Social Capital Performance Summary

To the friends and supporters of Social Capital:

This is the seventh of our annual letters in which I share our observations, reflections, and lessons learned over the past year, including how the technological, economic, and political trends of the year have influenced my thinking and investment portfolio.

Since I started Social Capital fourteen years ago, our work has spanned several paradigms of technology. From investments in Bitcoin and enterprise SaaS in the early 2010s to our more recent investments in deep tech, energy production, and the creator economy, we have tried to find the trends that will define the upcoming era and get behind them early.

Our investments span early-stage to late-stage companies in both private and public markets. In our experience, great opportunities are less about where a company is in its lifecycle, and more about a team’s ability to overcome a confluence of technological and regulatory circumstances in order to build something valuable. In the meantime, we try our best to see things with fresh eyes and study the ground truth so we can skate to where the puck is going to be.

The one throughline that's stayed the same over fourteen years is partnering with ambitious founders determined to solve hard and non-obvious problems, and constantly challenging our preconceived notions of a problem space and coming back to first principles.

For me, 2024 was the year we transitioned from a hard landing to a period where green shoots started to materialize and a new wave of momentum began to build.

To founders, my advice is to remain laser-focused on building products and services that customers love. Take the time to imbue craftsmanship and care into what you make, as well as to cultivate taste within your organization. At the same time, you must be rational and ruthless when making capital allocation decisions. Every day is a new test of your resilience and stamina, and you can improve both over time if you focus on it.

Our industry is one of Darwinism. Either you’ll continually rise to meet the moment or you’ll disappear.

What the hell is going on – 2024 edition

The Fed Loses Influence Over Markets

Throughout 2022 to 2023, the Federal Reserve embarked on one of the most aggressive rate hiking cycles in the history of monetary policy, increasing the Federal Funds Rate from 0.25% to 5.5% by the end of 2023.

Throughout 2024, the Fed was caught between the risk of persistent inflation and signs of economic weakness. Starting in the third quarter, the Fed initiated three rate cuts in response to cooling inflation and a softening labor market. The first cut occurred in September 2024, reducing the rate by 50 basis points to 4.75%-5.00%. The other two cuts followed in November and December 2024, each by 25 basis points, bringing the rate down to 4.25%-4.50% by year-end.

While inflation showed signs of moderating, it remained at 2.9%, well above the Fed’s target of 2%, leading to cautious optimism about the prospect of further cutting rates.

But just as significantly, as the Fed started to cut the Federal Funds Rate, long-term yields remained elevated or even rose in response.

What happened?

Conventionally, when the Fed cuts the Federal Funds Rate, markets interpret it as a signal of looser monetary policy, stronger GDP growth, and controlled inflation. This typically causes long-term yields to fall as well, as they reflect the expected path of short-term rates. Short- and long-term rates largely moving in tandem has been a cornerstone of modern monetary policy and the primary way central banks influence the economy.

However, a confluence of structural factors led to short- and long-term rates diverging, starting in September.

Bond market investors, responding to a surge in Treasury issuance, grew increasingly concerned about the sustainability of U.S. fiscal policy, as large deficits continued despite full employment. At the same time, demand for U.S. government debt weakened, as the Fed reduced its balance sheet through quantitative tightening, and as China and Japan both cut back their purchases of Treasuries. With more bonds being issued and fewer buyers stepping in, yields rose.

For the last 17 years, the Federal Funds Rate was one of the most important indicators in the economy. The Fed’s policy decisions, especially the combination of near-zero interest rates and aggressive quantitative easing, pumped trillions of dollars into the financial system. This flood of liquidity supported asset prices, suppressed borrowing costs, and gave the Fed extraordinary influence over economic conditions. In this regime, even small shifts in monetary policy could have massive downstream effects.

Part of that influence came from the scale of the balance sheet itself. When the Fed held such a large share of U.S. government debt, it effectively controlled key parts of the bond market. If the Fed decided to buy or sell assets, or simply stop reinvesting maturing securities, the impact could ripple across mortgage rates, equity valuations, and credit markets. The more liquidity it injected into the system, the more leverage it had in shaping outcomes.

But as the Fed moved toward policy normalization through raising rates and quantitative tightening, its influence began to wane.

