At times this has meant forging our own path and investing across stages and asset classes, which can sometimes be a lonely road. But we’ve also tried to create room for others to either partner alongside us or copy something that works. Ultimately, our investments are judged on whether they worked or not from time of entry to time of exit.

All of this said, while this approach has led us to explore different areas of technology and a range of capital raising tools, we believe there has been a common theme that has defined our work over the past 12 years: partnering with ambitious, independent thinkers who as founders are building companies from first principles. Ideally, when everything converges, we have historically been able to achieve both meaningful societal progress and meaningful commercial outcomes.

Building companies in an age of austerity

Currently, we find ourselves navigating one of the most complicated environments of the past 20+ years of technology investing.

In our 2021 annual letter, we wrote that the formula for successful technology investing must include founders who have the discipline to be hyper-focused on the things that will help their businesses succeed, balanced with the ability to ignore noise and distractions, no matter how difficult or unpopular. When done well, these specific founders have shown great ability to deliver outsized outcomes for their customers, employees, and investors.

However, on the cusp of a generation-defining economic regime change, many of us hadn’t adequately considered a key factor, which up until 2022 has been often forgotten or overlooked: austerity.

As we enter a sustained period of non-zero interest rates, discipline of mission must now also intersect with discipline of management and operation. Efficiency, risk management, business model fundamentals, and most importantly, sustained profitability, are must-haves – not nice-to-haves.

To founders, make no mistake. A company’s success will be judged by its profits and market leadership – not faux “profitability” metrics or your ability to latch your company onto the latest trend or fad.

Over time, this heightened level of focus and discipline will lead to better run and more efficiently managed businesses. Companies won’t be able to overpay for underperforming talent or underpay overperforming talent. They won’t hand out the proverbial “free lunch” or other benefits that aren’t indexed to profitability. Middle managers will be under pressure to do more actual work and less coordination. This process will be painful, but the end result will be worth it.

What the hell is going on – 2022 edition

As much as we’d like to put 2022 in the rearview mirror, it’s important to reflect and acknowledge how we got here. The past year brought a number of learnings, which have informed (and in some cases confirmed) how we think about the future.

End of ZIRP

The era of excess, abundance, and zero interest-rate policy has come to an end. Last year, we likened it to ending the best party in town – but instead of simply turning on the lights, the past year has been more akin to getting cold water thrown in our faces.

First, some history. ZIRP was initiated as a stimulus measure to rebuild the economy following the 2008 global financial crisis – and it ended up fueling the longest bull market in U.S. stock market history. Over that time, from 2008 to 2023, the U.S. Federal Reserve’s balance sheet swelled by more than 800% from $923B to $8.3T1.

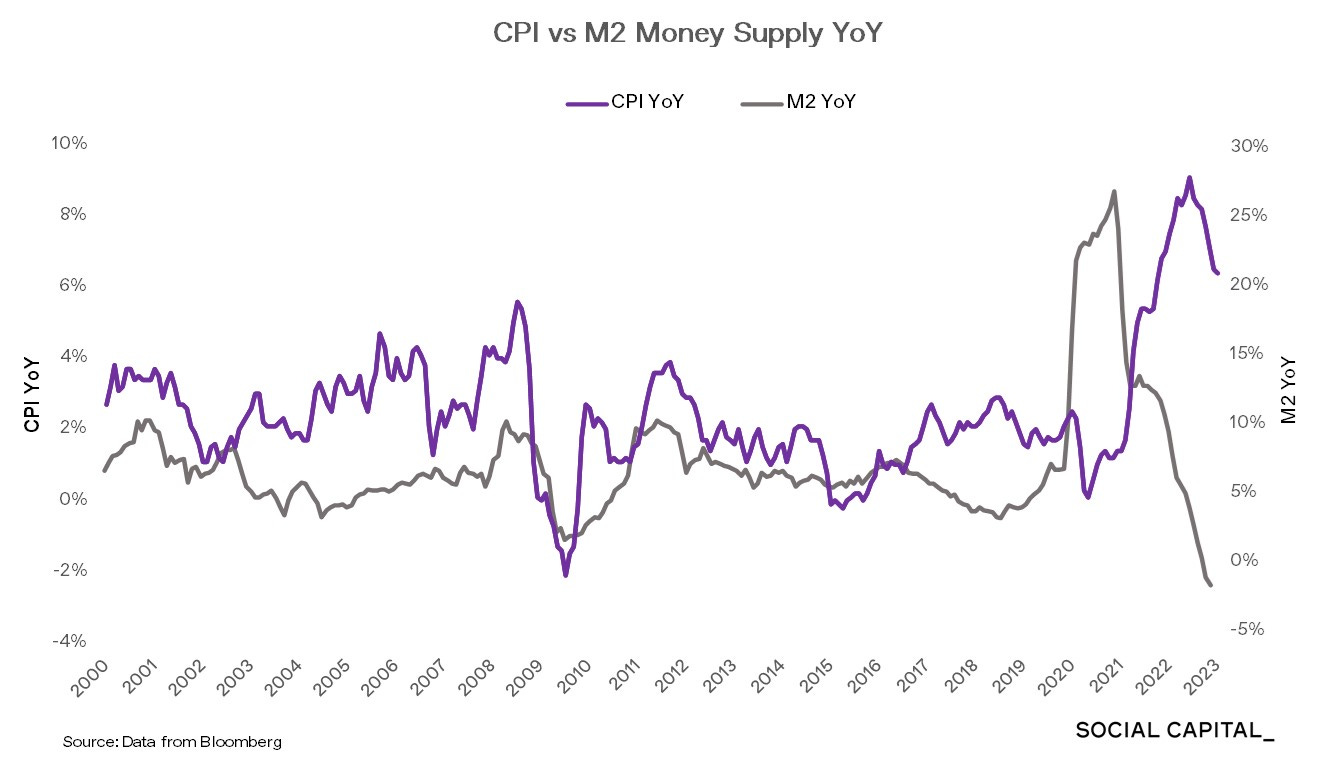

Second, Covid happened. In order to stimulate a shut-down economy, the government doubled down on ZIRP and started handing out cash like candy on Halloween – and this was the straw that broke the camel’s back.

All of a sudden, free money flooded the economy. And because of pandemic-related supply constraints, we saw commodities, shipping, and used car prices go through the roof. Meanwhile, excess liquidity continued to fuel higher household spending and persistent (not transitory) demand-side inflation. It was a perfect storm of pent-up demand colliding with a supply shock.

