Tesla Launches Unsupervised Robotaxis and FSD Rerates Insurance

Tesla launches unsupervised Robotaxi, NYSE announces tokenized platform, JGB bond yield break new highs, and more...

What I Read This Week: a summary of the content that I consumed this week…

Caught My Eye…

1) Tesla Launches Robotaxis and FSD Rerates Insurance

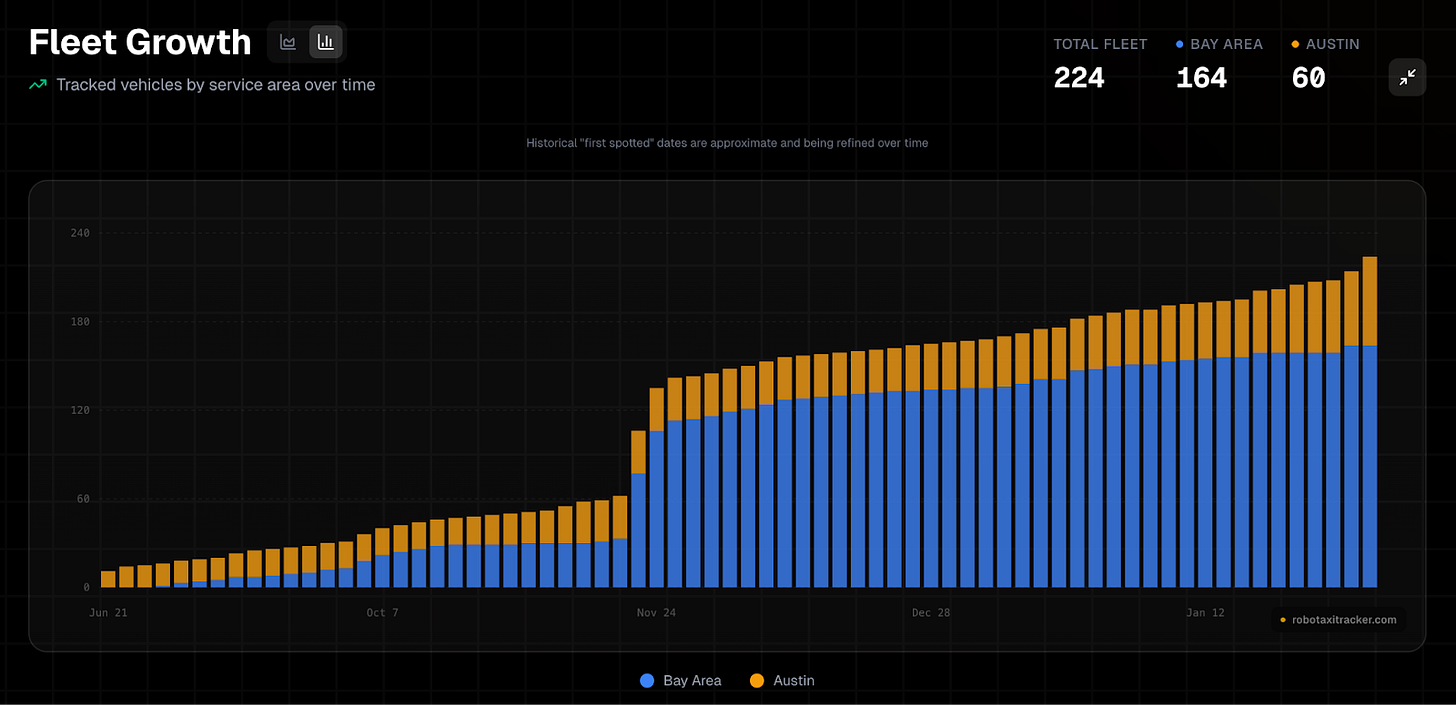

On January 22, 2026, Tesla officially launched its public, unsupervised Robotaxi service in Austin, Texas. This is the first time Tesla has removed human safety monitors from select vehicles, providing real-world proof of Tesla’s “Level 4” autonomy capabilities. The news triggered a 4% rally in Tesla stock, while Uber and Lyft fell 1-2%.

In the meantime, Tesla’s Full Self-Driving (FSD) is transitioning to a $99/month subscription model. Elon has given a heads-up that this price will rise as capabilities improve, with a massive jump in value for the rider when they can fully use their phone or sleep during a ride.

Tesla has given Lemonade, a digital insurance company, access to vehicle data that was previously unavailable. This allowed Lemonade to launch a new “Autonomous Car” insurance product that cuts premiums by approximately 50% for miles driven in Full Self-Driving (FSD). Lemonde’s pay-per-mile insurance tech stack uses real driving data to inform a dynamic risk model. This means they expect further cost reductions for consumers as Tesla releases more FSD updates that improve driver safety.

The program is set to roll out first in Arizona on January 26, followed by Oregon, creating a ripple effect that will prompt other insurance companies to follow suit. These developments give early signs that autonomous driving is now transitioning from experimental technology to a commercially viable, lower-risk ecosystem.

“I think self-driving cars, is essentially a solved problem at this point… and will be very widespread by the end of this year within the US. And then we hope to get supervised full self-driving approval in Europe, hopefully next month… And then maybe a similar timing for China, hopefully.” - Elon Musk, at Davos 2026

2) NYSE Announces Tokenized Securities Platform

On January 19, 2026, the New York Stock Exchange (NYSE) announced its development of a new platform dedicated to the trading and on-chain settlement of tokenized securities. This initiative marks a historic pivot for the world’s largest equity market, aiming to introduce 24/7 trading, instant settlement, and the ability to purchase fractional shares via dollar-denominated orders.