By 2024, the Fed had slowed the pace of quantitative tightening, reducing the monthly cap on Treasury runoff from $25 billion to $5 billion. Even at this slower pace, quantitative tightening may conclude by the end of 2025. This marks an end of a monetary era starting in 2008, defined first by extraordinary expansion and then by an aggressive pullback, ultimately leaving the Fed with much less influence over markets.

What does this mean for startups, venture capital, and the IPO market?

Because long-term yields remained elevated despite rate cuts, capital remained expensive across the board. Startups were forced to demonstrate profitability and operational discipline over growth to raise money and justify their valuations.

An era of free money led to a proliferation of venture funds, but this only accentuated the power law’s hold on venture: returns were highly concentrated among a handful of funds, while the vast majority of funds, especially newer funds, struggled to generate meaningful outcomes.

Infrastructure-heavy companies like CoreWeave and specialized players like LightOn drew record private funding and moved toward public markets with large raises. Yet even these IPOs initially showed mixed signs. CoreWeave’s listing priced below expectations, reflecting investor sentiment at the time that valuations were still too high.

Stripe, one of the most anticipated IPOs, chose to stay private, opting for internal funding and secondary transactions rather than subject itself to public market scrutiny and whatever valuation would come with it. This signaled a broader trend, where many of the most promising companies preferred to delay IPOs until conditions stabilized and stay on the sidelines in the meantime. In fact, even as S&P 500 reached all-time highs by the end of the year, many public market investors stayed on the sidelines as well, as people waited for clearer signals about the market’s long-term direction.

This prolonged the slowdown in IPOs, which then created a reflexivity in the private markets, where the backlog of late-stage startups continued to pile up. These were companies that were too mature to raise another late-stage round but also unwilling to risk the harsh valuation reset that the IPO process would bring. Many turned to internal financing, secondary share sales, or private credit to extend their runway while waiting for more favorable conditions.

Thus, venture activity slowed across most sectors, with one major exception – AI.

AI Becomes Our Sputnik Moment

Venture investment in AI reached a record $150 billion in 2024. Capital was allocated into every layer of the ecosystem, with the bulk of it going into the foundational model layer and the AI application layer.

Every week in 2024, new language models were released, many of them achieving top scores on benchmarks. But by the end of the year, model releases were so frequent that people became desensitized by the release of new models. And as language models approached the limits of publicly available internet-scale training data, companies transitioned to building reasoning models designed to make better use of the same data rather than relying on scale alone.

By the same token, OpenAI leveraged its first-mover advantage and extended its lead. ChatGPT has not only become a daily-use tool for millions of consumers and enterprises, but it also began to chip away at the habit of over a billion people to search for something when they opened their browser on their phone or laptop.

In that respect, despite a proliferation of high-quality models, OpenAI has pulled ahead. It wasn’t model features or benchmark performance that gave ChatGPT an edge – it was habit formation. Over time, whoever establishes the strongest habit with the largest number of people may win the AI chatbot race.

Yet despite over a trillion dollars being allocated to AI, no killer app has emerged beyond AI chatbots. While prototyping an app is easier than ever, building a production-grade app with a language model as a component in a system remains a challenge. Hallucinations and unpredictable behavior make it hard to reach the level of reliability enterprises require, often 99.9%+, especially in highly-regulated sectors like healthcare and banking. And for private investment dollars to find returns in the AI companies they invested in, it ultimately hinges on customers paying for AI apps. So far, this hasn’t happened.

Meanwhile, 2024 marked the year that China reached parity with the U.S. in the foundational model layer. By the end of the year, nearly one-third of the highest-quality language models were developed in China, including DeepSeek-V3, which matched even the leading closed-source U.S. models in reasoning, multimodality, and efficiency. These gains were achieved partly through innovations driven by constraints in compute, as well as through speculated workarounds of U.S. export controls on training chips.

As GenAI has yet to yield killer apps and as high-quality language models become more common, the focus of AI has shifted back to infrastructure. The defining constraints now lie in compute and electricity.