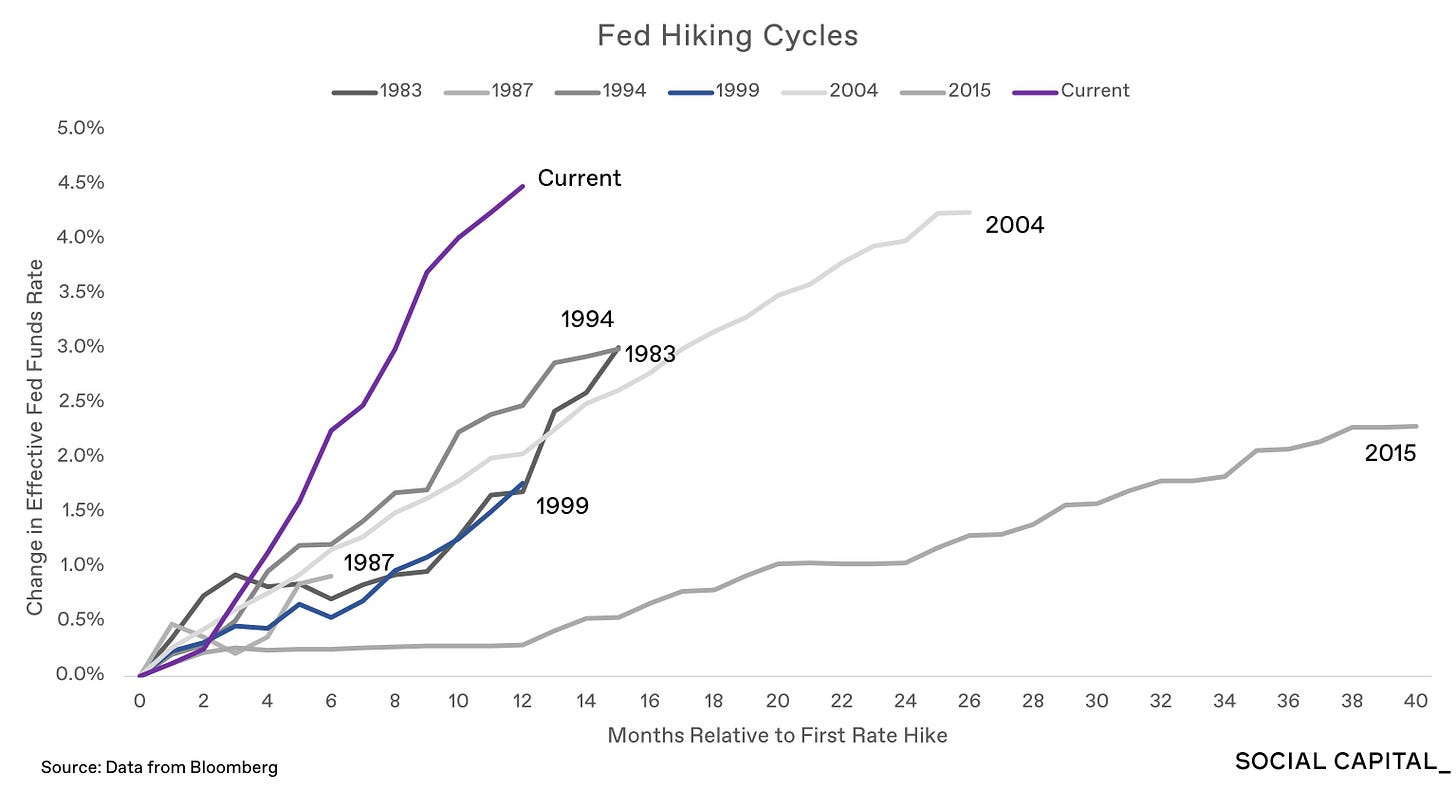

In an attempt to quell this problem, the Fed finally slammed on the brakes and enacted some of the most aggressive interest rate increases in U.S. monetary history. Since Q1 of 2022, the Federal Funds Rate has gone from effectively zero to approaching 5% in hopes of tempering the highest inflation rates we’ve seen since the 1980s.

While the rate of inflation appears to have peaked, demand remains strong, leading many of us to believe that there may still be more medicine (i.e. rate hikes) to come – and we may need to take this medicine for longer than previously anticipated.

From our perspective, the most alarming consequence in startup-land has been the divide it has created between the management teams who have “found religion” (i.e. made the tough decisions and managed their businesses smartly) and the rest who are trying their best to avoid reality.

If ZIRP was the drug, the high it created is now obvious – growth at all costs, unsubstantiated funding rounds, overhiring, and corporate glut. All the while, many VCs and capital allocators lived in a fantasy world where paper marks were deemed just as good as actual cash distributed to their LPs – and now many need to face reality.

War in Ukraine

After nearly a decade of simmering conflict, Russia’s invasion of Ukraine was the geopolitical story of the year. The human impact has been undeniable – tens of thousands dead and millions more displaced – but the war quickly also became a conflict of economic aggression.