The platform’s technical framework is designed to ensure fungibility between tokenized assets and traditional securities. This means investors will retain full dividend and governance rights regardless of the type they hold.

To achieve this, ICE is integrating the NYSE’s existing matching engine, Pillar, with a new blockchain-based infrastructure that supports multiple settlement chains.

The ecosystem will also be supported by BNY and Citi to facilitate tokenized deposits across its clearinghouses. This move underscores a broader industry pivot toward “Real World Assets” (RWA) and aligns with the views of other industry leaders.

“I think the movement towards tokenization is necessary. We would do more for democratization by reducing more fees if we had all investments on a tokenized platform…” - Larry Fink, Davos 2026, CEO of BlackRock, Interim Co-Chair of WEF

We are working on a deep dive on tokenization of equities. Let us know in the comments if you have any questions or thoughts on this topic.

3) JGB Yields Break New Highs Explained

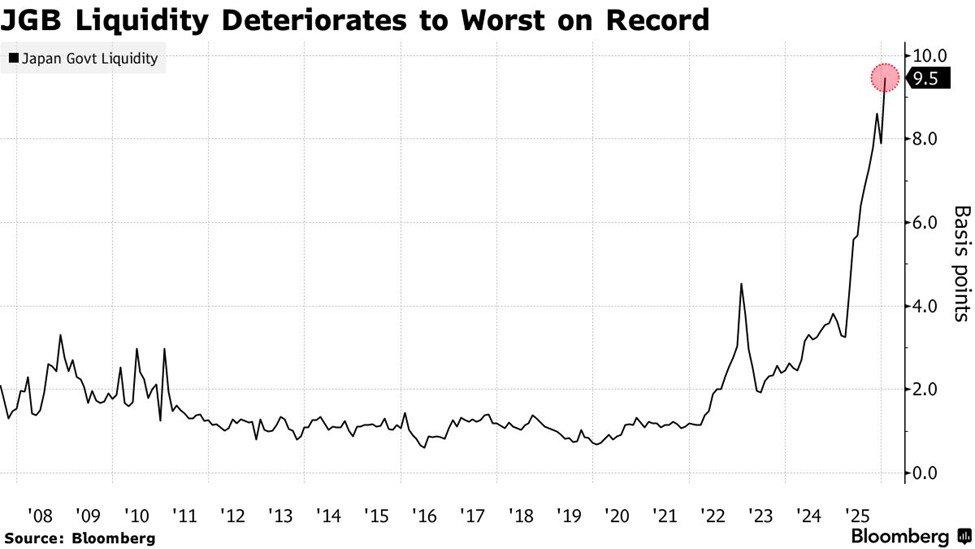

On January 19, 2026, the Japanese Government Bond (JGB) market experienced what U.S. Treasury Secretary Scott Bessent described as a 6-standard deviation move.

The 40-year yield spiked by 26-basis-points in a single session, breaching 4.2% for the first time since the maturity was introduced in 2007.

This crisis was triggered by Prime Minister Sanae Takaichi’s announcement to dissolve the current parliament and force a ‘snap’ general election on February 8. By doing this, she is bypassing lawmakers who oppose her and asking the public to elect a new majority that will give her the authority and mandate to carry out her economic plans.

Takaichi, who holds an approval rating above 70%, is widely viewed as a fiscal dove. She has vowed to end “excessive austerity” through a two-year suspension of the 8% consumption tax on food, and higher military spending, while stressing her commitment to Japan’s long-term sustainability.

The tax cuts and spending increase fueled investors’ fear of continued fiscal dominance, where the government’s debt needs override the Bank of Japan’s (BoJ) ability to control inflation. This collapse in confidence is reflected in the worst liquidity deterioration in the JGB market, driving a spike in yields and a weakening yen.

Typically, higher yields attract capital and strengthen a currency, but when yields rise because of fiscal risk (the fear of excessive debt issuance), the currency often devalues as investors flee the country’s perceived weakness. In response, there is speculation that Japanese authorities might step in to support the yen, leading to the largest one-day rally in six months.

Negative real rates persist, as the BoJ holds rates at 0.75% this Friday, while inflation remains above their 2% target.

Learn With My Friends and Me…

All-In Interview: Inside America’s AI Strategy: Infrastructure, Regulation, and Global Competition

New Deep Dive:

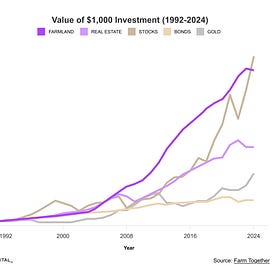

Who Controls the American Food Supply?

The $5 trillion economy of food production and distribution must function everyday regardless of weather, labor availability, or price swings.

Our analysis traces how value, risk, and control move from inputs to farms to processors to retailers. It connects the historical waves of change to today’s pressure points and shows how decisions made upstream shape outcomes that appear much later.

The report is organized around a set of questions...

Other Reading…

Exodus: The Largest Wealth Flight in California History (Pirate Wires: Mike Solana)

Debunking the Cooling Constraint in Space Data Centers (Mach33)

OpenAI Unveils Plan to Keep Data-Center Energy Costs in Check (Reuters)

Big Ideas 2026 (Ark Invest)

I really appreciate these crisp, informative insights—it's easily my favorite way to start a Saturday.

Thanks for writing