Today, both the U.S. and China are racing to retool their industrial bases for the AI era. But they are leading on different fronts. The U.S. continues to lead in advanced chips and the mass deployment of state-of-the-art chips, with xAI building the largest training cluster in Tennessee with 100,000 liquid-cooled H-100s on a single RDMA fabric.

Meanwhile, China is the world leader in energy production and infrastructure, generating more than 9,000 TWh, the largest coal fleet in the world, the undisputed leader in solar, and miles of ultra-high-voltage transmission lines across the country’s provinces.

Ultimately, the advantage will go to the country that integrates both massively deployed chips and massively produced electricity into a cohesive national platform.

What’s at stake if we lose this race?

Our position as the leader of the free world rests on two pillars: a vibrant economy and a strong military. Both increasingly depend on technological primacy, which increasingly rests on AI primacy.

The U.S. must now choose – be relentlessly focused on becoming a leader in AI, or drift into a world where China becomes the world leader in technology and military strength.

That is why this is America’s Sputnik moment. Not because we are behind, but because we could fall behind.

President Trump’s Comeback and Rise of New Media

In conjunction with an era of ultra-low interest rates coming to an end and a growing awareness of America potentially losing its primacy, we also witnessed one of the most remarkable political comebacks in American history.

Facing maximum legal, political, and media opposition, and surviving an assassination attempt, President Trump became our 47th president, winning all seven swing states in a decisive victory.

Over the past decade, MAGA became the largest grassroots movement in America by tapping into a deep, visceral sense of alienation felt by millions of Americans. It captured widespread frustration with an entitlement culture shaped by a decade of free money, institutions dominated by elite credentialism, and the rise of luxury beliefs increasingly out of step with the values of working- and middle-class Americans living outside coastal cities.

Nowhere was this discontent more visible than with the narratives pushed by traditional media. On the campaign trail, President Trump denounced fake news across mainstream outlets while appearing on long-form interviews on The Joe Rogan Experience and the All-In Podcast, reaching tens of millions of views on YouTube and other modern platforms. And in the wake of Trump’s victory, ratings collapsed across several traditional media outlets.

Over the past 15 years, traditional media has gradually lost credibility with Americans. As algorithmic systems disrupted traditional media’s business model, many media outlets were forced to adapt in ways that compromised quality. The surviving institutions increasingly leaned into partisanship and sensationalism, further accelerating a decline in the veracity of journalism and reporting. This collapse in trust in traditional institutions has coincided with the rise of a new media ecosystem, built around authenticity, long-form content, and direct connection rather than institutional prestige.

This shift in media is part of a broader reordering underway in our economy. The creator economy is no longer just a nascent trend – it is becoming the foundational layer in how demand is generated, how information flows, and how trust is built with consumers. With more than 70% of the U.S. economy driven by consumer spending, the way people discover and relate to products is being reshaped by creators and influencers who earn attention through authenticity and consistent, direct engagement with their audiences.

Founders who understand these dynamics in the creator economy, who build in the open, speak honestly, and lead with authenticity, will be able to impart their personal brand onto their companies and products over time. And those with the strongest brands can bypass traditional marketing channels entirely with an unprecedented level of reach for a single person.

The creator economy is entering a new phase where credibility and social capital grow together, and an individual’s brand is no longer an afterthought but a core engine of marketing and distribution.

And beyond new media, President Trump's election victory marked a deeper cultural shift away from entitlement and luxury beliefs toward accountability, merit, and efficiency. It also opened the door to a new wave of opportunities, focused less on software and digital products and more on manufacturing, industrials, real estate, and physical infrastructure.

A look at some of our recent bets

As the investing landscape has developed over the past decade, our focus has continued to shift between sectors and markets that are well-positioned to benefit from new and developing tailwinds. While some of our early bets (Slack, Yammer, Netskope, Intercom) were concentrated in enterprise SaaS, in more recent years, our focus has shifted towards AI, domestic energy production, and the creator economy.

Groq

Ultra-fast AI inference

If over one trillion dollars of global investment in AI over the last 15 years is to be taken seriously, then AI inference speed will soon be the differentiating advantage for companies with AI products and services. Faster model responses and lower cost per token means more fluid user experiences and better cost structures for AI companies.