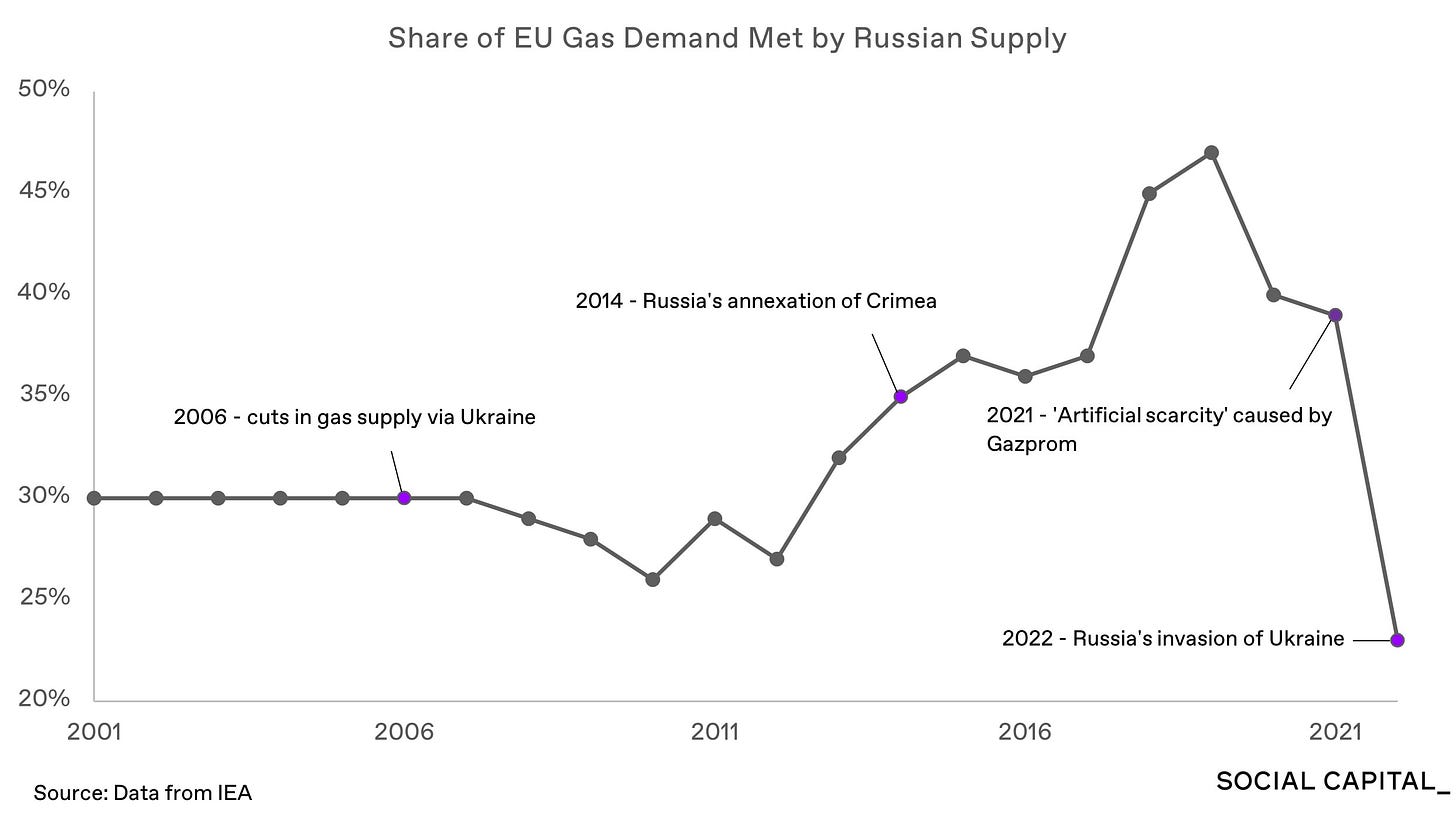

The economic shockwaves have been felt most acutely in the energy sector – but this was another problem years in the making. Instead of shoring up domestic energy production, Europe spent much of the past decade pandering to special interests, which meant weaning off reliable energy sources like nuclear fission and underinvesting in renewables like solar and wind.

As a result, Europe became significantly more reliant on Russian natural gas, so much so that from 2010 to 2018, Russia went from supplying roughly a quarter of Europe’s national gas intake to more than 40%.2

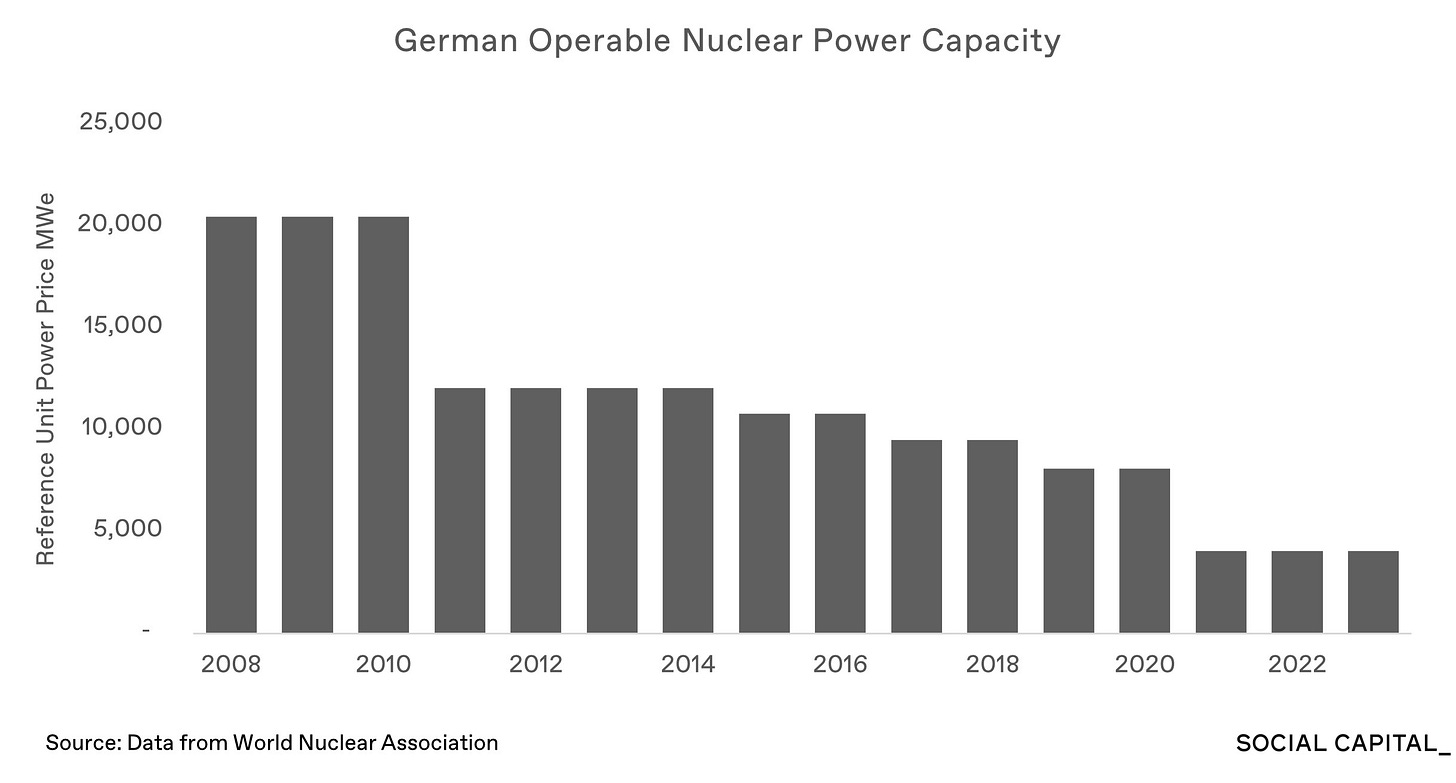

To make things even worse, European leaders had pursued an uncoordinated set of domestic policies that made this dependency worse than it needed to be. For example, in 2011, Germany obtained roughly 25% of its electricity from 17 domestic nuclear reactors. By the end of 2022, only three of those reactors remain and account for just 6% of the country's electricity. We believe this is largely the result of incumbents lobbying for their own survival and unscientific environmental zealots failing to realize the economic and political consequences of a fragile energy economy.3

As energy consumption continued to rise, energy supply became increasingly sparse. Knowing this, Russia was able to tighten its stranglehold on Europe’s natural gas spigot, forcing European countries to import much needed fuel from elsewhere and putting the global energy markets on tilt.

Beyond energy, the geopolitical ramifications of the war have impacted many other important sectors of the economy from food inputs to critical raw materials. As global superpowers were pressured to choose (or not choose) sides, we learned just how vulnerable the U.S. has become to the whims of other major producers, namely China.

