Coinbase Launches a Multi-Asset Product Stack

A summary of the content that I consumed this week…

What I Read This Week: a summary of the content that I consumed this week…

Caught My Eye…

1) The $2.5B Coursera and Udemy Merger

Coursera announced that it will acquire rival online learning provider Udemy in an all-stock merger that values the combined company at roughly $2.5 billion, with Udemy’s equity valued at about $930 million under the deal terms. Udemy shareholders are to receive 0.8 Coursera shares for each Udemy share held, creating a single public company positioned to compete more effectively across the ed-tech market. The transaction is expected to close in the second half of 2026 with full approval from both boards, but is subject to regulatory and shareholder approval. The goal is to merge so they can accelerate an AI-powered product roadmap and expand their global reach.

“We’re at a pivotal moment in which AI is rapidly redefining the skills required for every job across every industry. Organizations and individuals around the world need a platform that is as agile as the new and emerging skills learners must master,” - Greg Hart, CEO of Coursera.

The underlying incentive for bringing these two platforms together reflects structural pressures in the post-pandemic online education space. Individually, both companies traded well below their highs (down around 80% from their IPO prices). Coursera’s model centers on partnerships with universities and enterprise reskilling offerings, while Udemy’s marketplace aggregates courses by independent instructors. By uniting these complementary assets, the combined firm aims to build scale in enterprise training, particularly in high-growth areas like AI, data science, and software engineering, and to smooth revenue volatility through broader subscription and corporate contracts.

2) Google’s Project TorchTPU: Breaking CUDA’s Lock-In

This past week, a major leak from Reuters confirmed that Google and Meta have formed a strategic alliance to go after NVIDIA’s most powerful asset: the CUDA software moat. The new initiative from Google is to make its AI chips run on Meta’s open source platform PyTorch, the world’s most widely used AI software framework.

Their development releases a bottleneck by allowing other companies to lower switching costs from NVIDIA GPUs and CUDA’s ecosystem. For years, developers remained “locked” to NVIDIA because switching to Google’s hardware required a total code rewrite into JAX. TorchTPU eliminates this friction, allowing AI models to migrate to Google silicon with performance parity.

The collaboration with Meta and potential options to open-source parts of the TorchTPU work would accelerate its adoption. As more companies adopt their framework, Google will also be able to increase their ability to sell TPUs directly into customers’ data centers rather than limiting access to its own cloud.

“We are seeing massive, accelerating demand for both our TPU and GPU infrastructure. Our focus is providing the flexibility and scale developers need, regardless of the hardware they choose to build on.” - Google Cloud spokesperson

This shift is already manifesting in the market: Anthropic has committed to a fleet of 1 million Google TPUs, and Meta is reportedly planning to deploy TPU hardware in its own private data centers by 2027 to lower inference costs.

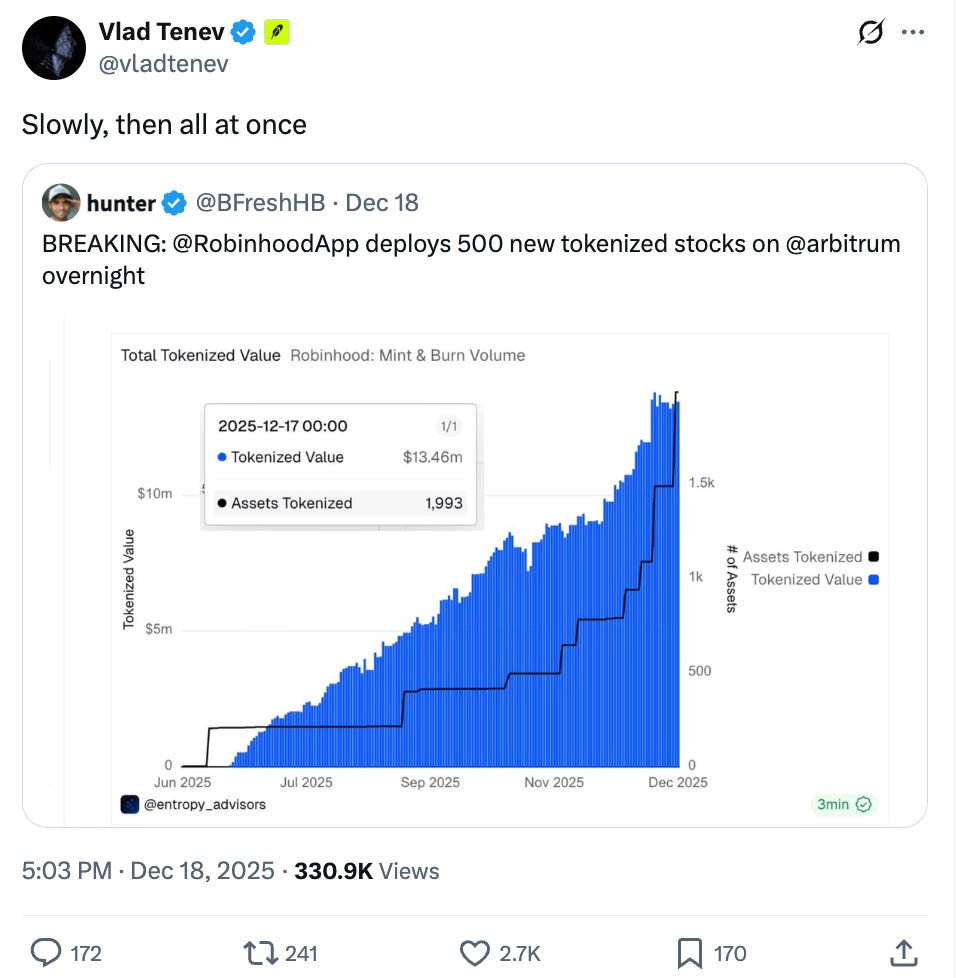

3) Coinbase Launches a Multi-Asset Product Stack

On December 17th, Coinbase announced a massive suite of new products:

- Stock Trading & Tokenization

- Prediction Markets

- Stock trading

- Futures and Perpetual Futures Trading

- Solana DEX Trading

- Coinbase Business

- Coinbase AI Advisor

- The Base App

- Coinbase Developer Platform (Custom-branded stablecoins)

This latest product launch reflects a clear strategic shift to reposition from a crypto brokerage into a multi-asset financial platform. Taken together, the launches suggest Coinbase is optimizing for optionality. With the parallel function of these markets, the company is able to vastly expand the TAM it can reach.

“You can look at all the different prediction markets out there... some people are using it as an alternative to news just to figure out what’s going to happen in the world, so this is what we call the everything exchange.” - Brian Armstrong, CEO of Coinbase

The consequential move underneath this all is infrastructural. As Coinbase is standardizing USDC as the core funding rail, integrating decentralized trading directly into its app, and reviving token sales under a more controlled, compliance-forward model, these steps point toward a convergence of traditional and future facing finance to move on-chain.

Learn With Me and My Friends…

Other Reading…

2025 LLM Year in Review (Andrej Karpathy)

I Think India Can Do It (Noah Smith)

The Depopulation Panic (Foreign Affairs)

Love the framing of Coinbase as an "everything exchange" rather than just crypto brokerage. The USDC as core funding rail piece is underrated, building that plumbing now gives them infrasrtucture leverage later. Reminds me of how Stripe became essential payment rails before most people realized payments infrastructure would matter. Also interesting how both Coursera and Coinbase are betting on expanding TAM through multi-asset/multi-domain plays at exactly the same time, tells you something about current market consolidation pressures.