Groq’s core mission is to deliver fast AI inference. Its LPU chips are purpose-built for serving large AI models with minimal latency, unlike GPUs that are more general purpose. By removing the bottlenecks of traditional GPU architectures in favor of a software-first, streamlined design, Groq’s system can output AI results significantly faster and more efficiently than competing systems (ChatGPT runs 13x faster on Groq hardware than on Nvidia’s).

In 2024, Groq raised a $640 million Series D at a $2.8 billion valuation to scale production of its next-gen chips and expand cloud capacity. That funding is powering the deployment of over 100,000 Groq LPUs this year, marking the largest AI inference compute roll-out outside of hyperscalers. Groq has also partnered with Meta to deliver lightning-fast inference for the Llama family of models. On the enterprise side, Groq also recently formed a joint venture with Aramco Digital to build one of the largest AI inference hubs in the Middle East, further building its global reach.

Palmetto

Arming the Rebels

Even as generating power gets cheaper, retail consumers still face rising electricity bills, as U.S. retail rates climbed nearly 5% annually from 2019 to 2023.

Palmetto is tackling this disconnect head-on with a consumer-centric clean energy platform. The company enables homeowners to install rooftop solar panels and battery storage with zero upfront cost, leveraging its LightReach financing plans for stable monthly payments. Through an app-based energy management tool and AI-driven recommendations, Palmetto helps users optimize their electricity usage and savings.

In 2024, Palmetto secured more than $1.2 billion of fund flows funding to expand LightReach, accelerating solar adoption to an average of 300 new households per day across 30 states. To date, more than 20,000 families have switched to solar through Palmetto’s leases and PPAs. The company has built a network of over 600 local installers and partners, and has expanded its offerings beyond solar by integrating home HVAC, EV chargers, smart energy devices, and retail power plans into one ecosystem.

Beast Industries (fka MrBeast)

Monetizing Attention at Scale

Jimmy Donaldson (aka Mr Beast) represents a new template for media and commerce, proving that an individual creator can build an empire rivaling large corporations. In 2024, he became the most-subscribed YouTuber in history, surpassing 550 million combined subscribers across his channels and amassing over 80 billion lifetime views.

This unprecedented level of attention is the engine behind a vertically-integrated business model. His content, elaborate stunts, philanthropy-driven challenges, and viral giveaways, acts as both entertainment and marketing for his ventures, all under the MrBeast brand.

Rather than rely on endorsements, MrBeast launched his own product lines and scaled them rapidly using his online influence. Feastables, his better-for-you snack brand, landed on shelves at Walmart, Target, and convenience stores nationwide, bolstered by golden-ticket contests in his videos, and hit $250 million in sales in 2024. This and other consumer businesses, together with merchandise and brand deals, pushed MrBeast’s enterprise toward half a billion dollars in annual revenue.

Equally notable, MrBeast reinvests much of his earnings into bigger content and philanthropic stunts, like planting 20 million trees via #TeamTrees or funding expansive charity projects on his Beast Philanthropy channel. This creates a virtuous cycle between doing good, producing viral content, and business growth.

Culturally, MrBeast has become a household name for many around the world and a defining figure of the creator economy. He has demonstrated how a single creator’s massive global audience can vertically integrate into multiple industries, from fast food to consumer packaged goods, all while bypassing traditional marketing channels. His model is influencing a new generation of creators to think bigger, turning content creation into the foundation of a diversified, creator-led business.

Closing remarks

After a period of recalibration, 2024 was the year I began rebuilding momentum across my investment portfolio and several other ventures.

Alongside my work at Social Capital, I started 8090, to build an AI-enabled software factory designed to produce high-quality, well-maintained enterprise software. This is the opposite of vibe coding and addresses the 90% of the market where real revenue is generated. Through 8090, I’ve been able to stay close to the ground truth of AI every day, both by confronting the challenges of building production-grade AI apps and by exploring how much language models can still be optimized under the hood to improve performance and reduce costs.

I also doubled down on my two forays into the creator economy. The first is my role as co-host of the All-In Podcast, where we broadened the scope of the show this year by interviewing political candidates, business leaders, media hosts, and authors, and by hosting more live events, including our first holiday show.