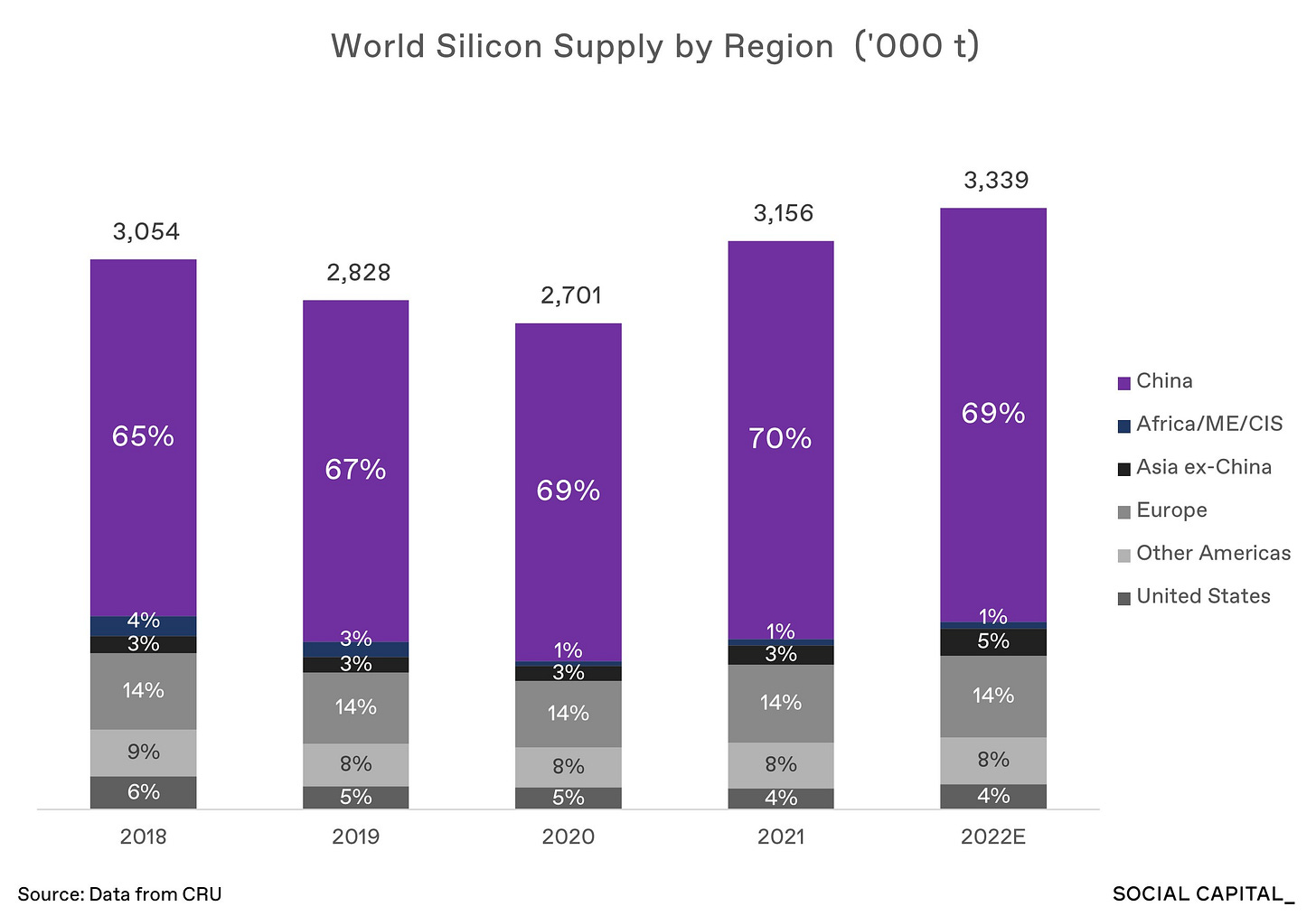

As another example, China supplies roughly 70% of the world’s silicon metal, the key input material for important outputs including semiconductors, PV cells, and silicon anode batteries.4 The same is true of nearly all other materials vital to battery production, including lithium, cobalt, graphite, and rare-earth elements.

All of a sudden, the United States’ reliance on a single exporter of critical input materials went from a long-term problem to today’s crisis.

Cash(flow) is king

As part of the reckoning of ending ZIRP, we witnessed a collapse in valuations for “growth” assets – defined as fast growing, typically unprofitable companies that are expected to generate cash flows years into the future in exchange for losses today.

In contrast, “value” stocks came roaring back. In this higher-rate environment, investors are placing greater value on upfront cash flows versus hypothetical future profits. We believe this is primarily due to two reasons.

The first is fairly obvious – the value of any asset can be calculated as the discounted value of its future cash flows. So as interest rates go up today, so does the opportunity cost of capital and the rate at which it has to grow. This is reflected in a higher discount rate, which more harshly judges future cash flows.

Therefore, valuations for growth assets that are expected to generate cash flows at some point in the future mathematically become a lot less valuable than those that generate cash flow now.

The second reason is less appreciated. When interest rates rise, capital becomes more expensive, leading to (1) a drop in consumer spending (loans cost more), and (2) a decline in capital deployment (financing becomes more expensive). Together, this results in a slowdown in growth as investment declines across the economy.

In contrast, during ZIRP, cheap credit and readily available financing drove consumer spending and economic growth because there was seemingly always more capital available – leading both company earnings and valuation multiples to skyrocket over this time.