The second is my subscription research service Learn With Me, where I share long-form deep dives on subjects that I think are important but are often underreported or misunderstood, and where I talk directly to like-minded people through our group chat.

Both projects have reinforced that there is tremendous value in integrating and synthesizing ground truth and insight that comes not just by reading, but by constantly talking to experts, principals, CEOs, and founders in the arena.

I’ve lived through and directly participated in the rise of the internet and social media, and I can say with confidence that this is the most exciting period of my career by far. We may be witnessing the biggest mega-trend in history (AI), a new era of American exceptionalism, and the formation of a new sense-making layer of society – all at once.

I feel incredibly lucky to be involved on all these fronts and work alongside many ambitious and determined founders and creators.

Never give up. That’s the secret.

Respectfully,

Chamath Palihapitiya

Appendix

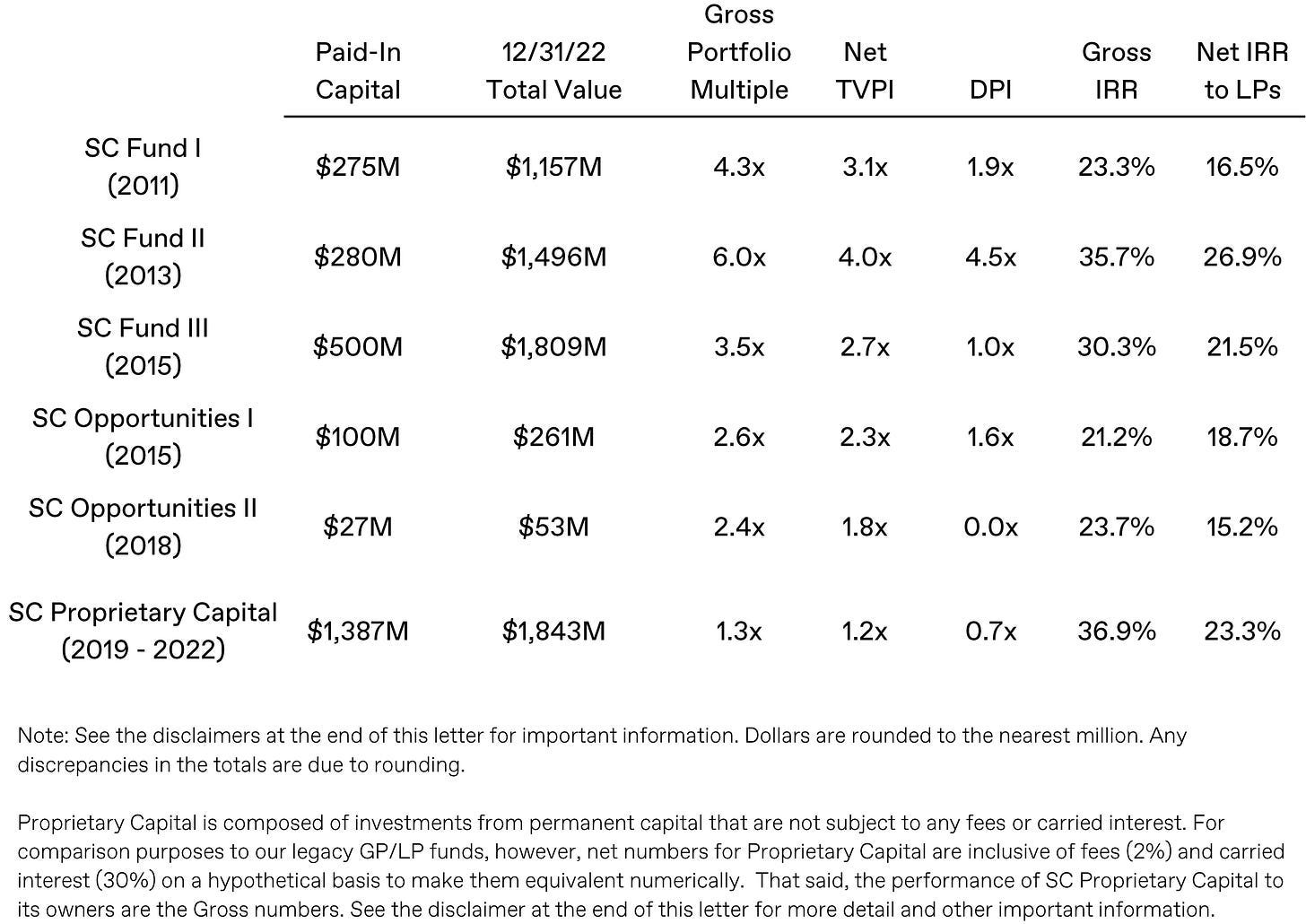

2023 Social Capital Performance Summary

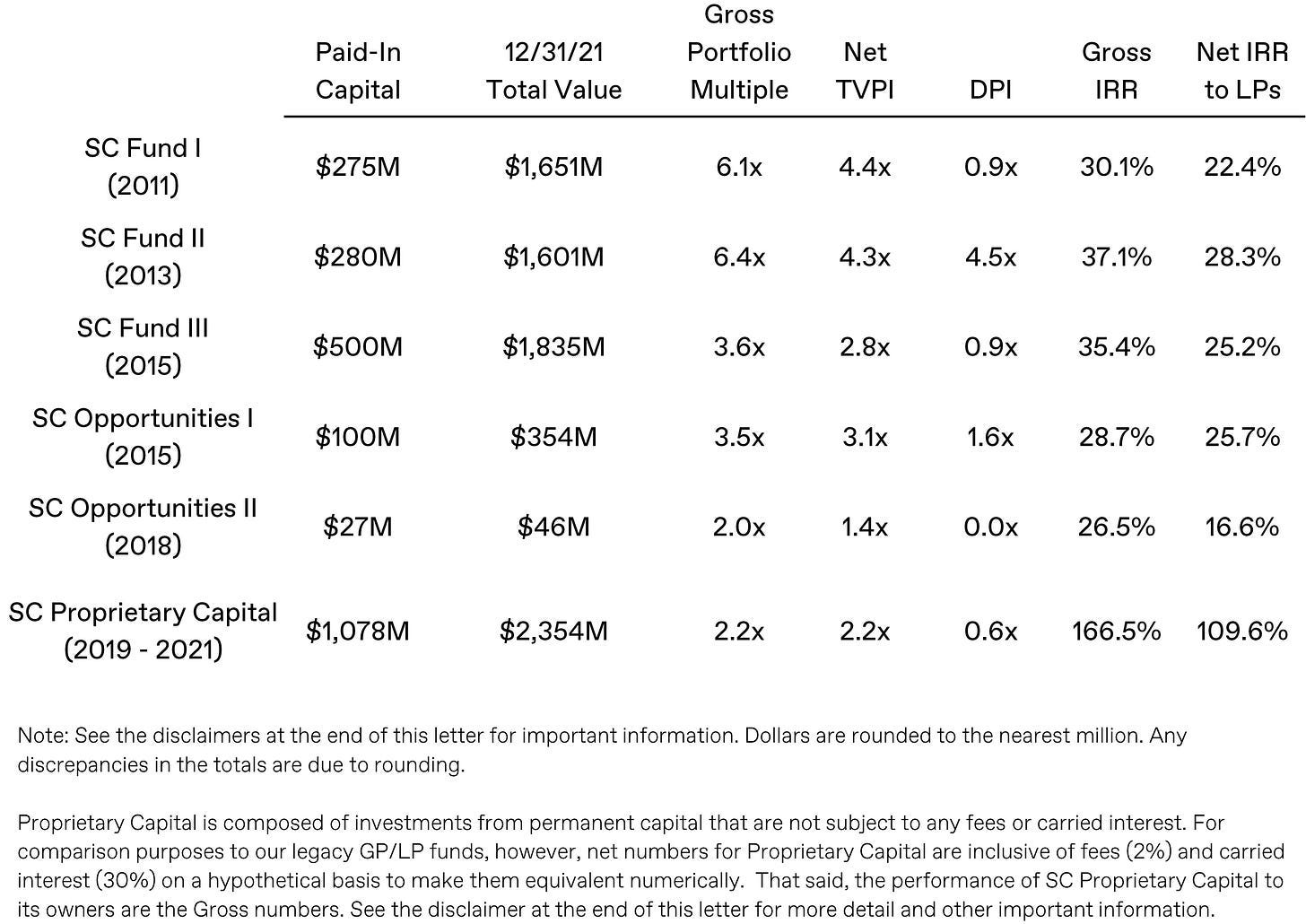

2022 Social Capital Performance Summary

2021 Social Capital Performance Summary

2020 Social Capital Performance Summary

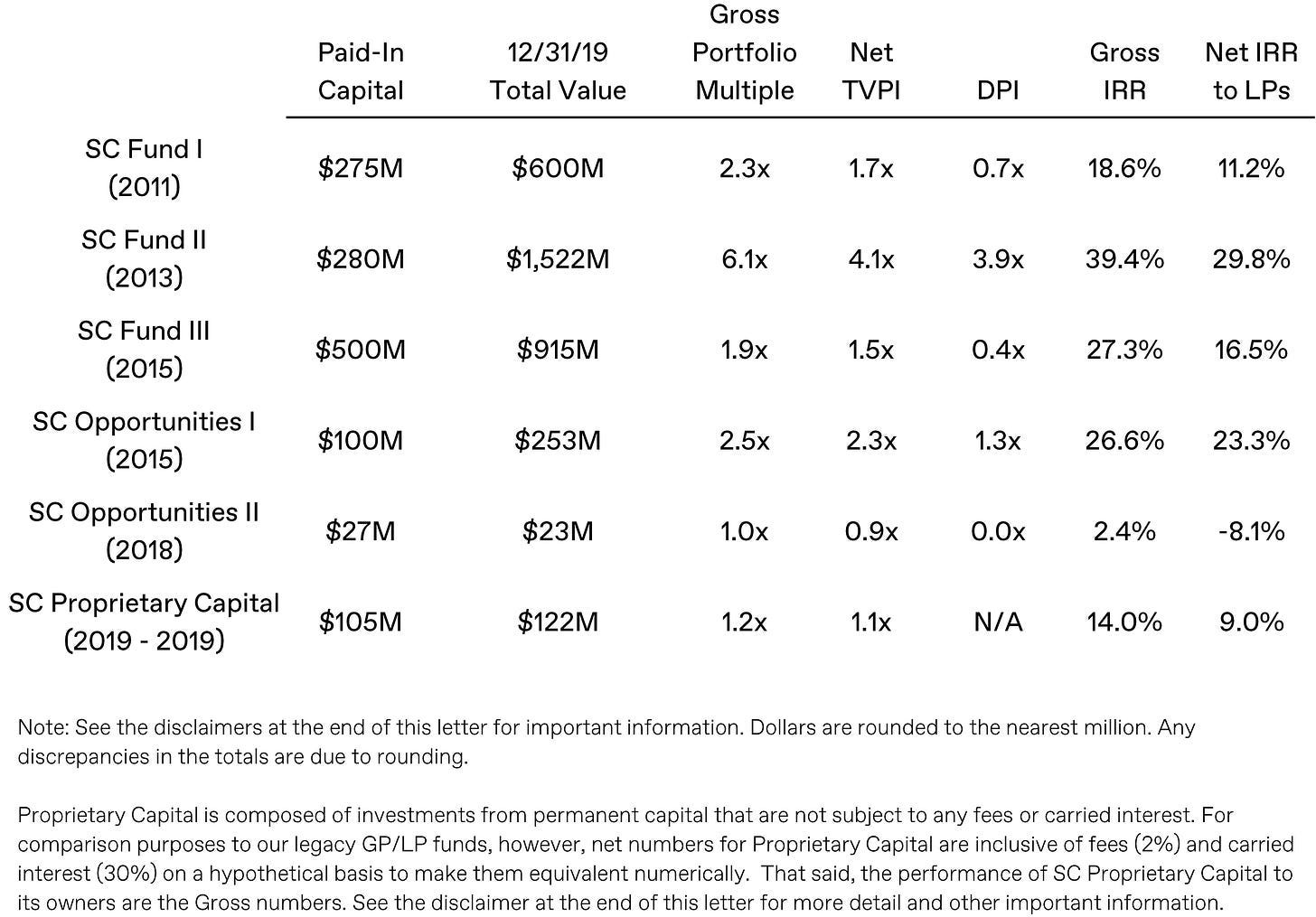