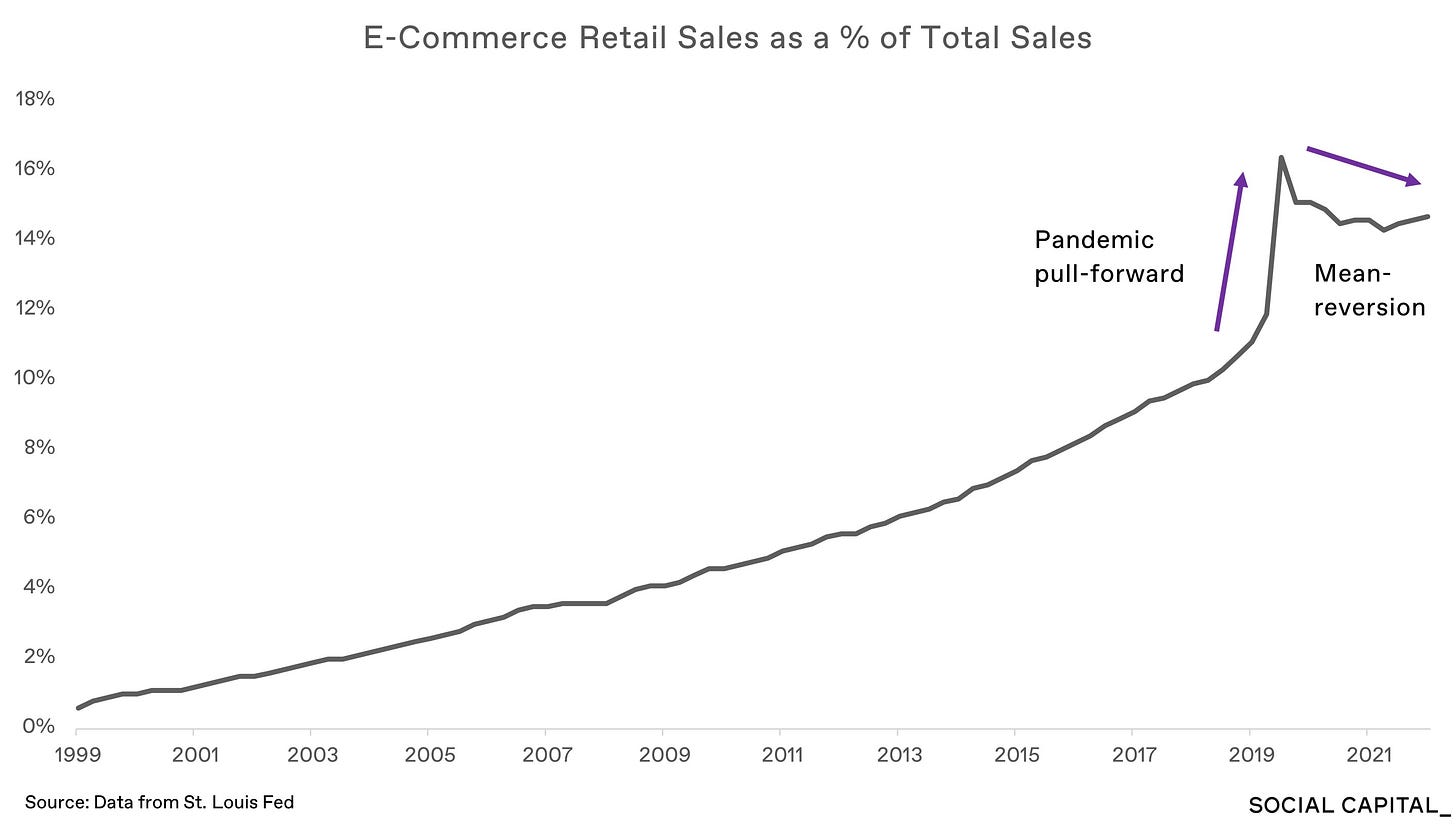

All this made for another perfect storm. As the economy reopened post-pandemic and consumer behavior shifted back to normal, the pandemic trends that many thought were here to stay actually began to fade. In turn, as companies realized their inflated profits were more of a one-time phenomenon and unsustainable, they slashed earnings projections across the board.

The combination of higher discount rates and downward revisions in earnings expectations led to a precipitous decline in valuations for growth assets, especially in tech, biotech, SPACs, and virtually all other negative cash flow businesses.

While we believe that most of the multiple contractions in these markets have largely worked their way through the system, we suspect there is still some more room to fall – particularly if the U.S. enters a recession in the coming year.

What does this mean for founders of technology companies and the investors that fund them?

While the previous market regime rewarded growth at any cost, the message to companies has now taken a u-turn. Our advice to founders: profits and cash flows matter again, and growth must be balanced with attractive margins to create sustainable business models that will endure the test of time.

Higher rates may have hindered valuations for now, however, the incremental returns on technology are ironically higher in an inflationary environment. More expensive labor and raw material inputs create even greater incentives to invest in technology to reduce costs elsewhere, so we remain bullish on technology as a key driver of societal progress.

How we think about the future

Since the advent of the microprocessor and personal computers in the 1970s, each decade has brought new innovation cycles that birthed new platforms, products, and services. The 1980s brought the modern operating system and software ecosystem. In the 1990s it was the internet. The 2000s spurred the transition from desktop to mobile. And in the 2010s we scaled software like never before with cloud computing.

We believe the 2020s will once again be defined by new applications of computer science – this time when unprecedented computing power intersects with massive real-life markets like energy and life sciences.

Driving this next era of innovation will be two core themes that we believe have the potential to create multiple $10T+ market opportunities.

First, the marginal cost of energy is going to zero.

At the end of 2022, scientists reported a major milestone in nuclear fusion technology. Since then, funding poured into fusion startups with hopes of disrupting the global energy generation market. While we believe this type of fusion technology is interesting, we still view it largely as a science project that is many decades away from being viable, let alone implemented at scale.

Our long-held view has been that the solution to our energy problems already exists. It also happens to be in the form of a nuclear fusion reactor – it just happens to be in the sky and is called the Sun.

Solar energy is clean, abundant, and becoming easier to capture and store. With residential rooftop systems, on-site battery storage, and connection to the local electrical grid, solar is more accessible and affordable than ever before. And once these systems are installed, the cost of generating electricity is effectively zero.

The tired criticisms that “it doesn’t work on a cloudy day” or “it only works in California” are outdated – with intermittency issues resolved by highly performant cells and batteries. Further, the latest advancements in solar technology are enabling cells to capture energy outside of the visible spectrum.

By supplementing solar with other zero-carbon solutions such as wind – along with palatable solutions like natural gas to aid the transition – we have an energy supply chain that quickly approaches $0/kwh.

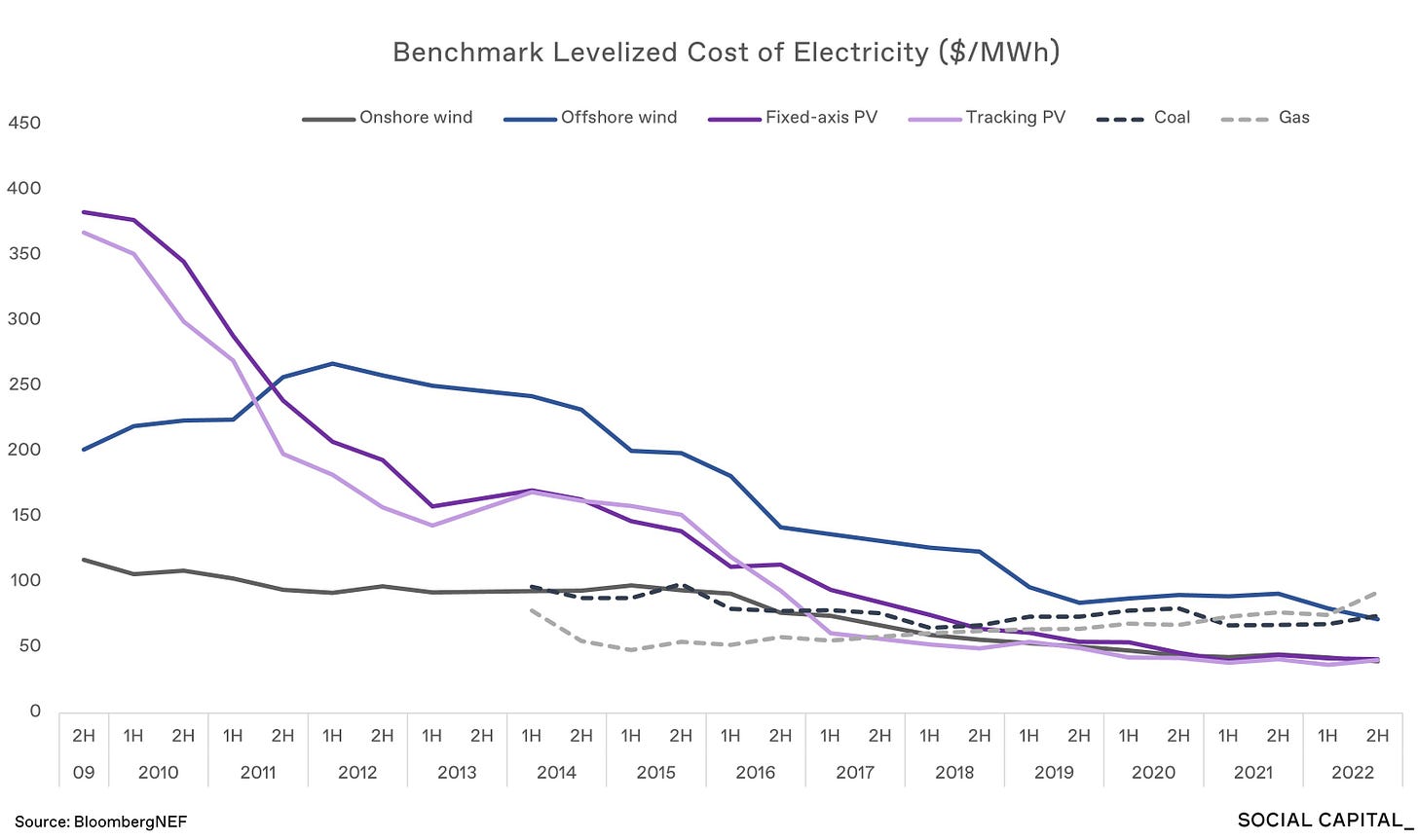

In fact, since 2009, the benchmark levelized cost of energy (LCOE) for solar has declined by more than 90%, giving it (alongside onshore wind) the lowest LCOE of any form of electricity generation. And we believe these cost savings can flow directly to the wallets of consumers.

Second, the marginal cost of compute is going to zero.

For the past half century, Moore’s Law has been the north star for advancements in computing power, cost, and size. However, in its current state, CPUs have effectively reached their limit in terms of scale, while the requirements for next generation applications like artificial intelligence and machine learning continue to grow exponentially.

In response, we are seeing a shift away from Moore’s Law and CPUs to parallelism powered by GPUs, ASICs, and FPGAs. These systems operate heterogeneously, combining different hardware to achieve better overall performance.

And with an abundance of cheap energy, the cost to build and operate these systems at scale is becoming less and less expensive. What might have cost hundreds of millions of dollars to build and operate a hyperscale data center will now cost tens of millions (or less).

Put another way, what may have been millions in startup operating expenses spent on cloud computing with Amazon, Microsoft, and Google, could come down to the thousands.

So, if the marginal cost of energy and the marginal cost of compute are both effectively going to zero, what does this mean for entrepreneurship and society at large?

Quite literally, the possibilities are endless.

An abundance of computing power without onerous or preventative energy costs means that virtually anyone will be able to pick the problem they want to solve and go after it.

Want to find a cure for a chronic disease? Instead of spending billions of dollars over the course of a decade researching and running clinical trials in a lab, we’ve now unlocked the ability to do drug development digitally – moving from in vitro to in silico.

Want to discover a more performant battery chemistry? Unlimited computing power could help us explore lesser known parts of the periodic table, and zero-cost energy could enable us to test and manufacture these new chemistries at scale.

But it doesn’t stop at the practical applications. The geopolitical ramifications, particularly in the case of energy abundance, will be unprecedented.

Nearly every modern war has been influenced by control of, or access to, natural resources. By making energy abundant and free, we will eliminate that driver and replace it with a massive peace dividend. Every nation can achieve true energy independence that isn’t contingent on taking from another or in forming alliances with strange bedfellows.

This would upend how we approach foreign policy, national security, and global trade, to say the least. With so much less energy (literally and figuratively) spent on these issues, it unlocks countless problems that we can work on to improve the economy and society, ranging from education and food security to affordable housing and healthcare.

Despite all the challenges of 2022, we still find several reasons to be optimistic. As an example, in just a span of 10 months, the U.S. federal government introduced three key pieces of legislation that will bring about enormous tailwinds for the movements above to come to pass.

Bipartisan Infrastructure Law ($1.2T). Touted as an investment in broadband coverage, airports, bridges, and highways, the BIL includes the largest investment in clean energy infrastructure in American history. More than $65B will be allocated to clean energy transmission and grid infrastructure, in addition to another $7.5B to build a national network of EV chargers.

CHIPS and Science Act ($280B). In an effort to reshore critical manufacturing capabilities, the federal government allocated $52B in funding for domestic semiconductor manufacturing.

Inflation Reduction Act ($738B). This monumental legislation provides nearly $400B in climate-related subsidies, loans, and research grants. We believe it will drive substantial value creation for private enterprises across critical minerals, battery storage, hydrogen, solar, and domestic manufacturing. For consumers, generous tax credits make it easier and cheaper to adopt clean energy solutions like rooftop solar. In other words, the government is subsidizing your ability to produce energy for free.

How does this play out in real life? In 2022, clean energy accounted for roughly 41% of total energy generation in the U.S. At the previous run-rate, that share of clean energy was projected to increase to 52% by 2030. But after passing the BIL and IRA, we are now on track to reach 81% share by the end of the decade.5

The Trifecta: bits, atoms, and higher rates

The combination of government stimulus outlined above gives us another 2 trillion reasons to believe there is a monsoon of tailwinds coming our way. But why is now such an interesting moment to be investing in technology?

Well, when looking back at the past 50 years of innovation cycles, there are very few instances where we experience tectonic platform advancements in both software (bits) and hardware/physical infrastructure (atoms).