2019 Social Capital Performance Summary

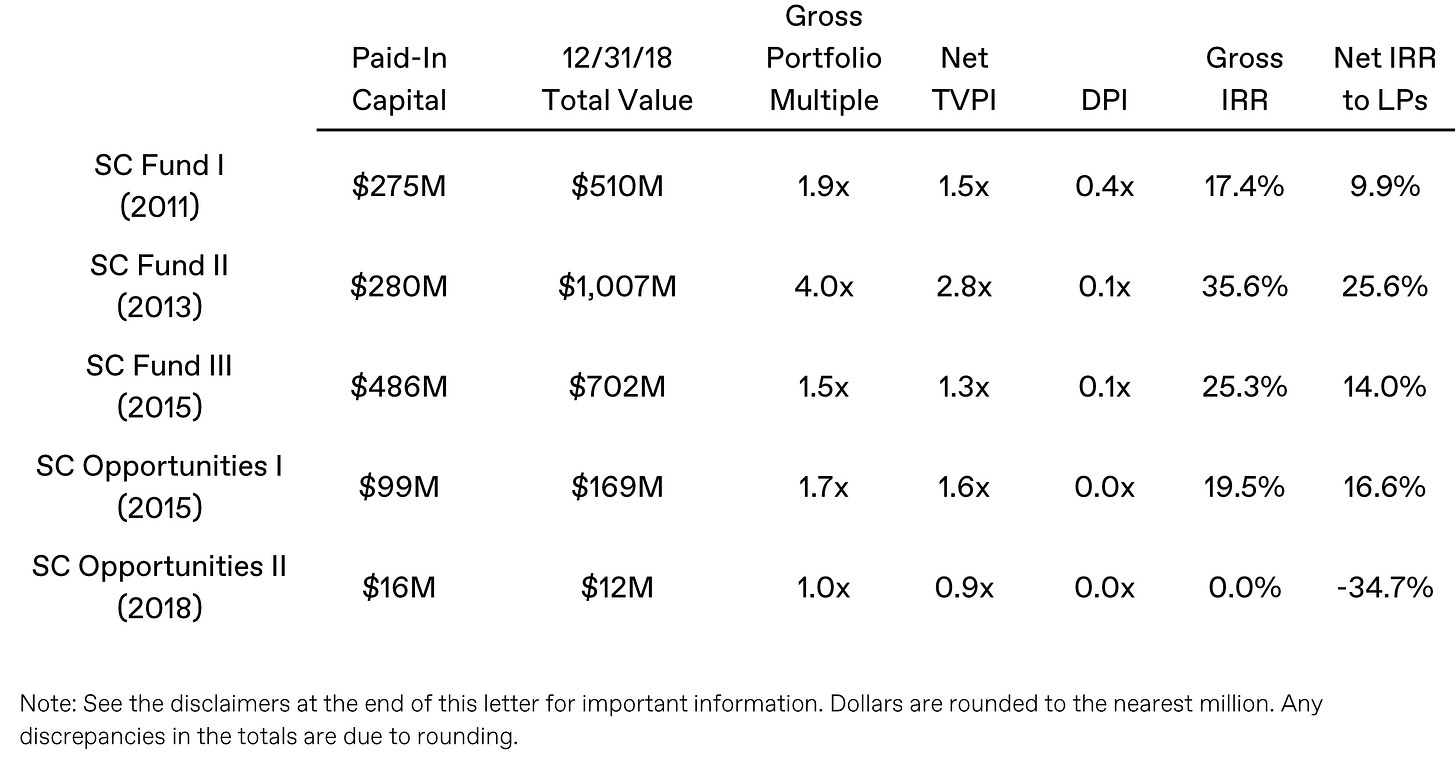

2018 Social Capital Performance Summary

First principles aren’t a framework—they’re a survival instinct now. Taste, discipline, and stamina will separate those who scale from those who disappear.

Thinking how best to apply some of these trends in traditional industries eg. My own whisky business, and also with respect to traditional portfolio investments.