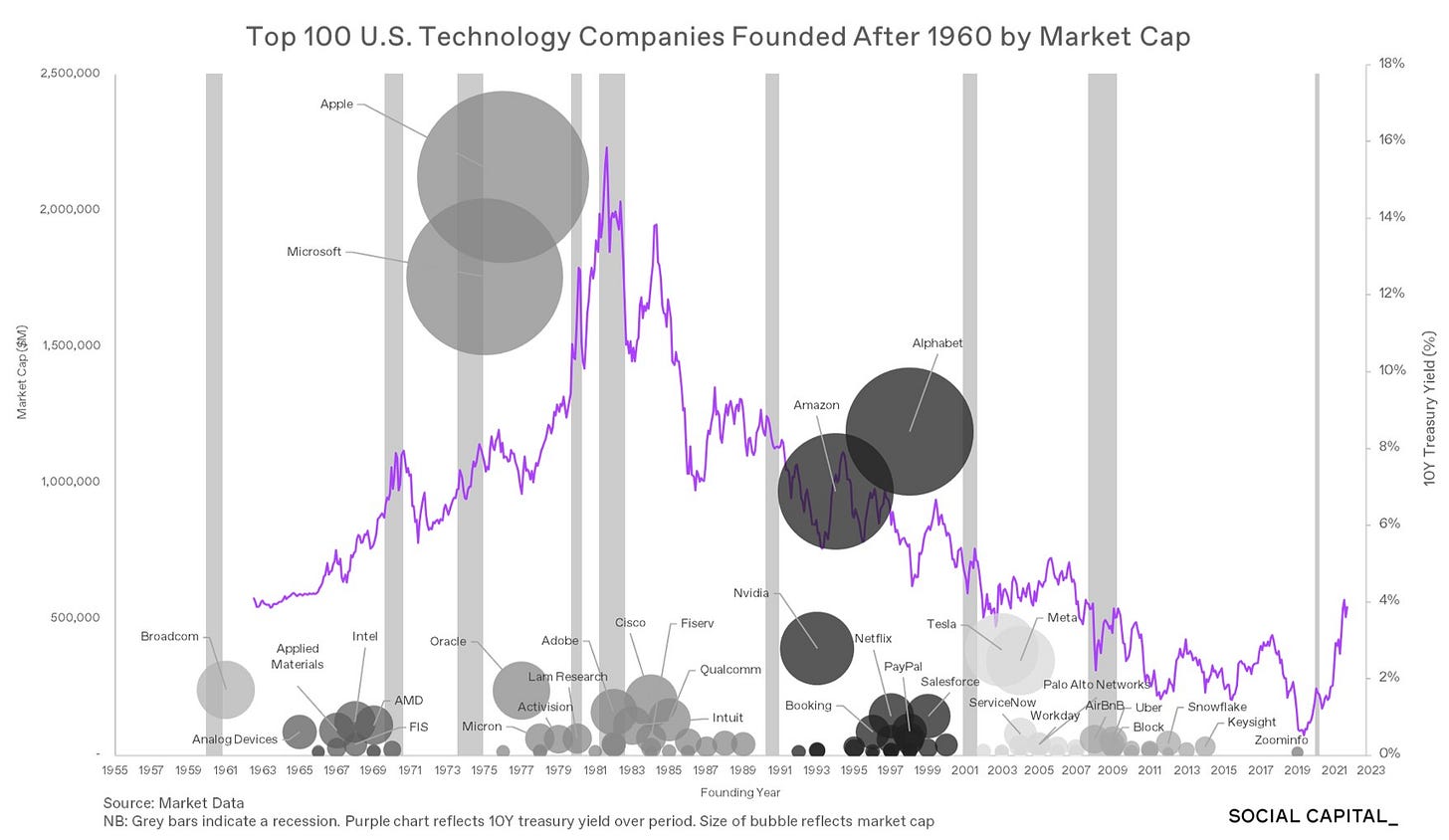

But it’s when these two advancements also intersect with the operational austerity of a higher interest rate environment that once-in-a-generation companies are born. Looking at each major cohort of technology advances since the 1950s, the results are quite startling.

In particular, two cohorts stand out among the rest. In the 1970s, it was Apple and Microsoft. In the 1990s it was Google and Amazon. In both cases, these companies evolved into platforms in and of themselves that would prop up entire generations of startups, create millions of jobs, and generate trillions of dollars of market cap.

The jury’s still out if a similar moment is upon us, and we likely won’t know until we’re on the other side of it, but we believe the trifecta of pieces may very well be in place for the next major innovation cycle to be born.

On markets

2022 was one of the toughest years I have faced. This was the third financial “crisis” I’ve been a part of (dot-com crash, GFC, end of ZIRP). To that end, as a manager and executive, I was prepared. I knew what to do and we executed a well practiced gameplan of tactical tasks to help ensure safety, sustainability, and continuity in the business I run.

That said, as an entrepreneur and investor, this was the first real cycle of headwinds I have faced, and it hit completely different. Applying the same set of tactical tasks to the companies I support and help build was much tougher. I had to carefully measure discipline of action with a sense of responsibility towards the people we had hired and the projects we had started. Navigating this period has changed my modus operandi in some small and some big and unexpected ways. A few of these observations and lessons follow…

It was clear since the beginning of 2022 that technology, as a whole, was about to go through a correction. But the consequences and extent of the drawdown was a surprise to most of us. The amount of absolute value destruction, not just in companies, but entire sectors including crypto, SaaS, SPACs, and biotech was alarming. This has created a wave of destruction with many unintended consequences. Companies without enough cash will have tremendous difficulty finding new capital and will eventually run out of money. This will include many companies whose success could meaningfully benefit society but who will never get a chance to get to market.

If your company is unprofitable, the mathematical truth of high interest rates is that it renders your company valueless. Translation: cutting non-core projects, lowering costs, and vastly reducing G&A while getting to profitability is now mandatory – otherwise you will have to face the consequences.

VC portfolios are now impaired – the extent of which is debatable but meaningful. The best VCs will take the medicine of markdowns early. It will allow them to preserve credibility with their limited partners while also showing leadership to their portfolio companies to show alignment and long-term thinking. If they don’t do this hard work now, they will create a long-term reputational risk by allowing founders to meander in this critical moment while they try to maintain fake performance metrics.

A small line of credit that we used to drive incremental returns during ZIRP quickly ballooned as some of the assets we used to collateralize it saw up to a 70% reduction in price. What initially seemed like access to free money became a liability that we managed carefully so we could continue to do business as usual. I have always considered myself to be a sober, risk-averse person who has relied on a large margin of safety when investing. To be consistent with myself, I had to recalibrate my original models and question from first principles the purpose of leverage in the first place.

Through all of these challenges, we tried to practice what we preach – austerity, expense management, and a focus on resetting our business back to first principles. Leaving 2022, I believe we’ve made the appropriate changes, sales, and sacrifices to find fitness. I am thankful to our team who helped execute through this complicated year as well as the founders and companies in our portfolio that embraced our call to action.

A look at some of our recent bets

Over the course of the past 12 years, we’ve made investments across the technology ecosystem. Given how we think about the future, however, our current focus for the foreseeable future will be concentrated in energy transition, life sciences, and deep tech – underscoring the themes described above.

That said, we will continue to place opportunistic bets in other areas whenever we encounter special founders operating from first principles. Below are a few examples of new and follow-on investments we made in 2022.

Palmetto

Arming the rebels

The idea of “arming the rebels” works well when there’s a powerful incumbent that holds its customers captive, no matter how good, bad, or expensive the product or service might be. But when the customer no longer relies on the incumbent, there is a high likelihood that, en masse, the rebels can turn an entire market upside down.

“Shopify exists to basically arm the rebels. We want a lot of people to go out and compete...” – Tobi Lütke

We see this happening in the energy industry. The incumbents: 1,700 public and private utility companies that control energy generation and transmission in the United States. These utilities are becoming a burden for American families. More than 20 million families (or 1 in 6 families across the U.S.) are behind on their utility bills.6 And it’s no surprise – last year household utility bills grew at double the rate of inflation!7

Notably, this is not due to an increase in the cost of generating the electricity (whose cost has actually become cheaper), but it’s the result of mismanagement that will collectively cost consumers trillions of dollars in capital expenditures and operating expenses over the next decade. For example, in some cases, these utility companies rely on physical infrastructure that hasn’t been maintained for decades and was originally installed almost a century ago.8

Who are the rebels? In this case, the rebels are the 100M homeowners across the U.S., each equipped with their own virtual power plants: solar panels on their roofs and battery storage on their walls. The utility companies simply cannot offer this level of independence and resilience. Through your own energy generation, you can minimize the risk of rolling blackouts, precautionary weather outages, and opaque energy bills. And now the federal government is helping you pay for it.

Palmetto wants to enable this level of energy independence at a local level, and they’re starting with rooftop solar. The problem with the traditional solar business model is that it’s essentially a construction company wrapped in a consumer lending business – neither are particularly efficient or high value.

With technology enabling many of the soft costs associated with the legacy solar market (design, construction, sales, installation, permitting, maintenance), Palmetto is able to bring an affordable product to market with software-like operating margins. Over time, Palmetto’s goal is to operate a clean energy marketplace, acting as a one-stop-shop for power generation, storage, and utilization for millions of Americans.

Mitra Chem

Securing America’s electrified future

Today, the overwhelming majority of iron-based cathode production (currently the prevailing choice for lithium-ion batteries) takes place in China. This creates obvious national security and energy security vulnerabilities.

At the same time, batteries are a key component to meeting our electrification goals, from EVs to residential and industrial energy storage. Without a stable supply of batteries, there is no sustainable energy future.

Powered by machine learning, Mitra accelerates lab-to-production timelines by 10x. This allows them to work on new higher energy-dense chemistry solutions that not only give the U.S. a potential competitive advantage, but could also dramatically accelerate our path to domestic production capacity and energy independence.

Mitra is targeting mass production of a next-generation, iron-based cathode by 2025, and in the meantime, they are working with leading automotive and storage OEMs to test and refine their products.

Swarm

Enabling global interconnectivity

We first met Sara Spangelo and Ben Longmier in 2016, before they even had a company to fund. What they had was a vision and an idea – that space technology could be the solution to offering affordable internet to anyone in the world.

Shortly after meeting, we seeded Swarm, the company Sara and Ben built, that ended up producing the world’s smallest communications satellite – it was so tiny it could fit in the palm of your hand.

In 2021, SpaceX acquired Swarm to bolster their own efforts to achieve a similar goal with Starlink. It was the first acquisition SpaceX had ever done.9 And in just a few years, the Swarm team went from working at our office in Palo Alto to the biggest private space company in the world.

Still at SpaceX, Sara and Ben are leaders within the Starlink team, playing an important role in the development of next-generation argon Hall thrusters, which Elon Musk called a necessary transition for electric satellite propulsion.10 They also recently helped add a new Starlink sales channel, which partners with mobile carriers to connect previously untouched coverage areas.11

It gives us great joy when founders achieve what they set out to do, especially when they achieve as great of an outcome as the Swarm team. Moreover, we’re extremely proud that Social Capital could play a very small part in Swarm’s incredible story – and, as SpaceX shareholders, we are excited to know they’ll continue to set their sights even higher in the years to come.

Saildrone

Exploring uncharted waters

Despite more than 70% of the Earth’s surface being covered by water, we know relatively little about our oceans. Yet, we have reason to believe that the ocean can provide useful insight into climate change, energy generation, carbon cycling, weather forecasting, rare-earth minerals, and food supply, not to mention the critical role it plays in national and maritime security.

Saildrone designs, manufactures, and operates highly sophisticated unmanned surface vehicles (USVs) that are powered by wind and solar, capable of autonomously sailing at sea for more than a year at a time. Equipped with cameras, radar, and other monitoring instruments, Saildrone makes real-time, cost-effective ocean monitoring and data collection possible at scale.

Fit for both civilian and military uses (though non-weaponized), the U.S. Navy operates a fleet of Saildrones and successfully resisted multiple recent attempts by a foreign government to capture the vehicles. More recently, Saildrone was able to survey more than 45,000 kilometers of previously uncharted ocean floor off the coast of Alaska’s Aleutian Islands and California.12

Early Is Good

Detecting diseases earlier

Approximately half of all cancer patients receive their diagnosis when their cancer is already at an advanced stage, which has a considerable impact on the disease’s prognosis and the patient’s survival rate.13 When caught early, though, patients often have more treatment options and typically an overall lower cost of care.14

In the case of bladder cancer, the five-year survival rate for early-stage patients (in situ or localized) is 70-96%, but that number drops to 8-39% if the cancer has spread beyond the bladder, depending on the severity.15 Bladder cancer also has a 50-80% recurrence rate, making it one of the most expensive cancers to treat over a patient's lifetime.

The case for detecting this disease earlier is obvious. But like many other cancers, we still rely on dated diagnostic techniques – in this case either a cystoscopy (invasive procedure inserting a camera into the bladder) or a cytology test (analyzing cells under a microscope), both of which rely on the subjective judgment of an oncologist or pathologist to make a diagnosis.

Early Is Good hopes to enable earlier, more accurate diagnosis of renal system diseases, including bladder, kidney, and prostate cancers. Their nanotechnology expands the boundaries of molecular diagnostic tests from single-type multiplex biomarkers to multi-type multiplex biomarkers – a breakthrough in disease detection.

EIG’s first product is a lab-developed test that analyzes a panel of biomarkers (proteins, miRNAs, mRNAs, and lncRNAs) in urine to diagnose bladder cancer, and if positive, the stage of the disease (including stage 0!). Early validation results are promising: 100% NPV (true negatives), 83% PPV (true positives), 100% sensitivity (correctly classify having the disease), and 86% specificity (correctly classify not having the disease).

So instead of needing to go to a doctor’s office, potentially undergo a risky procedure, and rely on a doctor to review the results, EIG would enable patients to complete a urine test at home, send it to a testing facility, and receive results in a matter of days.

The team is led by a sibling trio from Sri Lanka (my birth country), who co-founded EIG in Indianapolis after studying at Purdue. They are just getting started on clinical trials – but we hope this is the first of many technology-enabled advancements in earlier disease detection and treatment.

What’s next?

“It is not the critic who counts; not the man who points out how the strong man stumbles, or where the doer of deeds could have done them better. The credit belongs to the man who is actually in the arena, whose face is marred by dust and sweat and blood; who strives valiantly; who errs, who comes short again and again, because there is no effort without error and shortcoming; but who does actually strive to do the deeds; who knows great enthusiasms, the great devotions; who spends himself in a worthy cause; who at the best knows in the end the triumph of high achievement, and who at the worst, if he fails, at least fails while daring greatly, so that his place shall never be with those cold and timid souls who neither know victory nor defeat.” – Theodore Roosevelt

While 2022 was a challenge, the valor and lessons learned came from actually being in the arena, not commenting from the sidelines. We view the years ahead as our moment to keep experimenting and trying. We’re focused and grinding everyday.

Respectfully,

Chamath Palihapitiya

Founder & CEO

Dear Chamath, I am one of your admirers. In fact I wrote to you at the onset of Sri Lanka's Economic Crisis to advise our Government. I tried to contact you also when you brought the Google Loon project to Sri Lanka. I heard about a legal snag it had struck and contacted the best Telecom Lawyer to help out 'free of charge'. But it was too late. i met the then Minister Harin Fernando. Woul be honoured to be in touch with you. I am a retired career banker and now work in the Consulate of Iceland in Sri Lanka. Cheers, Emmanuel Gunaratnam . g.emmanuel.gunaratnam@gmail.com

Sir I have a startup business idea can you help me build my business & I am from Sri lanka